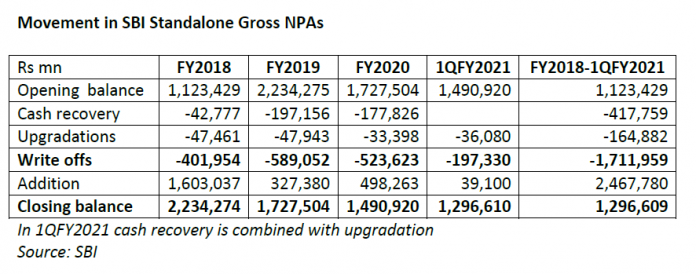

EXECUTIVE SUMMARY. Media commentators analysing the tenure (October 7, 2017 to October 6, 2020) of Rajnish Kumar as chairman of the State Bank of India , India’s largest bank by assets, have commented on the sharp decline in gross non-performing assets (GNPAs) in absolute and in percentage terms during his leadership. SBI’s GNPAs declined from Rs 2.2 trillion (10.9% of gross loans) in FY2018 to Rs 1.3 trillion (5.4% of gross loans) by 1QFY2021. However, the decline in NPAs was primarily due to write-offs, which are an accounting entry requiring minimal management intervention. If the improvement in asset quality had been primarily the result of recovery and upgradation of accounts, management would deserve to be commended, as strenuous efforts are required by bank staff to recover bad debts from defaulters. As the bulk of write-offs in government banks relate to corporate accounts, where promoters/founders have siphoned off funds by inflating project costs, or have diverted funds to other purposes, recovery from such defaulters is unlikely to be significant (accounts like Essar Steel are an exception). The trend of declining NPAs is likely to be reversed when another tsunami of bad debts from the Covid-19-induced lockdown hits the banking sector; banks would require massive recapitalisation as they write off bad loans. In SBI this round of write-offs will be managed by Dinesh Kumar Khara, who succeeded Rajnish Kumar as chairman on October 7, 2020.

DISCLOSURE

I, Hemindra Hazari, am a commentator on Indian banks, economy and the capital markets. I own equity shares in SBI. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

“As the bulk of write-offs in government banks relate to corporate accounts, where promoters/founders have siphoned off funds by inflating project costs, or have diverted funds to other purposes, recovery from such defaulters is unlikely to be significant (accounts like Essar Steel are an exception).”

Sir, We have to draw your kind attention to the above statement in your report. The bracketed one” Accounts like Essar Steel are an exception”gives an impression that Essar did not siphon off funds by inflating project costs. This is far away from the truth & was in fact the norm in all projects with active connivance of FI’s like IDBI which is in dumps since last 2 decades. Recovery from Essar for SBI & others was solely due to the IBC & NCLT. I am not quite sure you really meant what we as readers try to read in between your statements. Thanks.

To clarify, the exception pertained only to recovery on account of IBC & NCLT as you have rightly pointed out.