Hemindra Hazari

Rising net deferred tax assets (DTA) in a scenario of stagnant and depressed net profits is not a healthy sign in some of the banks, as current years’ net profits get enhanced while sometime in the future the net DTA will get reversed impacting future net earnings. This trend is visible in Axis Bank and ICICI Bank and investors must exercise caution in interpreting financial statements on the future trajectory of earnings.

Deferred tax assets and deferred tax liabilities are created on account of the difference between accounting income (reported in the books of accounts disclosed to shareholders) and taxable income in the same period as the revenue and expenses to which they relate. As per the Indian Accounting Standard, (IAS)-22

“The divergence between taxable income and accounting income arises due to two main reasons. Firstly, there are differences between items of revenue and expenses as appearing in the statement of profit and loss and the items which are considered as revenue, expenses or deductions for tax purposes. Secondly, there are differences between the amount in respect of a particular item of revenue or expense as recognised in the statement of profit and loss and the corresponding amount which is recognised for the computation of taxable income.”

In banks, the main difference between book income and taxable income arises on account of loan loss provisions and depreciation on investments. While loan write-offs lower taxable income, loan loss provisions with few exceptions are not tax deductible and hence when there are large loan loss provisions, taxable income may not get reduced to the same extent as book income.

The creation of a net DTA in a bank though classified as an asset does not provide the bank with either liquidity or with income generating capacity and therefore is an intangible asset. The Reserve Bank of India (RBI), the banking regulator in a March 29, 2003 notification had stated,

“Creation of DTA results in an increase in Tier I capital of a bank without any tangible asset being added to the banks’ balance sheet. Therefore, in terms of the extant instructions on capital adequacy, DTA, which is an intangible asset, should be deducted from Tier I Capital.”

However, with the deteriorating asset quality in the banking industry straining capital adequacy, the RBI relaxed the treatment of net DTA in a notification on March 1, 2016 and stated,

“(i) Deferred tax assets (DTAs) associated with accumulated losses and other such assets should be deducted in full from CET1 capital.

(ii) DTAs which relate to timing differences (other than those related to accumulated losses) may, instead of full deduction from CET1 capital, be recognised in the CET1 capital up to 10% of a bank’s CET1 capital, at the discretion of banks.”

Despite the regulatory forbearance, as a matter of prudence, analysts should deduct net DTA from tier-1 capital and from book value.

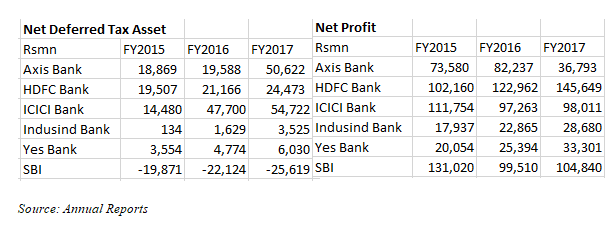

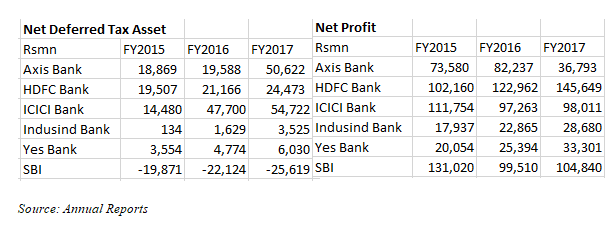

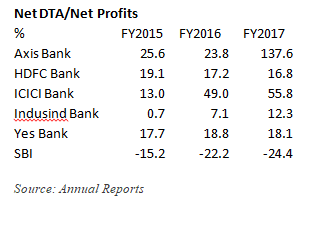

In the last 3 years, net DTA has risen sharply in ICICI Bank and Axis Bank and this coincided with the spike in loan loss provisions and stagnant net profits. Earnings of these banks will have fallen even more sharply if the net DTA had not been created. In FY2017, for Axis Bank not only did net DTA significantly rise but net profit fell sharply and as a result, DTA to net profit was 138%. In FY2016, ICICI Bank’s DTA to net profits rose to 49% from 13% in FY2015 and in FY2017 it continued to rise to 56%. SBI in contrast prudently maintains a net deferred tax liability.

The capital market must closely monitor the trend in DTA in these banks as they cannot indefinitely keep increasing it and at some point of time, it will have to reverse resulting in a charge to earnings. In the opinion of this writer, banks should focus on reducing net DTA and not increasing it as it will weigh down future net earnings.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I have no position in Axis Bank, Indusind Bank & Yes Bank securities but have a position in HDFC Bank and ICICI Bank securities referenced in this note. Views expressed in this note accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This note does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this note comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this note or hold any specific opinion on the securities referenced therein. This note is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.