Hemindra Hazari

In the run-up to the upcoming Budget, shares on the stock market have rallied, raising hopes of the long delayed revival in private sector capital expenditure and corporate earnings. But against the backdrop of an already slowing economy followed by the ill-conceived, disastrously executed demonetisation, might this be a false dawn?

Post the good monsoon, the current fiscal year (ending March 31, 2017) was expected to be a year of hope and recovery, compensating for two consecutive years of drought. The good monsoon was meant to lead to a surge in rural sales, and the pay commission hikes were to improve urban/middle class consumption. However, in the view of many commentators, a Modi-made disaster in the form of demonetisation nullified any likely gains from an agricultural revival and a hike in government salaries.

What is unappreciated is that even prior to demonetisation, there was an underlying trend of a slowdown in industrial production, bank credit, and wage growth (indicating poor, if not negative, employment growth). Not only was industrial investment low, but low capacity utilisation indicated it was not due to pick up soon. In April-October 2016, the index of industrial production (IIP) was a negative 0.3% as compared to 4.8% in the same period in 2015.

What demonetisation did was to intensify an existing trend of slowing economic activity. Non-durable consumer goods, which are largely items of mass consumption, reported a negative 2.5% growth (April-October 2016). This was on a low base – the corresponding period of 2015 saw just 0.1% growth. This indicates that even the good monsoon of 2016 was not having the desired impact on mass consumption. What is interesting is that consumer durables (white goods) remained the highest growing segment in the IIP. Their production grew 6.5% growth, on top of 11.8% growth in the corresponding period of 2015. In a relative sense, in this period of stagnation, the divergent trend between consumer durable and consumer non-durable reveals that the higher income, mainly urban, segment is doing better than the lower income, mainly rural, segment. It is also possible that the lower interest rates and the surge in bank retail loans, especially in unsecured personal loans, credit card debt and automobile loans, are contributing to the relatively better performance of consumer durable goods. But that too merely indicates that banks are helping to redistribute consumption upward.

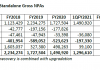

Small companies were being decimated in India even before demonetisation. The Reserve Bank of India study for the quarter ended September 30, 2016 for 273 non-government non-financial companies shows a year-on-year decline in sales of 29% (on a base of a decline of 22% in the previous year) for companies with sales of Rs 25-50 crores. For companies with sales of below Rs25 crores, it is much worse, with 730 companies reporting a decline of 49% on a base of a fall of 57%. The abysmal situation in small companies rarely gets any media attention as the latter’s focus remains solely on large companies and the advertising revenue and corporate access that sustains their business model.

All this is not to play down the negative impact of demonetisation.

As corporate results for the quarter ended December 31, 2016 filter in, they reveal the poor state of fast-moving consumer goods (FMCG or consumer staples) sales. Hindustan Unilever (HUL), the behemoth in the sector, reported a net sales year-on-year decline of 1.2% with volumes falling 4%. Significantly, the rural market performed worse than the urban market at a time when the exact opposite should have happened on account of a good monsoon. However, premium segments (i.e., with higher-income buyers) in detergents and personal care continued to do better. Since the quarter ended September 2015, HUL has reported a consistent deceleration in sales volume. It is interesting to note that in the quarter ended December 31, 2015 HUL reported a net sales growth of 2.7% and a volume growth of 6%; for the corresponding quarter of 2014, the company reported a net sales increase of 8.2% and a volume growth of 3%. That is, even with two consecutive years of drought, HUL managed to report growth in the December quarter of 2014 and 2015; but in 2016, despite a good monsoon and a hike in government salaries, which should have boosted its sales handsomely, the underlying economic weakness and demonetisation left a trail of destruction.

Not only have the sales of the country’s largest FMCG company plummeted, but they are a symptom of the underlying plight of the vast majority of the population, especially in rural India.

The All India Manufacturers’ Organisation (AIMO), representing over 300,000 micro, small scale, and medium and large scale industries engaged in manufacturing and export activities, in a study on the first 34 days since demonetisation, found that micro-small scale industries (MSI) suffered 35% jobs losses and a 50% dip in revenue. The study projected a drop in employment of 60% and loss in revenue of 55% before March 2017. A Punjab, Haryana, Delhi Chamber of Commerce survey showed that 80% businesses were showing a decline in their sales. As MSI are highly labour intensive, the loss of employment is bound to impact overall consumption in the economy.

In business TV studios, demonetisation is regarded as a necessary transient phase prior to a digital-led, black money-restricted sustainable growth phase for the Indian economy. Commentators and guests on business TV rarely muster the courage to be critical of government policy, and any negative development is given a positive spin to curry favour with the government and project an optimistic outlook for the market. In line with this obsequious philosophy, stock market analysts argue that economy may automatically bounce back with vigour from demonetisation with a push towards capital expenditure and a marginal increase in fiscal deficit in the budget.

The economic situation is dire, and the economy requires a massive increase in government expenditure and fiscal deficit to overturn the underlying economic stagnation and the drastic impact of demonetisation. The misery of the majority of the population, particularly the rural and low income sections, is acute. The government’s emphasis in the budget should be addressed to the needs of this employment-intensive segment as the data suggest that the minority higher income, mainly urban, segment is doing better. However, traditionally, local and global capital markets take a dim view of any significant increase in fiscal deficit and higher social expenditure on the low income segment. They press instead for subsidies to be provided to large capital-intensive corporates to stimulate growth. This might improve corporate bottom-lines, but it would not revive growth, which is stuck for lack of demand.

The government is in a peculiar bind. If it continues its earlier policy of increasing capital expenditure but reducing other heads of expenditure, thereby in the net reducing the expenditure/GDP ratio, maintaining the fiscal deficit and satisfying global capital, the economic stagnation will worsen and its political survival may be threatened. In the alternative, if it were to significantly increase social and capital expenditure and the fiscal deficit at a time when the US Federal Reserve is raising interest rates, foreign capital may depart causing an immediate economic crisis. In a few days the public will know how the government plans to respond to this secular underlying economic weakness accentuated by the Modi-made demonetisation.