Moneylife Digital Team

10 January 2020

Uttam Prakash Agarwal, an independent director and chairman of the audit committee of the board of Yes Bank has resigned, while making certain observations on the governance of the bank. While confirming the resignation, Yes Bank has said, its board was scheduled to review fit and proper status of Mr Agarwal, but before that he tendered resignation.Get Moneylife’s

Top Stories by EmailSUBSCRIBE In his resignation, as shared in a regulatory filing by Yes Bank, Mr Agarwal had said, “There are serious concerns as regards deteriorating standards of the corporate governance, failure of compliance, management practices and the manner in which the state of affairs of the Company are being conducted by Ravneet Gill, managing director and chief executive (MD/CEO), Dr Rajiv Uberoi- senior group president for governance & controls, Sanjay Nambiar, legal head and board of directors. I have raised my concerns on these very critical matters from time to time in the overall interest of Yes Bank and millions of its small and large depositors, investors, shareholders and all other stakeholders.”

Mr Agarwal had also sent a dissent note through email on the decision to call for extra-ordinary general meeting (EOGM) by the bank for raising capital. Yes Bank, in the regulatory filing, says the observations made by Mr Agarwal would be duly examined by its board. “…the Bank was reviewing the ‘fit and proper’ status of Mr Agarwal as directed by the Reserve Bank of India. In this respect, the Bank had obtained legal opinions from eminent jurists. These opinions were to be considered by the nomination and remuneration committee of the board (NRC) and the board of the Bank in their meetings scheduled for 10 January 2020. However, prior to the commencement of the proceedings of these meetings, the Bank received the resignation of Mr Agarwal.” Interestingly, in November 2018, Hemindra Hazari, a well-known research analyst, had cautioned about appointment of Mr Agarwal as independent director of Yes Bank. In his blog post, Mr Hazari, had stated, “The immediate appointment of Mr Agarwal, a former president of the Institute of Chartered Accountants (ICAI), as an independent director and probable future head of the (Yes) bank’s audit committee may not be the most appropriate choice. The concerned individual has dabbled in politics and failed to be elected from a suburb of Mumbai in a 2014 Maharashtra state election as a representative of a political party. Appointing chartered accountants-cum-politicians may not be the best way to restore confidence in the bank at such a critical stage.”

“While it is commonplace for corporate chiefs to cultivate the ruling party, it is not the normal practice for private sector banks, or private corporate sector entities in general, to nominate politicians as directors, as this adds an additional dimension of political risk. Investors should be cautious regarding Mr Agarwal, a chartered accountant-cum-politician, replacing Vasant Gujarathi on the audit committee. Indeed, Mr Agarwal may be even be appointed as the chairman of this important sub-committee of the board,” Mr Hazari had written.

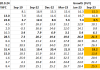

What Mr Hazari wrote in 2018 became reality, when Yes Bank named Mr Agarwal as chairman of its audit committee of the board. As reported by Moneylife, FY2019 had marked a rather unsettling year for Yes Bank, more so for its directors. After the exit of Rana Kapoor, the Bank suffered an exodus of directors. In fact except Bharam Dutt and Subash Kalia, all other directors had resigned by end March 2019. (Read: Mass Exodus of Directors From Yes Bank in 3 Months) Yes Bank closed Friday 5.30% down on the BSE, while the 30-share Sensex ended the week marginally up at 41,599.