EXECUTIVE SUMMARY. On April 23, 2020, Franklin Templeton India (FTI) took the unprecedented step of winding up its six debt mutual fund schemes. The Securities and Exchange Board of India (SEBI) then ordered a confidential audit report on this fiasco. Excerpts of the report have now appeared in the media (here and here). They reveal an abysmally poor standard of corporate governance at FTI, and serious allegations of unlawful gains and money laundering by its senior management.

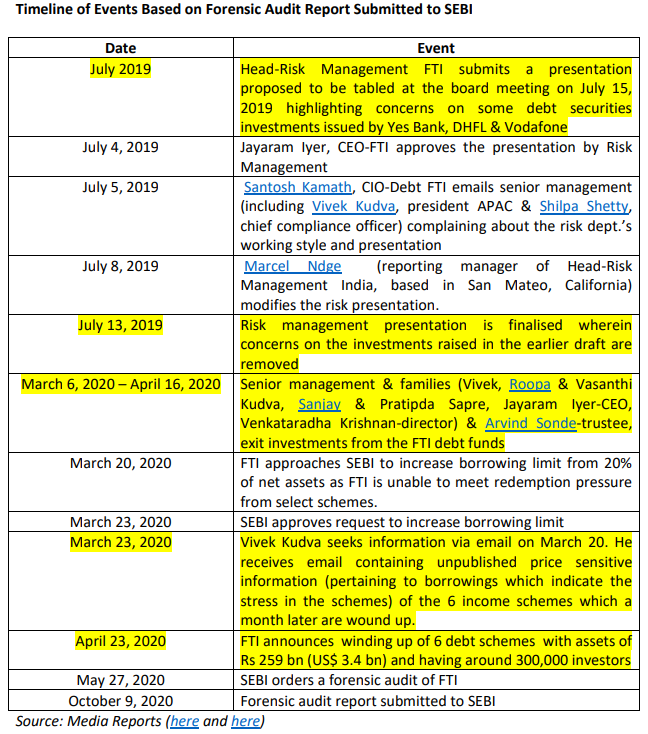

Franklin Templeton (FT) is known as a reputed 74-year-old multinational company which manages US$ 1.4 trillion globally. However, risk management at the Indian arm of this giant was given low priority. Business managers based in India were in a position to influence the director-risk based at FT’s headquarters in San Mateo, California. When critical concerns were raised by the India risk management team, these managers got them removed from a presentation made to the board of directors at FTI. Normally, regulators and the board of directors ensure the separation of risk management from business, so as to maintain the independence of the former; the latter are forbidden to dictate or influence risk reports. Such prudence and separation were disregarded by FTI. The fact that its director-risk in-charge of regional/global risk could be influenced by business managers in India is an indication of the state of FT’s global risk management. This should worry capital market regulators and investors in the geographical jurisdictions where FT operates.

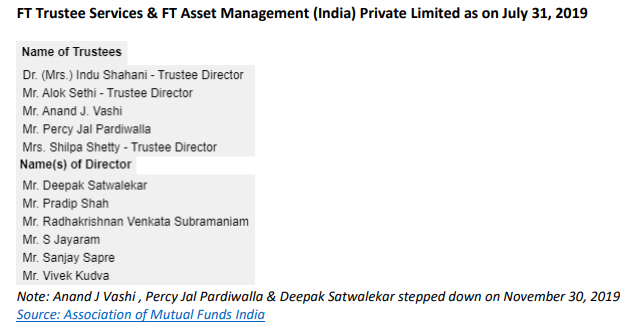

A number of top personnel are being investigated for their conduct (exiting schemes of FTI prior to the winding down announcement): Vivek Kudva, president Asia Pacific FT, his wife, Roopa Kudva (managing director, Omidyar Network India, independent director at Nestle, India and regarded as an expert on governance), Sanjay Sapre, president, FTI and Jayaram Iyer, CEO, FTI, Venkataradha Krishnan, director, FTI and Arvind Sonde, trustee, FT Trustee Services. This reveals the standards of ethics and integrity among the senior management of FTI. In the case of Roopa Kudva, it remains to be seen how companies such as Omidyar and Nestle, India respond if it is confirmed that their director undertook trades based on unpublished market sensitive information.

The announcement of the winding down of the debt schemes exposed the incompetence of FTI in corporate debt management. However, the leak of select sections of the forensic audit report has highlighted major fault lines in this multinational company, namely, the disregard of risk management and the lack of integrity and ethical standards among its entire senior management. To restore confidence the regulator should ensure a complete restructuring of the trustees and the board of directors of FTI’s AMC, and bar them from holding any senior posts in companies managing public funds, as they failed in their responsibilities. One only hopes that the rest of the mutual fund industry in India does not share the characteristics of FTI.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in Nestle, India. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.