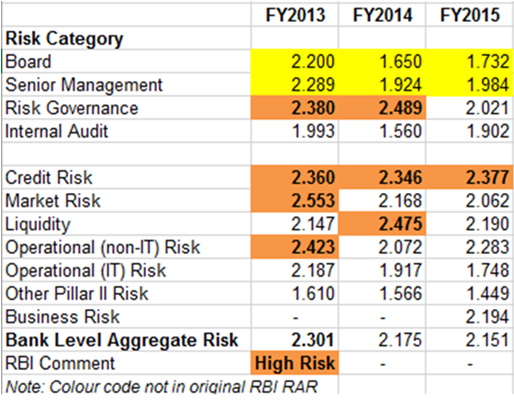

EXECUTIVE SUMMARY. Under the threat of being pulled up for contempt of court by the Supreme Court of India, the Reserve Bank of India (RBI) finally disclosed the confidential inspection reports, called Risk Assessment Reports, of some banks requested under the Right to Information Act (RTI), 2005. The reports, though dated (from FY2013 till FY2015), provide a valuable insight into the actual working of banks, at times in contrast to the management’s commentary to shareholders at that time. In the case of Axis Bank, the divergence of views of the management and the banking supervisor is evident. Many in the sell-side and business media tend to regard management’s commentary with reverence, and these supposed sentinels regurgitate the same to their clients and the public without the rigour of critical evaluation. The now public disclosures of the RARs of banks is a rude wake-up call to these watchpersons to thoroughly scrutinize and challenge audited accounts and management commentary. Media reports cite that Axis Bank may be considering a US$ 1.3 bn equity issue, and although a new CEO has taken charge, investors may well want to exercise caution regarding management commentary in light of the RARs that have been made public.

Recent Posts

Most Popular

Is Yes Bank Providing Custodial Services to RInfra for Its Valuable Property?

A high-profile bank collapses on account of high-risk, bulky non-performing corporate loans. With the intervention of the Reserve Bank of India (RBI), the errant...

Karnataka Bank board showed who’s the boss

As Hemindra Hazari, a Sebi-registered independent research analyst, has pointed out in his report, “Bank boards have clear-cut policies on the approval powers of all...

Economist – Prof R Ramakumar’s Speech at Tarakeswar Chakraborti Memorial Lecture – 1

https://www.youtube.com/watch?v=l72vK9c1RFg

Hemindra Hazari Speech at Tarakeswar Chakraborti Memorial Lecture – 2

https://www.youtube.com/watch?v=eXiLiqh6tuo

Memorial Lecture Held on June 14, 2025, at the Walchand Hirachand Hall, Indian Merchants Chamber, Churchgate, Mumbai

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and...

Official Trailer | The Great Indian Illusion | a Film By Varrun Sukhraj ।...

https://www.youtube.com/watch?v=nuJUMCz7yI8