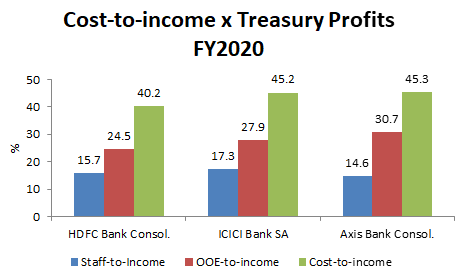

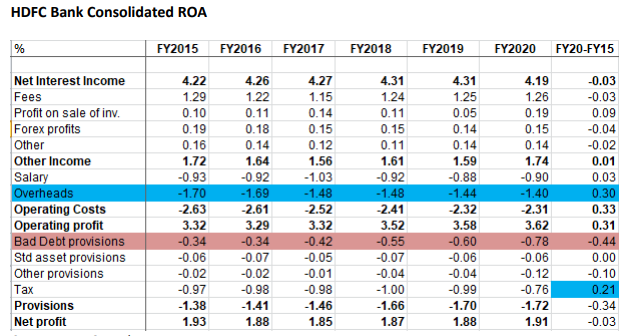

EXECUTIVE SUMMARY. A 6-year profitability analysis of HDFC Bank, India’s most valuable bank, reveals that it has been able to maintain it ROA despite a surge in credit cost for three reasons. Firstly, it has leveraged its overheads to generate more business for the bank, secondly, the lower tax rate in FY2020 and finally the domestic treasury profits also contributed to stabilising its profitability. Both the lower tax rate and treasury profits are not sustainable in the future. As compared with ICICI Bank and Axis Bank, HDFC Bank has superior cost-to-income (excluding domestic treasury profits) ratios. Despite having a large employee base, the new private sector banks have successfully deterred the formation of labour unions, which weakens the negotiating power of labour, and HDFC Bank has also benefitted from this situation.

The critical issue is whether the strategy of increasing its revenue at a faster pace than its non-labour overheads can continue in an environment of a stagnant or lowering net interest margin and rising credit costs. This implies that the bank has to dramatically increase the pace of digitisation, re-engineer processing and reduce human intervention in its processes to drive its business volumes to maintain its existing profitability. In the immediate Covid-19 environment where the quality of borrowers even HDFC Bank caters to has deteriorated, it will test the management capabilities of the bank to successfully deliver on such a strategy.

DISCLOSURE

I, Hemindra Hazari, am a commentator on Indian banks, economy and the capital markets. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. I own HDFC Bank shares. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

Very few Bank’s analysts do a detailed % P&L analysis to find out various moving levers –

OR a Du-Pont model – which can correctly point out that rising RoEs are brought in by the right way

a) rising margin , b) Rising asset turns and c) Falling leverage and not the other way