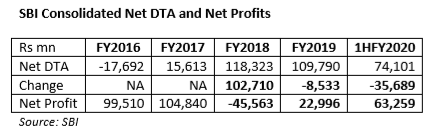

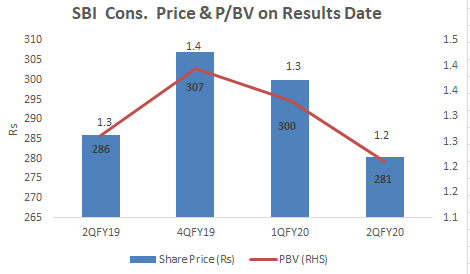

EXECUTIVE SUMMARY. No doubt the stock market has de-rated banking behemoth, State Bank of India (SBI), since its 4QFY19 results, on account of its corporate stressed exposures. Yet we should not overlook a positive feature: the bank’s concerted effort to reduce its net deferred tax assets (DTA) from FY2019, which the bank had imprudently created in FY2018 so as to report lower losses in that year. Unlike prominent private sector banks such as HDFC Bank, Axis Bank and ICICI Bank, which had to partly reduce DTA to conform to the recently lowered corporate tax rate, SBI had commenced reducing its DTA from FY2019 and continued this trend even in 2QFY2020 without shifting to the lower corporate tax rate.

This analyst has been repeatedly cautioning investors regarding the trend of consistently inflating net profits through the creation of DTA, which is not prudent accounting. It is also unfortunate that banks which have consistently increased their DTA have not been grilled by the media and the sell-side regarding the time line to reduce the DTA. It appears that independent board directors, auditors and the regulator are reluctant to probe this sensitive issue, as reduction in DTA results in lower profits. It is therefore heartening to note that India’s largest bank by assets is reversing its earlier policy, even though it has to take the hit on its chin through reporting lower net profits.