Worried customers have been queuing to withdraw money from India’s Yes Bank after the country’s central bank seized control of the troubled lender.

The Reserve Bank of India (RBI) said it wanted to “quickly restore depositors’ confidence” in the bank.

Depositors with Yes Bank can now only withdraw the equivalent of about $630 (£486) during a one-month moratorium.

During this time, the RBI will work on a rescue plan for India’s fifth biggest private bank.

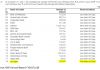

Yes Bank has an estimated $28bn in deposits but had been seeking new capital to bolster its finances before it was seized by the central bank.

Queues of people were seen lining up outside the bank’s ATMs in Mumbai after the announcement was made on Thursday.

“There is no safety. What’s happening? As Indians we felt our banks were the safest,” Nita Chabbria, a Yes bank customer, told the BBC.

“What was most frustrating is that the digital platform’s just shutdown. Neither the mobile or internet banking is working. I had to borrow money from my father.”

Another customer, Harish Chawla, said: “I’ve been here since 8:15 in the morning. They’ve given us a token and asked us to wait till 3pm. None of the managers are coming out and giving us any information.”

- Helping India’s farmers out of debt

- Helping India’s farmers out of debt

- Why India’s financial system is vulnerable to hacks

Yes Bank shares plummeted as much as 80% on Friday morning as the central bank said it was trying to work out a rescue plan to avoid any systemic risk to the economy.

“Its existence as an independent entity has now become unviable,” said Hemindra Hazari, an independent financial analyst.

“The moment a moratorium is announced, and you put restrictions on withdrawals, you lose your depositor franchise because they lose faith in you. The only option now is for another bank to absorb it.”

The RBI has asked State Bank of India, the country’s largest state-owned bank, to help with a revival plan for Yes Bank.

“It is too big to fail, and the regulators will not allow the situation to worsen,” said Jaikishan Parmar, a Delhi-based banking analyst with Angel Broking.

In 2016, India passed a law on recovering bad debts that placed more pressure on all banks to more quickly identify and report long-standing troubled loans and poor oversight, which have acted as a major drag on fresh lending.

“India’s banking sector – as well as the wider financial sector with the shadow banks – is still under stress, and there have been no quick fixes to this issue,” said TS Lombard director of India Research Shumita Sharma Deveshwar.

“The RBI has been reluctant to intervene in private financial institutions but it had to in this case to prevent a run on the bank, as well as to control the possible broader repercussions due to Yes Bank’s inter-linkages with other institutions.”

Private lenders such as Yes Bank were initially welcomed as bringing new technologies and fresh approaches to the state-dominated banking sector.