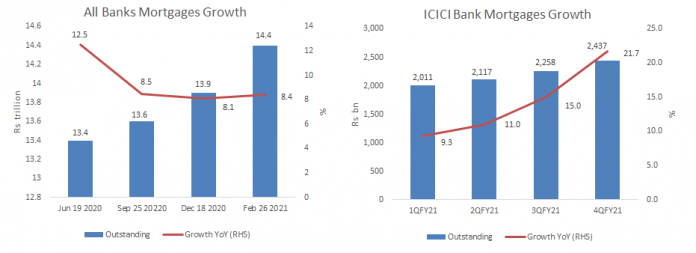

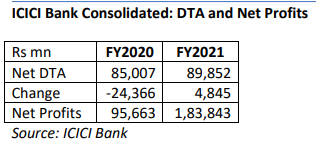

EXECUTIVE SUMMARY. ICICI Bank posted strong results for 4QFY2021 with standalone net profits up 260% yoy, but 11% down qoq to Rs 44 bn. While the analyst consensus and the capital market may view the results as a positive, investors need to monitor the bank’s focus on mortgages, which it has used to drive asset growth. As compared with the industry, ICICI Bank has accelerated its mortgages from 3QFY2021, and this has further spurted in 4QFY2021. Within mortgages, the loan against property portfolio needs to be carefully monitored, as such loans can result in higher losses when there is a downturn. Although mortgages are secured, the asset value can plummet when lenders sell the security to realise the loan. It is interesting to observe that, while HDFC Bank is de-emphasising retail loans, ICICI Bank still continues to aggressively grow retail. Like HDFC Bank, however, it has continue to increase its net deferred taxes (DTA), thereby inflating its net profits.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in ICICI Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.