EXECUTIVE SUMMARY. The phenomenal success of HDFC Bank under the stewardship of Aditya Puri, its first CEO, had some unfortunate consequences. It led to a belief that the recipe for achieving a premium valuation was to employ larger-than-life Alpha leaders who promoted an aggressive work culture, imposed long working hours on the rank and file, and tolerated abusive behaviour by managerial staff. Investors ignored the toxic culture, and the capital market, the banking regulator and successive governments applauded the strategy, which focused exclusively on shareholder returns. The de facto prevention of labour unions and officer associations, and the lack of public commentary on working conditions of the general staff, permitted this culture to flourish for a quarter of a century.

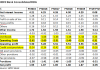

As HDFC Bank became the gold standard, some CEOs believed that this culture was a necessary ingredient for consistently achieving ambitious targets and getting an attractive valuation on the stock market. Amitabh Chaudhry, who was appointed as Axis Bank CEO on January 1, 2019, appears to have imbibed this culture in attempting to achieve his elusive objective of doubling the bank’s market capitalisation and achieving a ROE of 18% (a goal now postponed to FY2023-FY2025).

Sandeep Bakshi CEO, ICICI Bank, radically transformed ICICI Bank from a culture promoting individual stars to one focusing on teams in a collegial environment. Bakshi believes in maintaining an almost invisible media profile, and his strategy has delivered on performance parameters and rewarded shareholders. Similarly, HDFC Bank under Sashidhar Jagdishan has apparently taken a view that a genteel work culture can achieve similar results without resorting to toxicity.

The change in leadership in ICICI Bank and HDFC Bank has heralded a new beginning in both banks in terms of regulatory compliance, staff welfare and customer well-being. While the performance in ICICI Bank is visible, resulting in a surge and a re-rating of its share price, there have been some concerns regarding HDFC Bank’s sustainable future performance. In the opinion of this analyst, both leaders are putting in place the building blocks for sustained future performance, taking into account the interests of all stakeholders, and not just the shareholders.

But this need not be seen as a zero-sum game between shareholders and other stakeholders. In the long term, a bank’s performance depends more on whether it positively motivates its staff, maintains ethical norms in marketing, and prioritises stability over risky gains. After all, nothing is more important to a bank than its reputation, i.e., whether the public repose trust in it; and that cannot be achieved through toxicity at the workplace.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in all the banks mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.