EXECUTIVE SUMMARY. The Council of Ethics of the Government Pension Fund Global (GPFG), the Norwegian sovereign fund, recommended on February 19, 2020 that Page Industries (licensed to produce the Jockey brand of clothing and Speedo in India) be excluded from investment by the fund. GPFG is the world’s largest sovereign fund, with assets under management of around US$ 1 trillion, and it owns around 1.4% of global equities. For the world’s largest sovereign fund to specifically exclude an Indian company for investment should have been prominently highlighted by the Indian media but strangely, only BusinessLine carried this news on August 31, 2020, and while other media platforms reported it in the last 2 days, an in-depth analysis of its implications have been ignored.

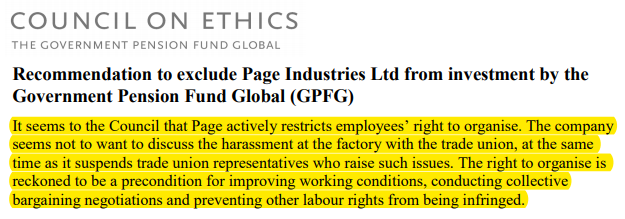

The report by the Council of Ethics to Norges Bank, Norway’s central bank, with manages the GPFG, highlighted the “systematic human rights abuses” practised by Page Industries. The Council observed some of these on an inspection of one of the company’s units at Bangalore: harsh punishments meted out to staff who returned from lawful leave or sick leave, penalties for failing to meet production targets even when production stalled for reasons beyond the control of labour, unhealthy and unsafe working conditions, and the company’s active involvement in not allowing workers right to organise. The Council also found that the company’s actions violated “internationally recognised human rights and national laws.” The Council was also concerned that Page Industries neither clarified these concerns nor permitted an inspection of the factory units.

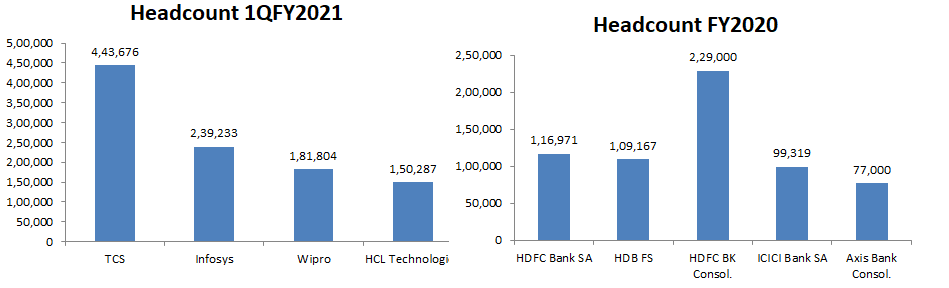

While Speedo International stated it would investigate the possible human rights violations by Page Industries, as it takes “all matters relating to workers and violation of human rights extremely seriously”, the issues raised (e.g. the right to form and join a labour union, fair wages and safe and healthy work conditions) by the Council of Ethics report are prevalent to one extent or another in major success stories of the Indian economy, where foreign institutional ownership is significant, such as information technology enables services (ITES) , export-oriented garment (here and here) industry, the automobile/auto ancillaries and private sector banking. To supress wages and maintain a compliant work force, labour laws are violated with near impunity by the Indian corporate sector. In their drive to attract investment, the Union and state governments actively cooperate in these violations. If such issues were to be seriously examined by foreign institutional investors, it would render a significant component of corporate India to be uninvestible.

Virtual Non-existence of Unions in Prominent IT Cos. & Pvt. Banks

DISCLOSURE

I, Hemindra Hazari, am a commentator on Indian banks, economy and the capital markets. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. I own equity shares in HDFC Bank, ICICI Bank, TCS and Infosys. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.