In an earlier insight, More Transparency Was Expected From HDFC Regarding Its Reliance Naval Exposure, on April 19, 2018, this writer had cautioned that RNE was a problem account in the industry and that most banks in the consortium would be classifying the account as a NPA.

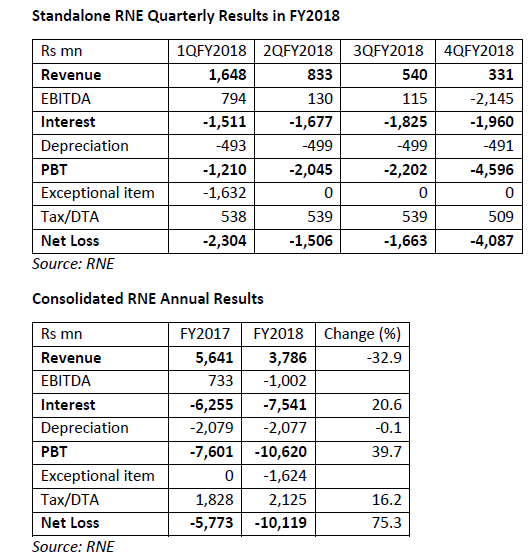

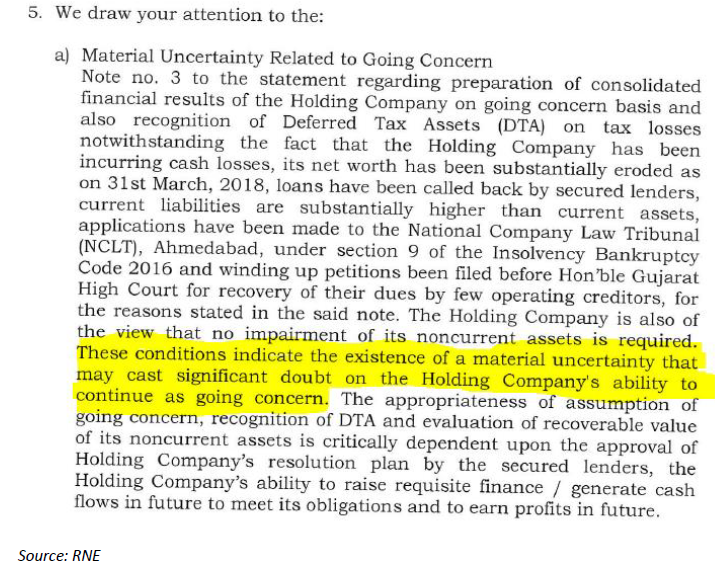

On April 23, 2018, RNE declared its results, which clearly showed a marked deterioration both in standalone quarterly results as well as the consolidated annual results. In consolidated annual results, revenue has fallen by 33%, while interest has risen by 21%, and in both years interest is more than revenue and losses have increased by 75%. In FY2018, it even reported an EBITDA loss. Indeed, Pathak H.D. Associates, the company’s auditor, commenting on certain observations, qualified the accounts and stating, “These conditions indicate the existence of a material uncertainty that may cast significant doubt on the Holding Company’s ability to continue as going concern.”

When RNE’s own auditor is questioning whether the company can continue as a going concern it is no surprise that the banks should be classifying the account as a NPA, especially when the company itself issued a press release on March 1, 2018 stating that banks will be classifying the account as NPA.

As per the Registrar of Companies, HDFC since March 23, 2015 has an exposure of Rs 1.7 bn. on RNE and HDFC has not denied the exposure in interactions with this writer. For the entire banking industry, RNE was a standard asset as on December 31, 2017 even though RNE had not serviced interest on that date. Since by March 31, 2018, RNE was 90 days past due on its interest, all banks in the consortium are expected to classify the account as NPA. Our earlier research note on Yes Bank had stated that the bank was an exception amongst banks in not classifying RNE as a NPA. HDFC reported its results on April 30, 2018, 7 days after RNE and it was apparent from HDFC’s results that it too was classifying the RNE exposure as a standard account.

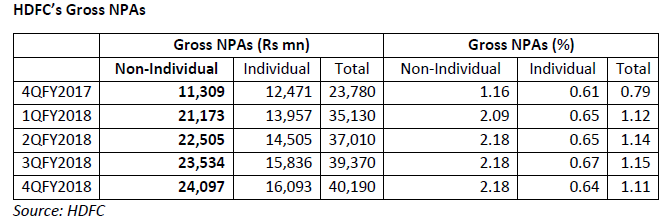

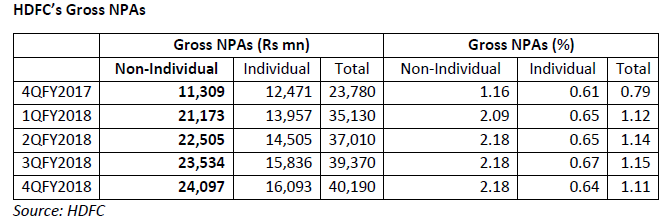

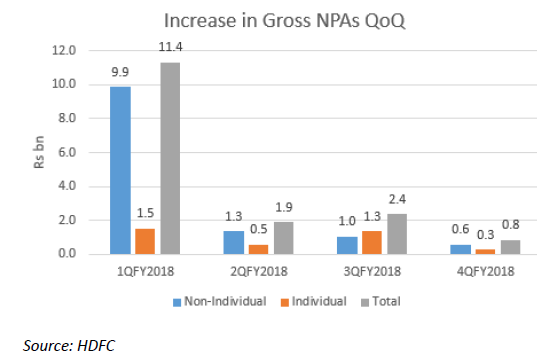

In the 4QFY2018, HDFC’s non-individual bad loans (essentially corporate) rose by only Rs 562 mn QoQ, significantly lower than its total exposure of Rs 1.7 bn to RNE which means that RNE was classified as a standard account in HDFC in the 4QFY2018 and it was apparently servicing its loan to HDFC while the company had ceased servicing to its consortium of banks in the December 2017 quarter.

The question naturally arises on why RNE is servicing its loan to HDFC and Yes Bank in a quarter when it was not servicing its loans to its consortium of banks. This writer, post the HDFC results, sent a detailed questionnaire to HDFC but despite reminders, the management declined to respond. One of the questions specifically pertained to whether HDFC had lent additional funds to either RNE or to any of the Anil Ambani group companies or any affiliate company, the proceeds of which were utilized to meet RNE’s interest commitments to HDFC.

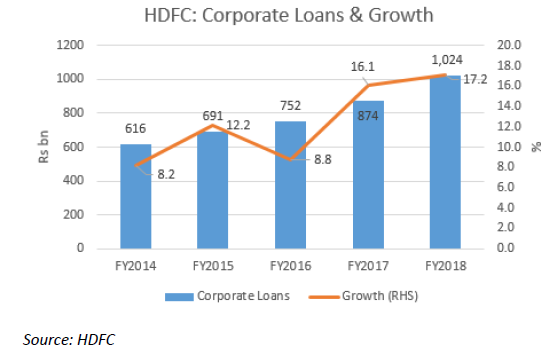

It remains a mystery why a blue chip company like HDFC, which trades at 5.2x consolidated book value, with foreign shareholding of 73% and has total bad debt provisions of Rs 34 bn, as compared with gross NPAs of Rs 40.2 bn as on FY2018, should avoid classifying a mere Rs 1.7 bn account as an NPA, when it is evident that RNE is no longer a viable entity. If HDFC had classified RNE as NPA as on 4QFY2018, its total non-individual NPAs would have increased to Rs 25.8 bn; NPAs would have risen from the reported 2.18% of non-individual loans to 2.39% of non-individual loans, and its total gross NPAs would have increased to 1.17% from 1.11%. The increase in its NPAs from RNE is not very significant, and HDFC could have easily classified the account as NPA without a material impact on its financials.

Since the publication of this writer’s earlier research note on April 19, 2018 cautioning investors of the RNE account in HDFC, this writer has not read a single research note by the sell-side or by the business media highlighting this critical development on a blue-chip and widely tracked company. According to Bloomberg, HDFC is tracked by 36 analysts with 80% maintaining a ‘Buy’ recommendation and it is strange but expected that analysts completely ignore this development in their reviews post HDFC’s results.

By not classifying RNE as a NPA in the March quarter when much weaker government banks, which trade at lower than 1x book value, are likely to classify the account as NPA, raises a credibility issue for HDFC. As this writer and the market are aware that HDFC does have a corporate account which should be a NPA, there may be more such accounts in HDFC which the company continues to classify as standard, and the market remains ignorant of them.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594). I have no position in any of the securities referenced in this note. Views expressed in this note accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This note does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this note comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this note or hold any specific opinion on the securities referenced therein. This note is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.