The shimmering lustre of India’s crown jewel of banking, HDFC Bank, is attributed to its chief executive officer (CEO), Aditya Puri. In a span of nearly 24 years he has taken its market capitalisation to US$ 74.4 bn, easily surpassing State Bank of India, the banking behemoth. The secular rise in HDFC Bank’s share price since its inception has made it a core holding in most institutional investors’ portfolio. It has a fawning fan following in the capital market, and criticism of the bank, its strategy and management is rare. One of the lesser known facts is that Aditya Puri may become the longest serving CEO in banking history, with the help of the Reserve Bank of India (RBI), the banking regulator. The sheer length of his tenure should be a concern as banks, unlike other companies, are highly leveraged institutions, and the largest stake holders are the public. Strangely, while sound banking practices insist on regular transfers of personnel in key posts and a maximum tenure for independent directors, the Indian regulator seems to have given a long lease to Aditya Puri and the other private bank CEOs, no doubt influenced by the glitter of its stock price performance. His term will be coming to an end at a time when there appears to be no sign of an economic revival, and even retail loan growth may slow down on account of issues in the IT and telecom sectors. His successor therefore may find the banking environment less benign.

Aditya Puri was appointed as HDFC Bank’s first and so far only CEO on September 12, 1994 and built the bank from scratch to a market capitalization of US$ 74.4 bn. and more importantly to an unrivalled price to book value of 5.3x, the highest in banks of over US$ 50 bn in market capitalization. In the process many institutional shareholders prospered, as it became a core holding in their portfolio, and most investors maintained an overweight position.

While investors may rejoice at Puri’s long tenure of 23 ½ years at the helm, and may even want him to continue as long as he is able, one must be cautious about lengthy tenures of bank CEOs, and banking regulators need to cap the tenure of CEOs.

Earlier, the RBI allowed CEOs of private banks to continue in their posts till the age of 65 years. When Puri was nearing that age in 2014, the RBI, citing the Companies Act, 2013 permitted the upper age limit to be raised till the age of 70 for private sector banks CEOs and executive directors. By citing the Companies Act, 2013 as its reference point, the RBI is treating banks like any other companies, when in fact banks are special and require different regulations, as they are highly leveraged and deal primarily with public funds.

In India, there is a major dichotomy between the tenures of CEOs in government banks and the new private sector banks. In the former, tenures tend to be a maximum of 5 years, while in the latter it can extend to much longer, as they are appointed at a much younger age compared with their counter parts in the government banks.

In private sector banks, as per the Banking Regulation Act, 1949 the maximum tenure for independent directors is eight years. The Central Vigilance Commission has issued instructions to government banks that clerical staff and officers need to be transferred every 5 and 3 years respectively, and staff remaining in a post for a lengthy period can be risky, as Punjab National Bank (PNB) found to its cost. One of the reasons that one of the key PNB officials involved in the fraud was allowed to remain in his post for so long because according to media reports he was found to be an efficient and a hard worker by his seniors. The fraud finally got unearthed when the PNB staffer retired from the bank. In government banks on account of the frequent change in CEOs on account of the individuals being appointed in their late 50s and with the retirement age at 60, the banks’ financials periodically were cleaned up as the new CEO started on a clean slate. When CEOs are given extra-long tenures, outsiders are unaware of the true state of the accounts. When long tenures in lower positions in banks are discouraged, how is it that the banking regulator permits and encourages long tenures in the CEOs post?

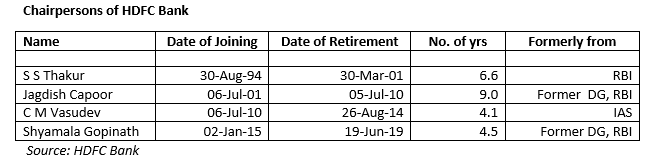

When a CEO has a long tenure, the individual tends to dominate the board of directors, and the board feels beholden to the CEO, especially if the share has performed well under the CEO’s leadership. The board, along with the other major players – the media, analysts, shareholders and even the regulator – become in awe of the CEO, and the CEO’s decisions are uncontested. Such a feeling of complacency and hero worship is not a healthy sign, especially in a bank, which primarily manages public funds. Aditya Puri’s tenure at HDFC Bank has so far outlasted 3 chairpersons of the board of directors and is expected to outlast the current chairperson as well.

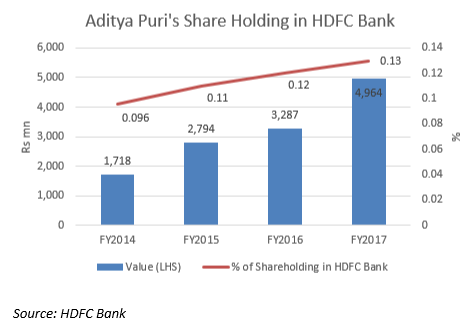

During his tenure at HDFC Bank, Aditya Puri, through stock options, has a significant shareholding of 3.44 mn shares, valued at nearly Rs 5 bn as on March 31, 2017. His holding in HDFC Bank has slowly crept up from 0.096% in FY2014 to 0.13% in FY2017, and in all likelihood, Aditya Puri may be the single largest individual shareholder in HDFC Bank. In a bank, when the CEO has substantial shareholding, conflicts of interest may arise, and it becomes the board and the regulator’s responsibility to carefully monitor to ensure that depositors’ interest are not jeopardized.

Long tenures of CEO also create an issue with succession planning. Aspiring and competent individuals leave the organization for leadership positions with rivals as they see no future for themselves to ever achieve the CEO’s position in their current organization. Indeed Shailendra Bhandari, part of the original core team which set up HDFC Bank, left as he did not see himself ever becoming CEO at HDFC Bank. Normally, for any senior post there should be more than one contender but in the case of HDFC Bank it appears that Paresh Sukthanker, the deputy managing director is the sole contender and heir apparent to Aditya Puri. In the Anglo Saxon banks, normally there is an opportunity given to atleast 2 individuals to succeed the CEO, and different assignments are given to them. The board monitors how they perform, and when a selection is made the loser normally leaves the bank. Being dependent on a sole heir without having a spare can prove costly for a bank like HDFC Bank if things go wrong. One of the CEOs of a small local area bank informed this writer how the RBI used to constantly emphasize succession planning when they inspected the bank, But apparently in the case of India’s largest bank by market capitalization, the same concerns by the regulator do not apply.

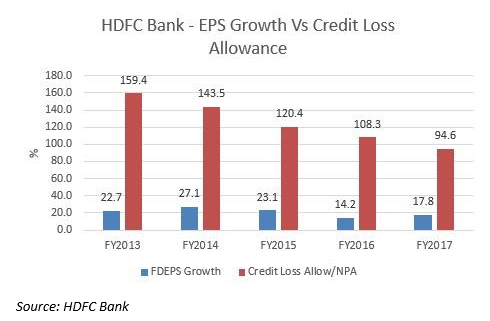

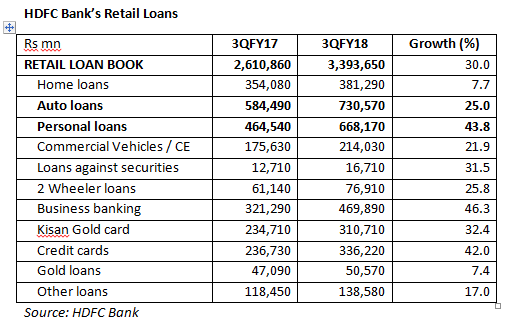

The quality and quantity of HDFC Bank’s earnings have been deteriorating as the economic slowdown has had an impact on the bank. Its fully diluted EPS growth has been decelerating. Worse: its credit loss allowance has also been falling indicating it cannot maintain the high allowances of the past and report earnings growth to the market’s satisfaction. Reputed banking analyst and fellow Smartkarma Insight contributor, Daniel Tabbush has been highlighting concerns on HDFC Bank’s rising credit costs for a while. Retail loans have been a critical driver for HDFC Bank’s overall asset growth, and personal loans (mainly unsecured) has been a major driver. Already the salaried sector is facing job losses in information technology, telecom and even HDFC Bank’s own headcount is coming down on account of automation and digital. If retail loan growth also gets impacted without a corresponding improvement in corporate performance, retail loans are also going to come under pressure in the near future. As HDFC Bank is approaching the capital market for an equity issue for future growth, investors should be aware that the glory days appear to be over, and in a span of two more years a new CEO will take charge.

To date, HDFC Bank has been the darling of the market for creating bountiful wealth for shareholders, and global investors are content for Aditya Puri to retire in the post of CEO. While there is no denying the contribution his leadership has made in the Indian banking industry and the capital market, one must exercise caution when bank CEOs are given such long tenures with the regulator’s blessings.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I have a position in HDFC Bank securities mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.