The Reserve Bank of India’s (RBI) approval of the selection of Amitabh Chaudhry, the then HDFC Standard Life Insurance Chief Executive Officer (CEO), as the Axis Bank CEO on August 8, 2018, and his taking charge on January 1, 2019, were celebrated by the market. Analysts and the media were also favourably inclined towards his lateral new hires in the senior management, all of whom had spent many years in HDFC Bank. Unfortunately, these developments actually revealed a strategic fault line in the organisation. The Axis Bank board in its quarter century of existence has not only failed to groom internal candidates for the top-most job, but also recently has been unable to nurture or to trust internal candidates being appointed as executive directors and other critical posts (exception of Chief Risk Officer) in senior management. Recently, it has announced a voluntary retirement scheme which is virtually devoid of benefits to the retiring personnel; over 50 senior management personnel are being eased out at the end of April 2019 with little more than Mediclaim and unexercised stock options to show for their years of service. Such a step is likely to send demoralising tremors down the entire organisation. When the board of Axis Bank believes that only outsiders can be trusted in critical posts in senior management, and these posts are denied to the in-house cadre, how can the bank achieve the present CEO’s performance objectives of a sustainable ROE of 18% and doubling the market capitalisation?

When Axis Bank (then called UTI Bank) commenced operations on April 2, 1994, the first CEO was Supriya Gupta, the former deputy managing director of State Bank of India (SBI). In his prior assignment, he was the CEO of the then State Bank of Bikaner and Jaipur (SBBJ) (since merged with SBI), so most of the officers he brought in came from either that bank or from the SBI group. When he retired on December 31, 1999, the bank was under stress from poor asset quality and capital adequacy (in FY2000 the bank reported net NPA of 4.7% and tier-1 capital of 7.99%), and the board decided to select P.J. Nayak, a non-banker who was then serving as the Executive Trustee with the founder, Unit Trust of India, as the chairman and CEO of the bank. Prior to that Nayak was a civil servant with the Indian Administrative Service (IAS). It was apparent that in the first 6 years of its existence, the bank had either not groomed an internal candidate to succeed Gupta or the board did not find anyone suitable for the job.

Nine years later, the time had come for Nayak to step down, but by that time the bank was on a far stronger footing (FY2009 net NPAs at 0.4% and tier-1 capital of 9.3%). However, in a stormy board meeting, the board did not agree to Nayak’s choice of an internal candidate to succeed him, and instead it selected Shikha Sharma, the then CEO of ICICI Prudential Life Insurance, who had negligible commercial banking experience, as his successor. Here again Axis Bank failed to place trust in a cadre of senior leaders to hold the reins of executive management.

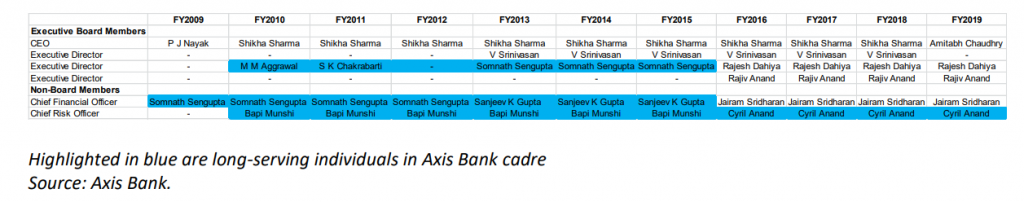

Executive Board Directors, CFOs & CRO Axis Bank Since FY2009

During Sharma’s leadership, outside appointees like Srinivasan, Dahiya and Anand (who had joined Axis Bank just prior to her appointment) were elevated as executive directors to the board. All the executive directors on the board post the resignation of Somnath Sengupta and Sanjeev Gupta, including Shikha Sharma, had never worked in a bank branch and had negligible commercial banking experience. It was therefore no surprise that under her reign, corporate credit, operational risk management and corporate governance sharply deteriorated. When the regulator declined to renew her term as CEO in April 2018, the board again chose an outsider and rejected individuals in her coterie to succeed her.

Outsiders Recruited in Senior Management of Axis Bank

The second major act of Chaudhry was to undertake a restructuring and coerce around 50-70+ senior management staff (executive vice presidents, senior vice presidents and vice-presidents) to take early retirement, without providing them any benefits. Shikha Sharma had also done a similar exercise , but that was some years after taking charge.

The inability of the board in 25 years of existence to select internal candidates as CEOs, or even groom them as executive directors, is a strategic failure in succession planning and management. Either the new CEOs since 2009 prefer to recruit outsiders without first evaluating the potential of the in-house senior management, or the in-house cadre of senior managers at Axis Bank is inherently of doubtful quality, which reflects extremely poorly on the management and human resource training.

Whatever may be the reason, the fact is that Axis Bank is a commercial bank, and not an investment bank, which requires a considerable number of its 60,000+ staff to be motivated to deliver on performance. Furthermore, the forced early retirement scheme, without any benefits to some of the senior management being shifted out, is likely to further lower the morale of the rank and file. If the officer cadre believes, based on the past 25 years of existence and recent announcements, that they can neither aspire for the CEO’s post nor for an executive director’s post nor for any other important post in the bank, and these will be reserved for outsiders, how can they be motivated to improve the performance of the bank and achieve the current CEO’s objective of doubling the market capitalisation and attaining a sustainable ROE of 18%?

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I have no position in any of the securities mentioned in this report with the exception of HDFC Standard Life Insurance and HDFC Bank securities. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.