Reliance Naval Engineering (RNE) will in all likelihood be classified as non-performing by all the concerned banks in the consortium for the quarter ended March 31, 2018. Long facing difficulty meeting its financial obligations, the company finally fell short in the December quarter. In the March quarter, banks in the consortium were unable to agree on a restructuring proposal and the account became 90 days’ overdue; a press release by the company may compel the majority of banks to classify the account as non-performing.

Although the major hit from RNE will be borne by State Bank of India and IDBI Bank, Yes Bank also has a significant exposure of Rs 4.85 bn. outside the consortium of banks. Interestingly, till the December quarter, in the banking industry RNE was classified as a non-restructured standard asset, and was not included in any of the restructuring mechanisms/disclosures introduced by the regulator; hence it sailed below the radar of most analysts.

More than the size of the hit that Yes Bank will take, its conduct in the entire affair is worrying, for it unsettles confidence in its reporting. Senior Yes Bank officials, led by Rajat Monga — the former chief financial officer (CFO), and the official responsible for mis-reporting two consecutive years of results — have been informing sell-side analysts in the March quarter that they have nothing to worry from Yes Bank’s corporate exposures. While the impact of RNE on credit costs of the bank is marginal and within the guidance provided by the bank, in this writer’s opinion the bank should have forewarned analysts of the possibility of a large, poor quality standard account belonging to a cash-strapped business group being classified as a NPA, especially when analysts were concerned of worsening corporate asset quality in the industry in the March quarter. Is this deliberate obfuscation? Or does the bank, in defiance of the industry, plan to classify RNE as a standard asset when it reports results on April 26, 2018? If it is the latter, then nothing has changed for this serial misinformer.

The Indian banking industry has a large exposure of around Rs 90 – 100 bn on RNE (formerly, Reliance Defence and Engineering Limited/Pipavav Defence and Offshore Engineering Company). An Economic Times article dated September 15, 2017 quoted two unnamed bankers as stating,

“Reliance Naval is classified as special mention account-2 or SMA-2 [not received dues for over 60 days but less than 90 days] with all banks. Somehow, in the past few months, the company has managed to make critical payment before the end of the 90-day deadline to prevent the account from slipping into the bad loan basket,”

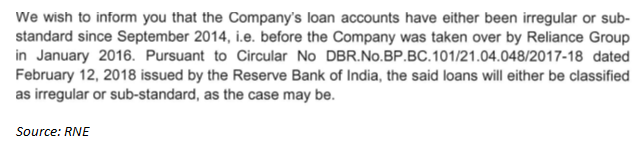

Since then, according to bankers this writer interacted with, RNE was unable to service its interest for the December 2017 quarter and it was negotiating a restructuring with banks which did not materialise. Consequently, on March 1, 2018, RNE issued a disclosure to the stock exchanges which stated,

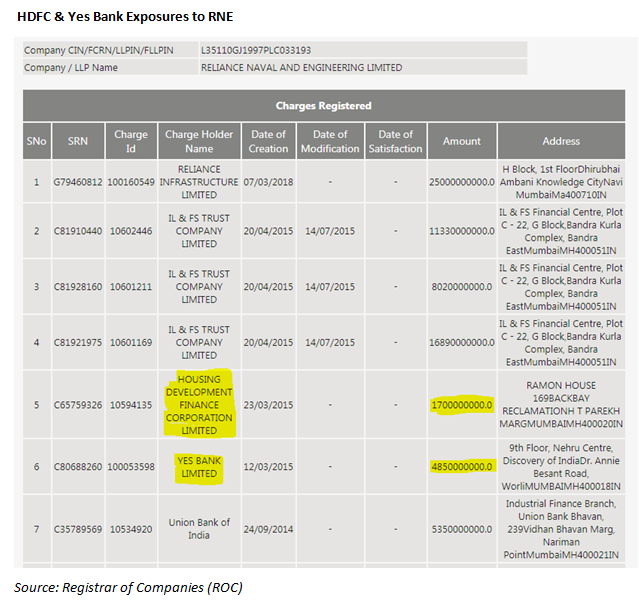

Some of the banks this analyst interacted confirmed that RNE has been classified as NPA by them for the quarter ended March 31, 2018 as a result of the RBI notification. The company has now 180 days for the creditors to accept the resolution plan, failing which the company will be admitted to the National Company Law Tribunal (NCLT). Government banks like State Bank of India (SBI) and IDBI have the largest exposures on RNE, but, interestingly, according to the Registrar of Companies (ROC), Yes Bank and HDFC also have exposures on the company.

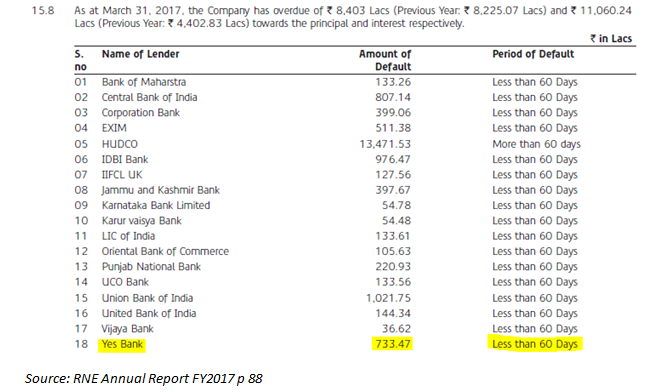

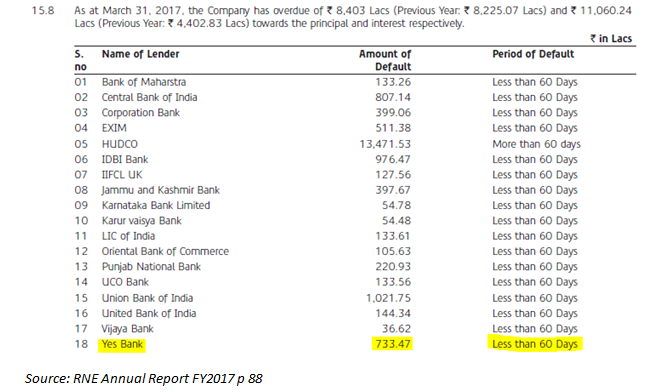

As per the ROC filing, Yes Bank, since March 12, 2015 has an exposure of Rs 4.85 bn. on RNE and there has been no change in the modification of charge since that date. The Yes Bank loan to RNE is at a coupon of 11% (spread of 0.25% p.a over YES Bank Base Rate), payable monthly. In RNE’s FY2017 annual report, the auditors highlighted that the company had overdues in repayment of interest and principal aggregating to Rs 1.95 bn, including a default of less than 60 days to Yes Bank of Rs 73.3 mn.

RNE Loan Payment Arrears as on March 31, 2017

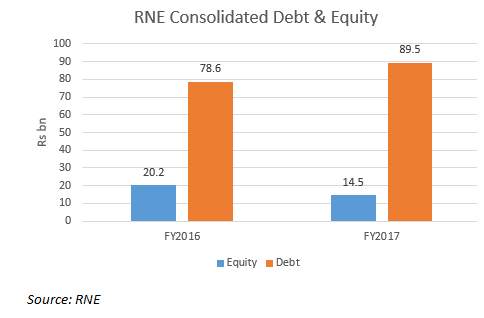

The debt of RNE has been mounting since FY2016, and in FY2017 the consolidated debt was Rs 89.5 bn, as compared to Rs 78.6 bn in FY2016, and its debt to equity is clearly unsustainable.

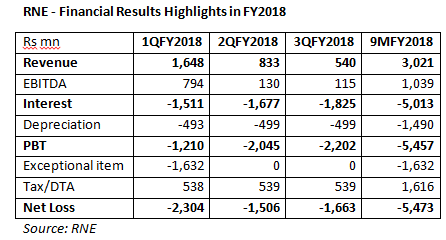

The financial results of RNE in FY2018 has only got worse. Revenue has plummeted, interest costs have not only soared but are significantly higher than revenue and losses are mounting.

What is even more interesting is that in early to mid-March, i.e. after RNE had informed stock exchanges that it was going to be classified as irregular and/or non-performing by banks, Yes Bank officials were informing sell-side analysts that all was well, and shareholders had no reason to worry from any corporate accounts that may be classified as NPA. Sell-side analysts were concerned as an RBI circular dated February 12, 2018 compelled the industry to classify accounts as NPA which were under various corporate restructuring mechanisms, and hence the industry was expected to be badly hit with a surge in corporate NPAs.

A research note by IIFL on a management meeting with Yes Bank, rated a ‘Buy’, dated March 23, 2018 states,

Well-positioned to mitigate credit quality issues. Management insists that the RBI circular will not accelerate its delinquencies. It proactively identifies stress and has adequate safeguards in contracts.

An HSBC note dated March 15, 2018 titled, “Buy: Management meeting reinforces positive outlook” said,

Our recent interaction with YES Bank’s management (Mr Rajat Monga, CFO, and Mr Niranjan Banodkar, Head of Investor Relations) provided interesting perspectives on some key areas, and overall, it reinforced our view that the bank is in a strong position to sustain its market share gains while improving its core profitability.

A note by J M Financial dated March 8, 2018, a week after RNE had informed the stock exchanges about it being classified as NPA, titled, “Yes Bank – Buy, Q&A with management,” said

“Q: What is the impact the recent RBI guidelines on stressed assets impacting Yes Bank and the credit costs outlook thereof?

[A] For Yes Bank, the impact of the recent RBI guidelines on our Restructured Book as well as on exposures to entities with systemic exposures above INR1Bn is minimal and it doesn’t alter the Bank’s outlook on its credit / asset quality parameters.”

It is apparent from these research notes that senior officials of Yes Bank were not informing sell-side analysts about its significant RNE exposure of Rs 4.85 bn, despite the company informing the public on March 1, 2018 that banks will be classifying the account as irregular/NPA. The slippage of RNE to NPA for Yes Bank may marginally move the needle on the bank’s overall credit costs, but nevertheless the size of the exposure is significant enough to forewarn analysts – a single account constitutes 16% of the bank’s 3QFY2018 gross NPAs of Rs 29.74 bn. A fallout of the RNE non-disclosure is how many more of such accounts, maybe present in Yes Bank’s portfolio that analysts have not unearthed? It is pertinent to remember that Mr Rajat Monga (the former CFO, a new CFO was appointed on April 3, 2018) has the dubious credibility of signing off on two consecutive years of untrustworthy accounts. If Yes Bank reports the RNE account as “standard” when it reports 4QFY2018 results on April 26, 2018, it reveals that transparency of asset quality remains an issue in the bank and naming and shaming the bank by regulatory disclosures has no impact.

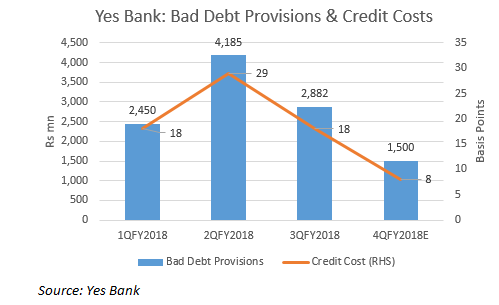

In the quarter ended March 31, 2018, the Indian banking and financial institutional industry is likely to add Rs 90-100 bn as NPA from this single account (RNE). The incremental bad debt provisions for the industry based on a minimum 15% provision will be around Rs 13.5 bn- Rs 15 bn, and for Yes Bank it would be around Rs 728 mn (around 25% of 3QFY2018 provisions from a single account). In 1QFY2018, Yes Bank had guided for FY2018 credit costs of 50-70 basis points (bps) and for the 9 month period ended December 2017, the bank achieved 64 bps. For the 4QFY2018, assuming the bank increases credit by 50% yoy and reports bad debt provisions of Rs 1,500 mn, assuming credit costs of 8 bps including RNA credit costs, then a single account will account for around half of the total credit costs for the bank. If Yes Bank adds the RNA credit costs to the Rs 1,500 mn for the entire bank, the overall credit costs increases to 12 bps from the earlier estimate of 8 bps.

More importantly though, trusting analysts who had faith in Yes Bank’s earlier accounts, and who continue to rate the bank as a “Buy” as they meet the same officials who conjured the earlier accounts, may consider taking some effort in cross-checking prior to regurgitating management commentary to institutional investors.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594). I have no position in any of the securities referenced in this note. Views expressed in this note accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This note does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this note comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this note or hold any specific opinion on the securities referenced therein. This note is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.