State Bank of India (SBI), India’s largest bank, became even larger with the merger of its five commercial banking subsidiaries on April 1, 2017.

Leading up to the All Fool’s Day merger, in mid-February 2017, finance minister Arun Jaitley was confident the step would make the bank a global player; a month later, SBI chairperson Arundhati Bhattacharya indicated that she expected to boost the bank’s annual profit by Rs 3,000 crore in three years.

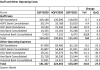

When SBI declared its results on May 19, analysts discovered, to their horror, that the path to global greatness lay through a minefield of subsidiaries’ losses, estimated at Rs 5,792 crores in the quarter ended March 2017 and Rs 10,243 crores for the full year. Excluding non-banking SBI subsidiaries such as life and general insurance, which reported annual profits of nearly Rs 2,000 crores, the losses would have been higher. SBI’s recommended dividend of Rs 2.5 per share for FY 2017, will entail an outflow of Rs 2,073 crores, far exceeding the consolidated net profit of Rs 241 crores and shareholders should not approve the dividend as it will be paid from the bank’s reserves. Post the results, on May 22, SBI’s stock price fell by 4.6% to Rs 294 and it is currently trading Rs 288, indicating investor apprehension with the huge and unexpected losses of its former banking subsidiaries.

What was particularly disturbing was the complete lack of transparency regarding disclosing these losses in the SBI result presentations, in which the bank only focused on the far better standalone results. The only clue in SBI’s press release, apart from the mandatory disclosure of consolidated abridged annual results, was a single sentence, “Net Profit (after minority interest) of SBI Group declined from Rs 12,225 crore in FY’16 to Rs 241 crore in FY’17…”

In contrast, analysts polled by Bloomberg had estimated full year consolidated profits of Rs 6,887 crores.

It was known that SBI’s banking subsidiaries were having a difficult FY’17 in anticipation of the merger, and the consolidated results for the nine month period ended December 31, 2016, revealed losses of a minimum Rs 4,550 crores in the subsidiaries. However, the additional loss of Rs 5,792 crores in the quarter ended March was a shock to the capital market, as the bank’s guidance had not indicated losses of this magnitude in the concluding quarter. There is no explanation in the public domain by SBI regarding what had happened to cause such a deterioration in the final quarter – had the economy experienced a tailspin or did the parent wake up to considerable ‘ever-greening’ of bad loans by its subsidiaries?

It is more than a little troubling that a bank with SBI’s rich heritage has opted to remain publicly silent on such an issue.

The lack of transparency in publishing and discussing these losses by the SBI senior management is also compounded by potential issues of governance. After all, these banking subsidiaries had been under the direct managerial control of the parent since their takeover by SBI in 1959; they shared a common chairperson with the parent, their managing directors were on deputation from SBI, they had a common information technology platform, an integrated treasury, and most, if not all, of their major commercial and credit decisions were first vetted by SBI. The question that naturally arises: Was the banking regulator (RBI), the parent (SBI) and the chairperson (Bhattacharya) oblivious to the state of asset quality in these subsidiaries? Was the drumbeat of consolidation of creating a global bank merely a disguise to bail-out poorly-managed banks? And, finally, who is to be held accountable for these huge losses?

Unfortunately, amid a government-induced euphoria over bank consolidation, neither the majority shareholder (the government), nor the banking regulator, nor the media, nor myriad banking analysts, are raising these issues of national and capital market interest.

Another curious development was the surprising overnight management shuffle in Punjab National Bank (PNB) and Bank of India, where their chief executive officers were sent to smaller banks ostensibly for poor performance. However, in the case of PNB, its Q4 results actually showed an improvement – SBI’s Bhattacharya on the other hand was given a one year extension on October 1, 2016, to provide continuity for the merger of the bank’s subsidiaries which resulted in huge losses.

Has the government misstepped in compelling SBI to merge all five of its banking subsidiaries in a single stroke? After all, India currently needs its largest bank to be at the vanguard of its economy, to stimulate stagnant economic growth. Instead, its attention is now largely directed inward, trying to resolve the asset quality of its former subsidiaries and addressing the far more complex issues of integrating human resources and realigning organisational structures and career paths of its mammoth staff. Before the government continues on its ill-advised strategy of more government bank mergers, it should pause and evaluate how SBI is digesting its former subsidiaries. Merging other government banks will be far more complex than the SBI merger as the SBI group had common policies in human resources, information technology, accounting, basic banking systems, a similar culture and SBI bank subsidiaries were always subservient to the parent and its authority. The commonality within the SBI group cannot be assumed to be prevalent amongst the nationalised banks, especially when senior management’s attention is engaged in firefighting huge non-performing assets in the industry.

To bridge the gaping hole the former subsidiaries have blown in SBI’s consolidated balance sheet, the bank is finalising an equity issue of nearly Rs 10,000 crores. As many investment banks will eventually participate in the issue, it is unlikely that their research analysts will release critical reports on SBI or on the ills of bank consolidation. However, as the immediate experience of the SBI merger has shown, reality can be very different from the visions of grandeur eloquently articulated by proponents of consolidation.