EXECUTIVE SUMMARY. In a significant event, Deepak Parekh, the non-executive chairman of HDFC, agreed to settle with the Securities and Exchange Board of India (SEBI) in connection with the latter’s investigation of non-compliance with the erstwhile Listing Agreement. Parekh settled the issue by paying Rs 937,500 (US$ 12,727) to SEBI “without admitting or denying the findings of fact and conclusions of law…”

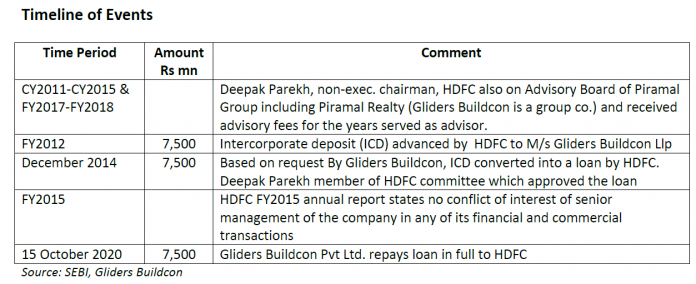

As per SEBI’s settlement order, the capital market regulator had conducted an investigation into an inter-corporate deposit (ICD) of Rs 7.5 bn extended by HDFC to Gliders Buildcon Realtors, a group company of Piramal Realty, in FY2012. Sometime in FY2015, at the request of Gliders Buildcon, HDFC converted the ICD into a term loan. Parekh was chairman of HDFC, and was on the committee which approved the loan. At the same time, he also belonged to the Advisory Board of the Piramal Group, including Piramal Realty, for which he received advisory fees for the calendar years 2011 to 2015 and for the FY2017 and FY2018. The order stated, “HDFC has adopted a Code of Conduct for all its Directors and Senior Management Personnel in terms of Clause 49 (I) (D) of the erstwhile listing agreement. However, the applicant failed to comply with the Code of Conduct of HDFC Ltd., resulting in the violation of Clause 49 (I) (D) (ii) of the erstwhile listing agreement.”

What is surprising is that an individual of Parekh’s stature and experience, in a company which is a favourite of foreign investors and professes to maintain high standards of corporate governance and transparency, could have committed such a violation. Normally, board directors disclose their interests and recuse themselves from discussions where there may be even perceived conflicts of interest. In this particular case, Parekh was on the HDFC committee which approved the conversion of an ICD into a term loan for Gliders Buildcon, while also accepting advisory fees from the Piramal group. SEBI’s settlement order throws a spotlight on Parekh’s advisory role to companies (especially in real estate), from which he earns fees, while simultaneously being on the important loan committee of HDFC, which extends loans to corporates, many of whom are engaged in real estate. It is also disheartening that HDFC has neither publicly clarified this issue nor provided any explanation for the conduct of their non-executive chairman.

The business media, apart from summarising the SEBI settlement order, has completely ignored the event, by neither analysing the implications nor providing additional information. Given the iconic stature of Parekh in India’s financial system and the prominence of HDFC, one expected the media and the sell-side to further investigate and comment on this important development. Sadly, the state of business journalism and sell-side research is such that when it comes to prominent companies and iconic business leaders, critical reporting and analysis are eschewed.

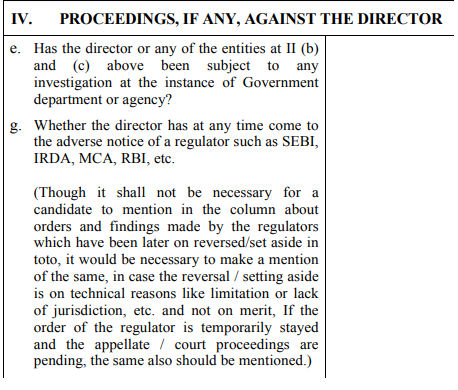

The critical issue before HDFC from a corporate governance perspective is how the board of directors will view the payment by its chairman in settlement of an investigation by the capital markets regulator. Although the settlement order clearly states that the monetary payment does not imply admission of guilt or wrong doing, HDFC’s Fit and Proper Criteria for its directors, has a section on whether its directors “have come to the adverse notice of regulators such as SEBI…” As HDFC accepts deposits from the public, has a foreign shareholding of 72% and is the parent of prominent companies in the financial system such as HDFC Bank, HDFC Asset Management, HDFC Life Insurance and HDFC Ergo General Insurance, the conduct of its board directors, and especially its chairman, must be pristine.

Extract from HDFC’s Fit and Proper Criteria for Directors

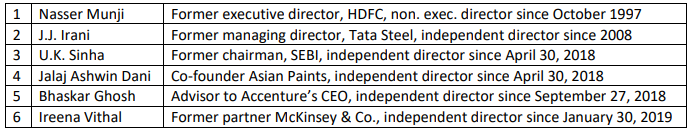

The role of HDFC’s independent directors and its Nominations and Remuneration Committee (NRC) in responding to Parekh’s payment settlement with SEBI and his eligibility to continue as a director will be closely watched by the capital market, and it may also set an example of how boards should respond when faced with such a situation.

HDFC Independent Directors

It is worth recalling that, even though there was no conclusive evidence of his wife’s wrongdoing, Caesar declared that “Caesar’s wife must be above suspicion”, and divorced her.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in HDFC Bank and HDFC Standard Life Insurance. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

Absolutely agree with you on the lack of compliance on the part of Mr Parekh. Esp since he himself has been a signatory to the policy.

And the lack of any detailed reporting and follow up on the part of the media.

Surprising that it has gone unreported for so long a period .