It seems miracles do happen. The lame walk, the dying return to life, the blind see – well, maybe not the last, if they are sell-side analysts and the business media, in which case they keep their eyes closed for life. Had they attempted a close analysis of Yes Bank’s 4QFY2018 results, they would have found that Reliance Naval Engineering (RNE) account of Rs 4.85 bn was classified by the bank as a standard performing asset — a feat surely equaling the lame walking or the dead returning to life. This despite the fact that RNE’s 4QFY2018 results, declared prior to Yes Bank’s, show worsening financials, with most of the 20-member bank consortium of the company likely to classify the account as non-performing for the 4QFY2018.

An issue that naturally arises is how Yes Bank is able to get its loan serviced by RNE in the March quarter, when RNE was unable to service the consortium banks since the December quarter. Moreover, the precarious financial health of RNE indicates that it will be difficult for any bank to continue to classify the account as performing in 1QFY2019. Given that Yes Bank is a repeat offender, reporting untrustworthy accounts for FY2016 and FY2017, the regulator should examine how such an account has been classified as standard by the bank in the March quarter.

In an earlier insight, Reliance Naval Sinking Into NPA – Yes Bank to Take a Hit, on April 19, 2018, this writer had cautioned that RNE was a problem account in the industry and that most banks in the consortium would be classifying the account as a NPA.

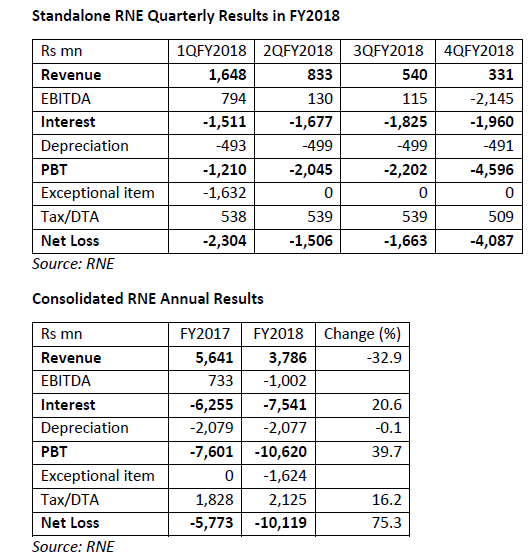

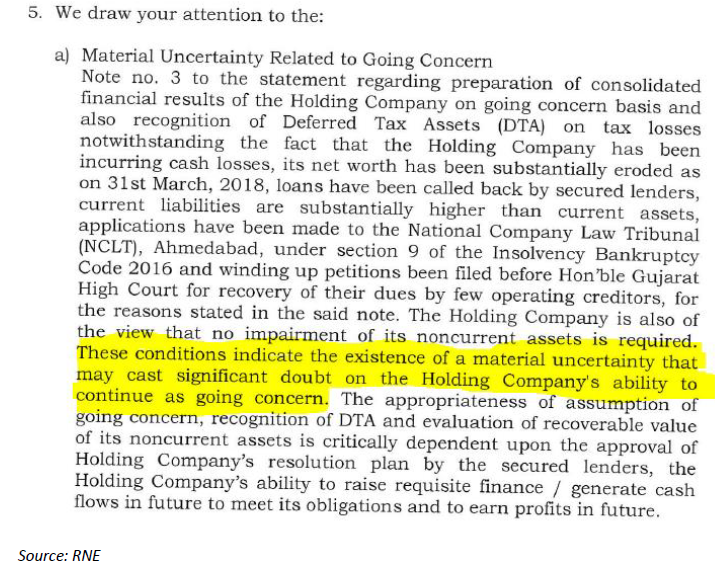

On April 23, 2018, RNE declared its results, which clearly showed a marked deterioration both in stand-alone quarterly results as well as the consolidated annual results. In consolidated annual results, revenue has fallen by 33%, while interest has risen by 21%, and in both years interest is more than revenue and losses have increased by 75%. Indeed, Pathak H.D. Associates, the company’s auditor, commenting on certain observations, qualified the accounts and stated, “These conditions indicate the existence of a material uncertainty that may cast significant doubt on the Holding Company’s ability to continue as going concern.”

When RNE’s own auditor is questioning whether the company can continue as a going concern it is no surprise that the banks should be classifying the account as a NPA, especially when the company itself issued a press release on March 1, 2018 stating that banks will be classifying the account as NPA.

Yes Bank, as per the Registrar of Companies filing, has a sanctioned exposure of Rs 4.85 bn on RNE, and this account was classified by all the banks as a standard account as of 3QFY2018, although for most banks the company had not serviced interest dues as on December 31, 2017. Since as on March 31, 2018, it had become 90 days past due, most of the banks would classify the account as NPA — with the notable exception of Yes Bank.

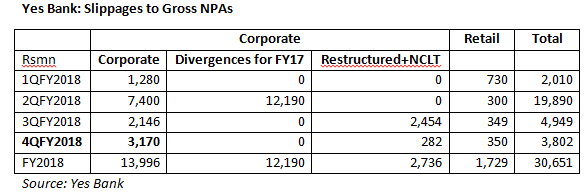

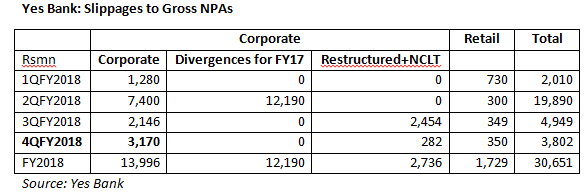

When Yes Bank reported its 4QFY2018 results on April 26, 2018, 3 days after RNE, it became apparent that the bank’s RNE exposure was classified as performing, as the total corporate slippages to NPAs in the quarter was only around Rs 3.17 bn, lower than its RNE exposure.

Responding to a journalist’s query during the results press conference on the status of the RNE account, Rana Kapoor, the promoter-CEO of the bank, said that the RNE account was performing for the bank and it was a well collateralized exposure which could be easily liquidated.

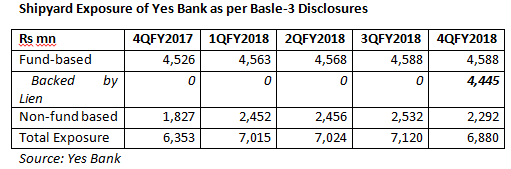

The Basel-3 disclosures pertaining to industry-wise loans and collateral held show that Yes Bank, under the shipyard classification, has a total fund-based exposure of Rs 4.6 bn, which is close to the ROC disclosure, and hence one can infer that the fund-based shipyard exposure is that of RNE. More importantly, it reveals that prior to the 4QFY2018, this exposure was not backed by lien but in 4QFY2018, a lien of Rs 4.45 bn suddenly appears.

It appears that this lien of Rs 4.45 bn is the well collateralized security that Rana Kapoor is alluding to. The issue is by the 3QFY2018, all the banks were aware that RNE was a problem account and the likelihood of it becoming a NPA was very high. Not only was RNE cash-strapped and excessively leveraged, the Anil Ambani business group it belonged to was also experiencing financial difficulties. As per the bankers this analyst interacted with, RNE was unable to even pay for normal banking fees but yet miraculously, it was able to exclusively carve out a security of Rs 4.4 bn for Yes Bank, a non-consortium bank in a period of financial crisis when even the company’s auditor was questioning its existence as a going concern.

This amazing feat of banking by Yes Bank needs to be investigated by the banking supervisor, as Yes Bank has supposedly not only been able to get its loans serviced when the company was unable to service loans from the consortium of banks, but it has also been able to extract a highly liquid security from the company during a period of acute financial crisis. Whether Yes Bank can continue to classify RNE as a standard account in FY2019 remains to be seen. It cannot be ruled out that it would instead contribute to a hat-trick in mis-reporting of the bank’s accounts in FY2018.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594). I have no position in any of the securities referenced in this note. Views expressed in this note accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This note does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this note comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this note or hold any specific opinion on the securities referenced therein. This note is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.