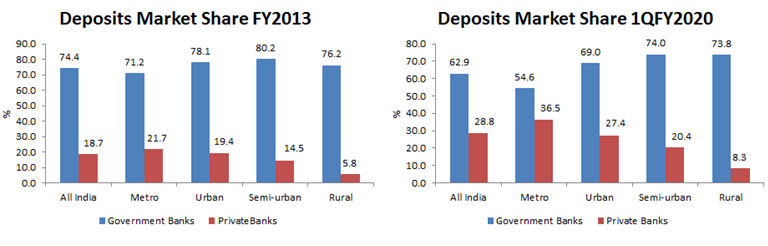

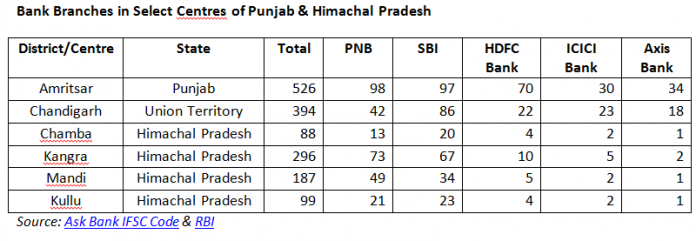

EXECUTIVE SUMMARY. A visit by road to some of the scenic tourist destinations in the mountainous and mainly rural state of Himachal Pradesh highlights the negligible presence of private sector banks and the sheer dominance of government banks, particularly Punjab National Bank and the banking behmoth, State Bank of India. Unlike in metropolitan centres in India, where the private sector banks have a significant and highly visible presence along with the government banks, in rural India, which accounts for around 66.5% of India’s population, the private sector banks have a limited presence. From a business perspective such a strategy by private sector banks may be commercially succesful, as banking business is concentrated in metropolitan and urban centres in India. Private sector banks in the last 6 years have significantly increased their market share of deposits and loans at the cost to the government banks in these lucrative areas. Disturbingly, it also indicates that the bulk of India’s population residing in rural centres are not a commercially viable opportunity for the new private sector banks, even after a quarter of a century of their existence.