Seminar organized by ASSOCHAM on 29 May, 1984 at Bombay on The Role of Board of Directors in Corporate Governance

I will confine myself to the philosophy of corporate control and management as it has evolved over the years and to, naturally, some remarks about the special committees of the board.

We have moved a long way since the Bhabha Commission made its report in the early 1950s. This was a report of historic importance which some of us tend to forget these days. This was the report which laid the foundations of our corporate law and intervention by the authority. Many people might remember that when this report came out and the Companies Act, 1956 was enacted, it did one extremely important thing : apart from requiring much greater disclosures and explicit responsibility of the board and the management to the shareholders, it introduced the public interest clauses which required either government approvals or the power of government to intervene in certain situations. This was a power that went with the philosophy of that time, whether it related to Britain during the Second World War or to the Indian polity and economy after independence, in which it was believed and fairly widely accepted by consensus that ownership itself did not confer all the rights of management nor did it confer all the powers of disposal, but that it had to take into account whatever was considered to be the public interest, and it was further accepted by consensus at that time, not only in terms of law but in terms of general public acceptability, that government could be trusted to be the sole custodian of public interest.

Since this philosophy ruled in the 1950s and 1960s, we have travelled a long way. We have involved the government in many things, we have involved the public interest in a wide variety of situations. At the same time, however, there is a general questioning about what public interest means, who should be its custodians and interpreters and what kinds of public debate and controversy are legitimate—I am not saying what is possible or legally required but what is legitimate—in terms of public consciousness and in terms of a consensus—about management as well as intervention in management by public authority. To put it very mildly, there are doubts all along the line. There are doubts not only about how the corporate sector is governed, but also about how the government is governed. I think whatever we say in the year of grace 1984—which, again, is a very historic year—we have to understand that there is no such general consensus as informed on the formation and discussion of public policies in the 1950s and 1960s.

There is no doubt that there is a greater assertion of rights now by various others, whether they are majorities or minorities. Just as there are assertions of minority rights in one form or the other, there are assertions of majority rights in one form or the other and these are not as yet leading to any clear acceptable solutions. We are in a state of transition all over the place. The transition includes, so far as government is concerned, the role of the cabinet, the role of Parliament and civil servants. The same applies to the way one views the boards and their functioning. The board, after all, is one of the institutions created by law, just as the government is created by the constitution. In respect of boards, it is not only law that lays down what is to be done, there are conventions, there are various concerns about legitimacy, about functioning and accountability. I do not think that even those who are very concerned either about the rights of ownership, so far as private property is concerned, or the rights of control, so far as public authority is concerned, would say that in all these one has any clear ideas any more or that there are any clear solutions envisaged just now. But it would be true to say that wherever there is power, there has to be responsibility and accountability. Again, this is not based on law but arising out of conventions, even more so arising out of credibility in the actions taken and in the roles assumed and. finally in terms, in a democratic society, of achieving solutions and arriving at policies of consensus rather than through confrontation.

Having made these general remarks, may I say that we should not allow certain recent events to cloud our thinking too far. There are many basic issues arising partly because management has become more complicated; not only have the laws become more complicated, management itself is a complicated exercise now. There are many more elements in the total situation which have to be kept in mind and taken into account and we have inherited old institutions which have to be adapted and restructured for various purposes.

My friend. Mr. [S.S.] Nadkarni. was good enough to say that as a result of various improvements that have been effected, one at least knows how the boards function now. So some of the mystique has been lifted. I think the same would apply to the functioning of government as is brought out in various Parliamentary reports and proceedings. It would be brought out in respect of the functioning of the international organizations. I dare say it would come out in respect of any important body into which one cares to have a look. But I would like to give the warning that one should not be carried away by rituals being duly performed. I always get nervous when the institutions or their directors are very particular about circulation of agenda papers in good time, about holding of meetings and about the recording of minutes. These are very important rituals, but they are rituals. There has to be something much more than that and I think there should be a lot more concern with having, as Mr. S.S. Nadkarni himself suggested, occasional full discussions on basic issues like those relating to personnel or commercial purchases and sales or technology and so on. I dare say these are nor the practices generally.

I think the insistence on rituals has led to the fulfillment of the required rituals. But so far as the content is concerned, I do not think we are anywhere near that. That is partly because some people are very hesitant to put things in writing—partly because they cannot write, partly because they think so—I feel it is not something one should get nervous about; I think some people do write, some cannot write: some people are good in technology, others are not good in technology. There are also many people who feel that putting things on paper either commits them to certain things or it will lead to leakage. But I think most of the reasons really relate to this that the commercial bureaucracy, no less than official bureaucracy, hates to get committed on paper. Even if and when the papers are produced they would tend to be watered; let us be prepared for that, because that is how bureaucracy after all functions normally. One has to be careful even about having these papers or these important items for discussion. I think there have to be some more ideas on this subject rather than merely production of papers or holding of meetings once or twice a year for the purpose.

It would be true to say that most boards spend their time on the fulfillment of rituals required by law or in terms of what the institutions have laid down. But then we should also be very clear about what is expected of the managements. In many cases, whether the management is professional or of the family type, there is a marked reluctance to share power, not just because of secrecy but because people do not know how to share power or they do not like to share power or to share information. This is an attitude that comes of a vertically structured management. There it is believed that if you discuss anything horizontally or if you have to ask people for their opinions in a genuine, meaningful sense rather than merely out of courtesy, then there would be something to gain from that kind of involvement and discussion. It would be as true of the professional bureaucracy as of the commercial bureaucracy, true of professional as well as family management. It does require skills of a sort which most of our people as yet do not have. I do not know whether it obtains in other countries or not but the whole idea of horizontal discussion involving several persons is let me put it very clearly, contrary to the culture of operation that we have. In the old family enterprises, may be the karta made all the decisions. These days the Managing Director is a pure professional : he thinks he is the wisest person on earth and therefore should not be disturbed in any manner. If he is a family owner, he thinks he owns the enterprise, why should anybody else be bothered. So we go all along the way. This, unfortunately, is as true of the public sector as of the private sector, except when come danda is being wielded from elsewhere.

Here let me come to one of the issues that we have to be very careful about before I come finally to the special committees. In terms of the philosophy as it evolved in the Fifties and Sixties and as it was accepted generally that there would have to be public interest interventions or involvements, the concept of financial institutions was not known at that time to begin with. As it came about, the financial institutions were either creditors or owners. But of late, one notices that there is, shall we say, much more coordination between these creditors and owners as such and the regulatory authorities in government. One therefore, gets a combination of ownership, credit and regulatory and control powers. In terms of the older philosophy, one could have argued that the owners per se, in a socialistic framework or in a mixed economy, do not have the right entirely to manage fully on their own or to control the management fully on their own. If that is still the philosophy—I do not know whether it is—then the institutions as owners cannot claim to have the same right as the public interest people generally would have, because as owners and creditors they cannot claim, by the mere virtue of being owners or creditors, to be looking after the public interest. Public interest invocation is the prerogative of government and of no one else. But when you have a combination of these, then one does get a mix-up of the roles as well as perhaps, of the objectives and the interpretation of what is public interest. I am mentioning this because I think it is rather an important point in terms of the corporate control philosophy and one needs to debate this even though the occasion itself might be one that involves certain contemporary events. Furthermore, in most laws or in terms of the philosophy as it was put out in the Fifties and Sixties what was government required to do when it acted in the name of the public interest ? It had to satisfy itself, just as a collector of a district or a district magistrate has to satisfy himself in terms of the prevalent laws, it had to apply its mind and come to an opinion. Therefore, the law said, “in the opinion of government.” This may have been all right when there was a consensus on accepting the government as the sole custodian and interpreter of the public interest. When that consensus does not exist, whatever the reasons, then one comes into the wide area of doubts and possible misunderstanding. I am not taking a position one way or the other on this, but I thought I should bring out some of these issues because I think they are rather important for understanding both the present and the future.

Now about the special committees. There is certainly a great advantage in having committees of the board. This has been, especially ever since this matter of share transfer became important—and please remember it acquired importance first in the early 1950s when one of the large companies in Bombay was cornered by a large business group and when there were threats that certain other large companies would be cornered— and since the first case that occurred incidentally when the management did not care to check the share transfers at all, many boards woke up and set up share transfer committees. Of late, share transfer committees are meant to relieve the board of a large amount of routine work. But this is an area which, while it has certain other exclusive implications, is something meant to relieve the board of certain very routine functions. Normally, when there is a very large share transfer involved, matters do get referred to the board. But it takes care really of the routine.

About the others, there can be a management or executive committee of the board with or without a managing director, though normally it has been almost the accepted practice in recent years that when there is no managing director, there should or must be a management executive committee at least in a large public company. We are not talking here about other companies just now. This committee, in the opinion of institutions, should get dissolved the moment a managing director, is appointed. This has been the view taken in several cases. Whether this should be so is a matter which needs looking into. Also, where you have a managing director and also a management executive committee, what are the respective roles of the two? I would think that in a large company operating in a high risk area, it is certainly useful to complement the managing director with a management committee of the board. There are many things in which it is better that a single person should not take the total responsibility and that a part of the board should be involved both in the discussions as well as in the decisions.

There is also the question of management style. There are some managing directors who do not like management committees at all. I am talking of bare facts, I am not talking of what is considered polite or impolite. Some managing directors feel that this kind of committee negates their existence or clips their powers. But I would still feel that in the high risk company it is a useful concept and that the management committee should have more powers than the managing director, but beyond a certain point, of course, things should be referred to the board.

In American companies—this is not the practice here—there is also a finance committee of the board which looks into both long-term investment as well as working capital management. Here again, some finance directors take a very dim view of having any committee of the board which looks into both long-term investment as well as working capital management because they feel that other people’s involvement in this important area clips their wings. They have a feeling that this leads to diffusion of responsibility, that it leads to possible misunderstanding, the control gets diluted or that matters get postponed. But really I think the problem arises from the fact that again, as I said earlier, a lot of managements in this country do not like horizontal discussion or involvement, they prefer the structure to be highly vertical. In fact, the whole idea of committeefication at the top requires horizontalisation of management style rather than keeping it vertical. Therefore, it does require acceptance of the concept of horizontal discussion and involvement.

One can have ad hoc committees for management selection or such important things as diversification or modernisation. Normally a committee for management selection is welcomed by everybody, for the very obvious reason that it appears to be more fair and that if there are any questions about appointments, they can be easily answered by saying that a committee of the board was involved. But if this committee, let us say, starts looking into the structure of the management or any such important thing, it is not welcome because that is supposed to be a closed area and a prerogative of the full-time management.

Finally, there is this question of audit committee of the board. In large US companies it is a very important institution. But I should remind the members that first of all the audit committee in the large US companies does not have anybody who sits on executive decisions. Therefore, the reported recommendation of the Narasimham Committee that the institutions’ directors should be on the executive committee or purchase and sales committees as well as on the audit committee, is I think, fundamentally inconsistent. You cannot be involved in certain basic decisions and then sit down and audit or evaluate them.

Secondly, let me also make the meaning of the word audit very clear, because the same word has different meanings in different parts of the world. Audit in the US or American English is really evaluation. It is not audit as we understand it. For instance, when the World Bank has an audit report, it is not dealing with accounts and vouchers or financial statements : it is dealing with evaluation in terms of performance and results. I think it will be very sad if the so-called audit committees in the board were to start becoming a super internal audit. What they are concerned with is an evaluation of performance and procedures and systems and things like that rather than add another agency to look into accounts.

In general, there is one great problem with the constitution of any important committee of the board. Who is to be in and who is to be out ? If there is an important committee of the board, those who are left out feel very left out because they feel that they have been deprived of involvement and the board’s powers have been taken away. Things do not come to the board, we do not know what is going on even though the minutes might get circulated, because the minutes after all are only a formal record, they are not supposed to tell you of all the discussions that take place or of all the actions that one really rakes. So. those who are not on an important committee feel left out and that builds up in certain situations a very latent resentment in the board not only against the management as such but against those who are members of those committees and this bursts in some situation or the other off and on.

But I think, on the whole, having committees of the board is a very useful way of involving the members of the board as also of getting what I think is very economical advice from persons who would have a continuing association with the company as compared with consultants who are paid specifically for a specific job. who have no continuing responsibility in the implementation or in the result. If the board is properly constituted, various members can make useful contributions. It cannot always be done in a full board meeting, but it can be done in a committee. But I would also say in defence of those who do not sit on some of these committees that they also serve who sit and never open their mouth. I think their role has also to be recognised and let us also face it that notwithstanding all that you say about the responsibility of the board and contribution by members, that if every member of the board started speaking on everything or taking interest in everything that comes before the board, it would be very inconvenient to everybody concerned, apart from absorbing a lot of time.

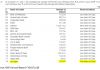

Finally, let me end on the question of compensation. The compensation for directors is ridiculously low. It does not really make any sense if any service is expected out of them. The limits prescribed under the Companies Act were framed long ago. They take no account of the extent of involvement or the responsibility. There is no distinction between different kinds of directors at all and the provisions about payment of commission to the directors have been interpreted in different ways by various companies, by the Company Law Board and finally, by the various institutions. The net result, therefore, is that there is only the official compensation which is merely Rs. 250 per meeting which discourages anybody from either asking for advice and consultation or quite often, from providing it.

Mr. Chairman. I think I have roamed over a rather wide area. I felt that one needs both a historical and a philosophical background as well as an idea of how things can be made to function. But I will close on one note which I think is fundamental: whether it is the functioning of the board as a whole in relation to the management or committees of the board, all this requires a certain acceptance of the idea that different interests or different persons are there to contribute, that they have a right to contribute, that they should be made to contribute to the maximum extent possible. Therefore, this requires something like an entrepreneurial contribution in terms of making people contribute. But if the idea is that there should be no contribution, no involvement—and that is what is uppermost whether in official circles or in corporate circles- then, naturally, one does not get that kind of response. So one really gets back to the idea : do we want people to be involved or we do not want them to be involved ?