India will likely need to pump in additional capital into any state-owned banks it puts on the block to make them attractive for potential buyers, and faces challenges that range from the need to amend the nation’s banking laws to hostile employee unions, analysts say.

Finance Minister Nirmala Sitharaman said in her budget speech in February that the government plans to sell two public sector banks and launch an IPO of shares in Life Insurance Corp. of India in the fiscal year ending March 31, 2022. The sales are expected to make these state-owned companies more nimble and help the government raise funds to bridge its yawning fiscal gap, which worsened due to the drag from the COVID-19 pandemic.

The government has not disclosed the names of the two banks it plans to sell. However, local media reports have identified Central Bank of India and Indian Overseas Bank as the likely candidates, citing senior officials and a government think tank’s recommendations. Bank of India Ltd. is another lender the government may sell under a multistage process.

“Selling stakes in these banks will be tough due to their weak financial performance and low equity valuations,” said Nikita Anand, an analyst at S&P Global Ratings. “The process to amend banking laws to facilitate stake sales and dealing with labor unions could be time-consuming.”

Banking overhaul

The proposed sales are a part of the government’s efforts to overhaul the state-dominated banking system, which has been plagued by rising bad loans and profitability challenges. As part of the efforts, it conducted three rounds of mergers among state banks to make them bigger and better, cutting their total number to 12 from 27 in 2017. Given the banks’ weak finances, the country kept injecting capital to help them grow their lending, especially to priority sectors that private sector banks often find less lucrative. In total, it invested 3.5 trillion rupees as capital into state banks in the last five years, Anurag Singh Thakur, the then junior minister for finance, said in February.

“While the government’s precarious fiscal position may not allow substantial recapitalization prior to sale to improve their attractiveness to investors, it could nevertheless make the public sector banks more attractive by resolving the bigger bad loans before sell-off so that investors clearly know what their liabilities would be,” said Alok Sheel, the RBI chair professor in macroeconomics at the Indian Council for Research on International Economic Relations, a New Delhi-based think tank.

Prior to a sale, the government will need to amend banking laws that require it to keep a minimum ownership stake of 51% in state-owned banks. While Finance Minister Sitharaman said the government would introduce legislative amendments for privatization, it has yet to bring the bills to Parliament. Opposition political parties and bank employee unions, including the main All India Bank Employees’ Association, have vowed to oppose the plan, citing concerns over job security.

“For potential foreign investors, India and Indonesia are the only genuine emerging market banking stories in Asia. … But why would a foreign investor looking for exposure to the Indian growth story switch out of private sector banks that have shown their competitive advantage through consistent market share gains over time into banks that have lost market share and bring a series of legacy challenges?” said Chris Mallin, founder of macro consulting company CMMP Advisory. Mallin has been analyzing and investing in Indian financial services since the early 1990s.

Possible options

The privatization may happen via capital infusion by another state-run company, a bailout led by a foreign bank or a capital infusion by a strategic investor, Jefferies said in a note after the budget announcement. It cited the precedence of the government-owned Life Insurance Corp. taking a majority stake in IDBI Bank Ltd. in 2019. In November 2020, Singapore’s DBS Group Holdings Ltd., in a deal proposed by the central bank, acquired ailing Indian lender The Lakshmi Vilas Bank Ltd.

Jefferies noted that the asset quality at Indian state-run banks has improved with the majority of stressed loans recognized and that the banks are “reasonably capitalized.” That may help attract investors. “While these banks have lost share in lending, many of them have been able to grow retail deposits well, especially in the post-COVID era as they gained due to risk aversion,” according to Jefferies.

However, state-run banks, especially the lenders that may be on the block, are still struggling to make profits. Analysts say the government may have to spend money to shore up their capital before any sale.

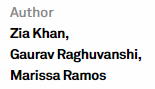

Indian Overseas Bank swung to profit in the fiscal year ended March 31 after reporting losses for at least two fiscal years, while Central Bank of India has been reporting losses for the past three years. Indian Overseas Bank’s return on average equity improved to 5.04% as of March from negative 59.05%, while Central Bank of India’s ROAE has remained in the negative territory for the past three fiscal years. Meanwhile, the two banks’ common equity Tier 1 ratios improved to 12.91% and 12.82%, respectively, as of March, from 8.21% and 9.33% in the prior fiscal year, according to S&P Global Market Intelligence data.

Contrapunto

“The government will have to pump in money to make the sale more acceptable. So, the net amount it can receive from the sale is relevant,” said Hemindra Hazari, a Mumbai-based independent banking analyst.

Instead, the government should keep capitalizing its lenders as they play a key role in funding infrastructure projects and in providing access to banking in economically weaker remote areas of the nation. “The government should not sell the banks just to show its reform credentials. In fact, the government should dominate the sector,” Hazari said. “If the country needs additional spending by the government, it should simply do it, rather than focusing on fiscal deficit, which is just a number.”

India’s fiscal deficit came in at 9.3% for the financial year ended March 31, significantly higher than the 3.5% that the government had planned for the year, mainly due to the COVID-19 pandemic. For the current fiscal year ending March 31, 2022, the government expects the fiscal deficit to ease to 6.8%.

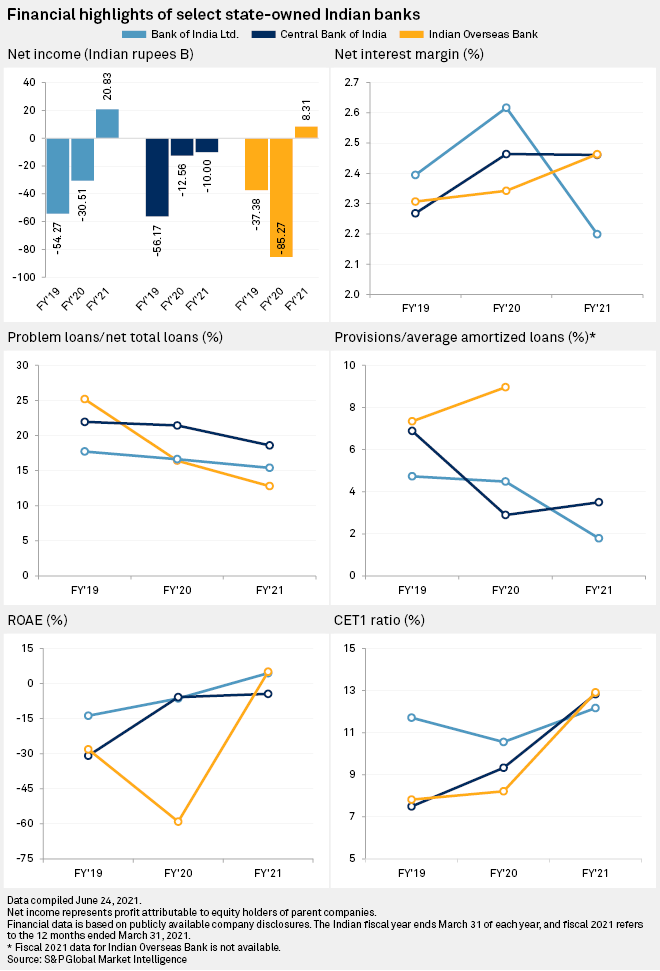

Shares of state-run lenders that may be sold have gained this year. Year-to-date, shares of Indian Overseas Bank, Central Bank of India and Bank of India have gained 141.91%, 85.11% and 50.15%, respectively.

As of July 12, US$1 was equivalent to 74.56 Indian rupees.