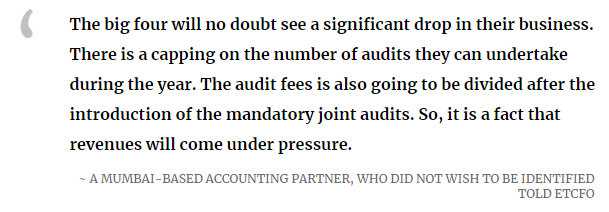

The audit income of Deloitte, EY, PwC, and KPMG could be hit due to the new capping and mandatory joint audit norms. They are auditing more than a dozen non-bank lenders and will have to give up many clients to comply with the mandate of the regulator.

- Mannu Arora

- ETCFO

- May 03, 2021, 11:17 IST

The Reserve Bank of India, on April 27, placed restrictions around “audit and non-audit work” of the network firms. The new norms state there should be a minimum time interval of one year before or after any network firm can undertake work if its audit firm has been appointed for the audit. Also, the regulator imposed on the number of audits that a firm can undertake during the year.

The restrictions are applicable at a network firm level and seen to have wider implications for the global giants. The Big Four are increasingly seen quoting first “low price” to grab audit and subsequently take up lucrative non-audit work through a different entity of the same network firm, which creates concerns of conflict of interest.

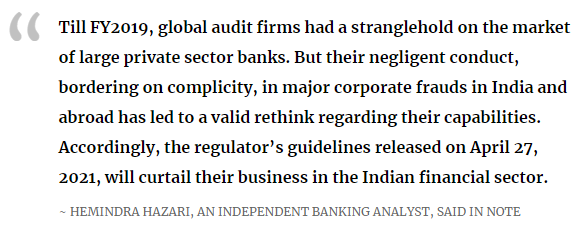

“It is in the lucrative non-audit work that the pinch will be felt…(Before the RBI circular) the audit arm of a group of entities was awarded the statutory audit, while lucrative assignments were given to entities within the network of firms of the same statutory auditor. This arrangement compromised the independence of the audit,” Hazari wrote.

The audit income of the big four giants could be hit due to the new capping and mandatory joint audit norms. The guidelines for network firms put a cap of four audits in case of commercial banks, and eight audits in case of shadow lenders. The joint audit is mandatory for firms with asset size of Rs 15,000 crore and above. Further, the regulator reduced the tenure of auditors to three years from currently four years in case of banks, and five years in case of shadow lenders.

Learn approaches to forecasting starting from the classical linearforecasting methods to non-linear approaches, predicting extreme events and therefore the sorts of techniques employed by traders.Register Now Certificates of participation will be awarded on successful completion of the courseGlobal giants are auditing more than a dozen non-bank lenders, and will therefore have to give up many clients to comply with the mandate of the regulator.

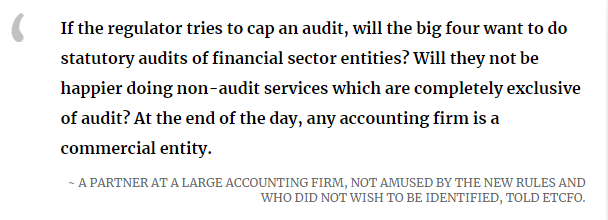

Non-audit work

The new audit guidelines could discourage the big four to invest in their audit practices in the long-term, and to offset the likely loss from audit income, they could shift their focus increasingly to more non-audit work “exclusive completely of audit”, two partners at two separate large accounting firms said requesting anonymity.

His view was echoed by another partner at a large accounting firm.

“…What is the incentive for firms to invest in tools and technology if tenure is limited to three years and there is a restriction on the number of audits….” said another audit partner at a large accounting firm.

Business models

India’s new stricter rules for bank auditors came in the backdrop of a series of financial sector frauds including the Rs 1-lakh crore scam at the construction financier IL&FS which erupted in October 2018, and raised questions on the audits done by global giants.

The statutory auditors of the IL&FS, Deloitte and BSR & Co (Audit affiliate of the accounting major KPMG), have been facing the regulatory music; the Indian government has sought a five-year ban on both the network firms, and the case is being fought legally.

India is increasingly tightening the noose on the big four as it tries to tackle issues of concentration and auditor’s independence.

“The (RBI’s) new guidelines are going to insert a major spoke in the wheel in the business model of the global audit firms, as well as some of the large domestic audit firms,” signed off independent banking analyst Hemindra Hazari.