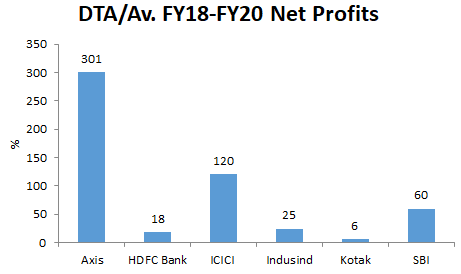

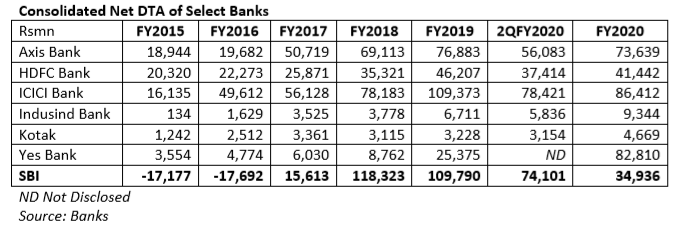

EXECUTIVE SUMMARY. At a time when many private sector banks such as HDFC Bank, ICICI Bank, Axis Bank, Indusind Bank and Yes Bank have increased their deferred tax asset (DTA) in 2HFY2020 as compared with 1HFY2020, thereby inflating their net profits in the period, it is heartening to observe that State Bank of India (SBI), India’s largest and the government’s premier bank, has continued its policy (since FY2019) of reducing its DTA. By reversing its earlier policy (in FY2017 and FY2018) of increasing DTA, SBI has adopted a more conservative accounting policy and in doing so, stakeholders must note that its reported consolidated profits have been depressed in FY2020 by Rs 75 bn, or by 38%. SBI’s consolidated outstanding DTA in FY2020, at Rs 34.9 bn, is now significantly lower than that of ICICI Bank, Yes Bank, Axis Bank and even HDFC Bank.

While SBI is one of the few banks which is reducing DTA, the Reserve Bank of India (RBI) continues to be ignorant of how other banks have been consistently increasing DTA (in 2QFY2020 those banks which opted for the lower corporate tax rate had to reduce DTA). They do this to inflate net profits so as to meet capital market expectations, and thereby to prop up their share prices. It would be prudent for SBI to continue this policy and reduce its DTA to nil in the immediate future.