EXECUTIVE SUMMARY. The near-absence of a government stimulus to revive the Indian economy from the Covid-19 meltdown portends a severe and prolonged economic slowdown. This will squarely hit the banking industry with huge credit costs and low growth. In such a dismal scenario, the only lever available to the banks is cost management: to reduce costs and to leverage the existing cost structure to generate more business. In both respects, banks would have to adopt a revised business model: successfully implementing digitisation, which would entail re-engineering processes, developing new businesses and taking market share from other banks must take precedence to reduction in headcount; salary cuts (starting from the bloated remuneration given to senior management); and a re-examination of overheads.

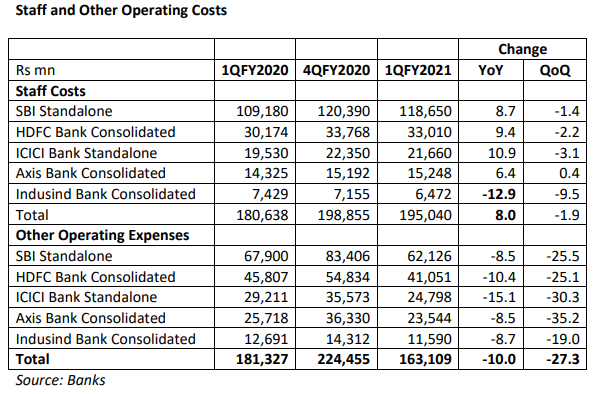

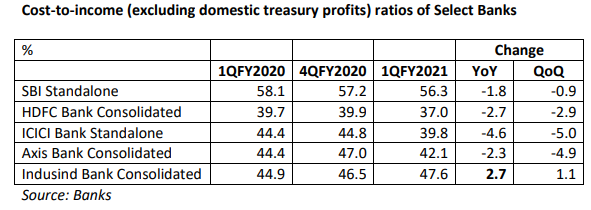

As compared with government banks, private sector banks have a higher component of non-staff costs to staff costs, on account of the incentives they pay to direct sales agents (DSAs) and for business processing outsourcing (BPO); for government banks such work is done by their own staff. In the 1QFY2021 it would appear that banks have commenced cost cutting measures, as they reported a decline in non-staff operating expenses. However, management commentary claimed that this was on account of the loss in business, which resulted in lower expenses related to the business, such as sourcing fees and commissions to direct sales agents (DSA). But nevertheless the banks in our sample, with the exception of Indusind Bank, reported improvements in the cost-to-income (excluding domestic treasury profits) ratio.

While the 1QFY2021 results reveal that the banks are aware of the importance of cost management, a lot more has to be done as credit costs in the coming days rise sharply. The only lever available to management to prop up profits in the face of the inevitable economic slowdown is to hasten the process of digitisation, thereby reducing headcount, develop new business verticals and slash salaries. Shareholders therefore need to closely monitor cost-to-income ratios stripped of treasury profits to determine which banks are successfully implementing cost management and digitalisation.

DISCLOSURE

I, Hemindra Hazari, am a commentator on Indian banks, economy and the capital markets. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. I own equity shares in HDFC Bank, ICICI Bank and SBI. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.