EXECUTIVE SUMMARY

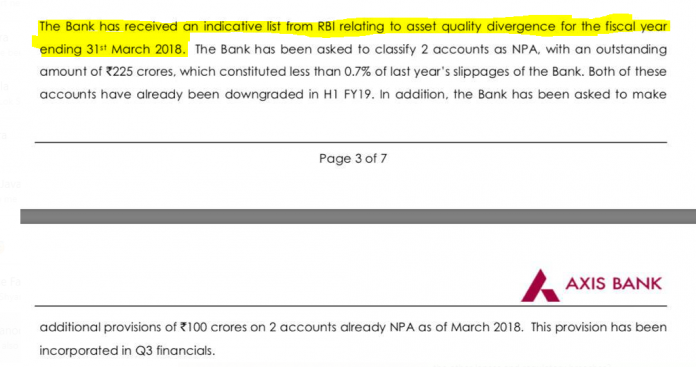

Yes Bank is in the cross hairs of the Reserve Bank of India (RBI), the banking regulator. On February 13, 2019, the bank issued a press release stating that the regulator’s risk assessment report (RAR) for the year ended March 31, 2018 revealed nil divergence, i.e. the bank’s net profits and asset quality were in conformity with the regulatory norms, unlike in FY2016 and FY2017. However, on February 15, 2019, the bank released a note stating that the RBI had pulled up the bank, as publicly disclosing a part of the RAR breaches regulatory confidentiality and is in violation of regulatory guidelines. While the RAR is indeed confidential, the RBI did not publicly admonish other banks like HDFC Bank, Axis Bank and Kotak Mahindra Bank (KMB) when they had publicly revealed nil divergence from their RARs. It is apparent that Yes Bank is the bad boy in the eyes of the regulator, and the bank will have to renew its efforts to change that perception. Shareholders have to therefore exercise caution and take the surge in the share price with a pinch of salt.