Hemindra Hazari 4 March 2017

Axis Bank has had a tough year. Just as it was slowly recovering from the demonetisation fiasco, wherein some of its officials were arrested for money laundering, its non-watch list corporate loans slipped into the non-performing category in the third quarter of FY’2017. In the last month, news reports have indicated that various private sector banks have been looking to merge with Axis Bank.

Axis Bank’s share price rallied on the back of these media reports, providing relief to shareholders and Axis Bank staff holding stock options. However this also set off alarm bells within the bank’s senior management over issues of job security in the likelihood of a merger. Allaying fears within the bank, Shikha Sharma, Axis Bank CEO went on record to state, “there is absolutely no truth to this [merger]”. However, the government, directly and indirectly through ownership of life and general insurance companies, owns around 30% of Axis Bank. And it has in recent times been exploring the divesting of Specified Undertaking of the Unit Trust of India’s (SUUTI) 12% stake in Axis Bank to meets the divestment target laid out in the Union Budget. Interestingly, till date, no senior government official or an official from the Life Insurance Corporation (LIC), which holds a 14.5% stake, has gone on record to explicitly deny the rumour of a merger.

What banks should be talked about, when considering a possible merger?

As Indusind Bank and Yes Bank’s market capitalisation are significantly below Axis Bank, the possibility of a merger of these banks with Axis appears remote and since ICICI bank, like Axis, is facing issues of asset quality, a merger of these two banks is also unlikely. If any larger or similar size bank were to acquire Axis, it is doubtful whether the current senior management of Axis would survive in the merged entity. Analysing a prospective merger of Axis Bank with other banks, Bank of America Merrill Lynch (BoAML) has concluded, “EPS accretive benefits would exist only for a potential combination with Kotak Bank, in our view.” Hence, according to BoAML it is not profitable for the other new private sector banks to merge with Axis Bank.

According to sources, Kotak Mahindra Bank chief Uday Kotak had in the past approached Axis Bank twice for a merger, which was ultimately not pursued. During his first attempt, he had indicated that he would like to be in a position of executive control for the merged entity.

In any merger, especially in this bleak economic environment, two critical issues need to be addressed. Firstly, does the book value of the bank truly reflect its assets and liabilities? And secondly, is the price to book value multiple, a key valuation benchmark, for the bank realistic?

These two indicators are vital for understanding the fundamentals and valuation of a bank. For outsiders, the answers to both questions are subjective and it depends on the assumptions taken to factor the ‘adjusted’ book value. The market should remember lessons from the past. In January 2000, Bank of Madura (BoM) merged with ICICI Bank at an exchange ratio of two shares of ICICI Bank for one share of Bank of Madura. However, the merged accounts revealed that practically the entire free reserves of BoM had to be written down as the bank had under provided liabilities which was unfortunately not revealed during the due diligence. The end result was that ICICI simply overpaid.

One year later, in January 2001, Axis Bank (then called UTI Bank), to shore up its capital base, nearly merged with Global Trust Bank (GTB) which reported strong capital ratios, at a proposed merger ratio of 9 shares of UTI Bank for 4 shares of GTB. Fortunately for UTI Bank, the merger was called off on account of a rigging up of GTB’s share price. In FY’ 2002, following a stringent Reserve Bank of India inspection, the accounts of GTB underwent a drastic deterioration and GTB’s capital was completely eroded to the tune of a negative Rs. 1,000 crores for bad debts which was finally borne by the government-owned Oriental Bank of Commerce (OBC). OBC acquired it to bail-out GTB’s depositors in June 2004. The lesson to be learnt is audited accounts cannot be taken at face value and a comprehensive due diligence is required prior to any merger.

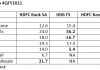

In the case of Axis Bank, the state of its loans needs to be minutely examined. As this writer has pointed out, the sudden appearance of its corporate watch list in the fourth quarter of FY’ 2016 is troubling. Analysts are not only concerned by the sudden deterioration of corporate loans not only from the watch list but also from the broader corporate loan portfolio. Moreover, the bank, like many banks, has been aggressively increasing its retail loans during a period of an economic slowdown and reports low retail non-performing loans. The quality of the retail book also needs to be thoroughly examined in any due diligence exercise. Indeed, going by data in the BoAML report, one can see that in the third quarter of FY’17, Axis Bank had stressed assets of 7.7% which constitutes nearly half of its net worth. This amount of stressed assets is the worst in its sample of new private banks. It is only after a comprehensive review of Axis Bank’s loans by independent auditors and experienced bankers can it be determined whether its reported book value is credible and its current market valuation realistic. Banks like HDFC Bank and Kotak Mahindra Bank have a credible history of not over paying for assets.

Integration of staff and culture

Another critical issue which does not get the attention it deserves is integrating the staff and culture of the merged bank. Unlike quantifiable assets and liabilities, which seamlessly and clinically merge in excel spread sheets, integrating organisational structures, reorienting reporting and responsibilities and redrawing staff career paths poses a significant human resource challenge for the merged entity.

In Axis Bank’s case it is unlikely that HDFC Bank or KMB will allow the senior managers at Axis Bank in controlling positions in the merged entity and therein lies the sense of job insecurity in the higher echelons of Axis Bank post the news reports of a merger. For KMB, which has recently absorbed ING Vysya Bank, to merge a further 56,762 employees of Axis Bank, (1.8x its staff as of FY2016) and an additional 3,211 branches is going to be a mammoth task in human resource and organisational management and the sheer number of employees of Axis Bank may overcome the work culture of KMB which may not be desirable for the latter.

Any well-managed bank which merges with Axis Bank also needs to be aware that during the tenure of the existing Axis Bank CEO, the organisational structure of the bank has been geared towards promoting marketing and selling of financial products while weakening control and operations to achieve ambitious sales targets. Checks and balances such as operations and audit were regarded as impediments to growing the balance sheet and experienced bank staff well versed in control and operations were systematically weeded out in favour of younger sales oriented inexperienced bankers. It is this transformation in the organisation which finally got exposed in the demonetisation period when its staff were arrested for money laundering.

In light of the current depressed economic environment, the asset quality and operational control concerns at Axis Bank, interested banks may need to carefully determine whether the current valuation of Axis Bank factors these issues and does not weigh down the combined entity in the likely event of a merger.