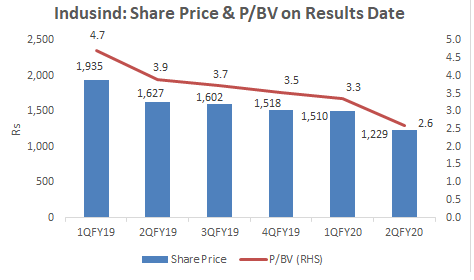

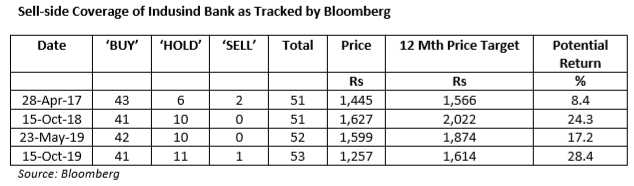

EXECUTIVE SUMMARY. Indusind Bank, once a hot favourite of the market and of institutional investors, is fast losing its lustre. It has fallen by around 21% in the past year, and lost around US$ 1.4 bn for shareholders. But right through this decline, while the market had concerns on asset quality, the overwhelming majority of the 53 sell-side analysts continued to repose faith in the bank and its senior management by steadfastly maintaining their bullish view on the bank. This is despite the bank reporting significantly higher credit costs than the sell-side estimates, compelling them to increase their credit cost estimates for FY20 and FY21E and reduce their 12 month target price on Indusind Bank. Neither the sharp deterioration in asset quality, nor the downgrading of estimates, nor the fall in the share price, nor the opacity in CEO succession has deterred the loyalty of the sell-side to the bank. The safety of the herd ensures that there will be no accountability when bullish calls go horribly wrong. The continued sell-side devotion to Indusind Bank may result in a sour and not so happily-ever-after ending for the bank’s shareholders.