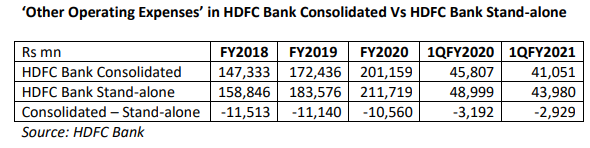

EXECUTIVE SUMMARY. In comparing a company’s stand-alone expenses with its consolidated accounts, it is highly unusual for the consolidated numbers to be lower than the stand-alone numbers. But what has gone unnoticed for some years in HDFC Bank is that its stand-alone ‘other operating expenses’ has been consistently higher than the reported equivalent in the consolidated accounts. Even though India’s most valuable bank is covered by 50+ sell-side analysts who minutely examine the financials, and by a large tribe of business journalists, this particular aspect has been overlooked. The anomaly is explained by the significant payments HDFC Bank stand-alone gives to its non-bank finance subsidiary, HDB Financial Services (HDB FS), which also provides business process outsouring (BPO) for the retail operations of the bank. These expenses get eliminated in the consolidated accounts.

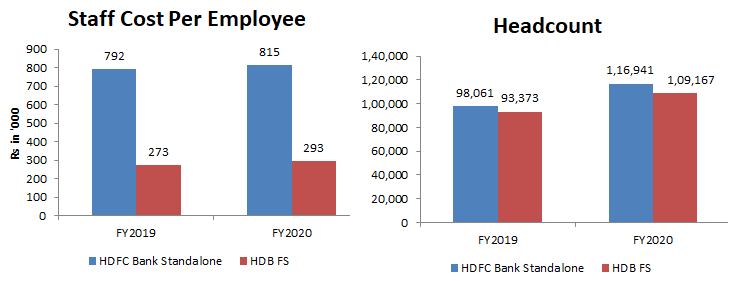

Although HDFC Bank’s payments to its subsidiary boosts the latter’s topline, the BPO profit margin is significantly lower than the profit margin on lending for the Non-bank Finance Company (NBFC) subsidiary. However, transferring a significant component of HDFC Bank’s stand-alone staff cost to its subsidiary, where the staff cost per employee is much lower, contributes to the superior profitability of the consolidated entity.

DISCLOSURE

I, Hemindra Hazari, am a commentator on Indian banks, economy and the capital markets. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. I own equity shares in HDFC Bank. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.