It has been 3½ years since the Reserve Bank of India imposed a moratorium on Yes Bank, superseded its board, and organised a financial bail-out by a State Bank of India (SBI)-led consortium, as well as a board and financial restructuring. While financial solvency and stability have been restored to the beleaguered bank, it would be an uphill task for the bank to return to the levels of profitability and net interest margin (NIM) comparable to peer banks in the near future.

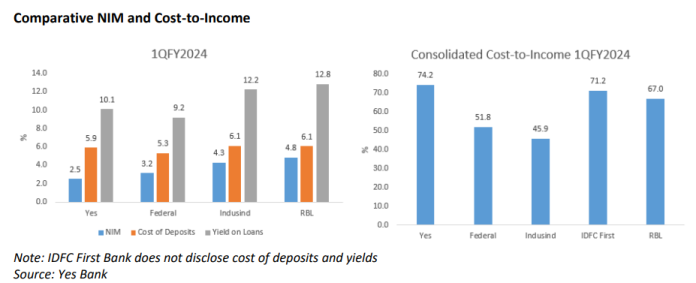

Yes Bank’s essential problem is that its NIM is significantly lower than that of other banks, while its cost-to-income remains higher. Yes Bank has high operating expenses, as it continues to invest in retail lending, but not in high yield/high risk loans. While the bank’s cost of deposits is competitive, the bank lacks high-yielding retail loans such as credit cards, vehicle loans, personal loans and micro-finance. The bank’s earlier strategy of making high-risk corporate loans spectacularly back-fired, and hence in the post-restructured phase, it has had no appetite for such corporate loans. Nevertheless, it has been the bank’s corporate loans which have been compensating for the born-again retail focus of the bank.

Comparative NIM and Cost-to-Income

Note: IDFC First Bank does not disclose cost of deposits and yields

Source: Yes Bank

Yes Bank, since its incorporation in November 2003, focused on corporate banking, as its founders (Rana Kapoor and Ashok Kapur) were corporate bankers. However, retail banking is not a recent phenomenon for the bank. In June 2012, the bank recruited Pralay Mondal from HDFC Bank to reinvigorate the bank’s retail operations.[1] Yes Bank’s current executive director, Rajan Pental, also joined the bank from HDFC Bank in November 2015 to drive the retail strategy. The hiring of senior banking executives specialising in retail from India’s leading private sector bank demonstrated Yes Bank’s commitment to retail from around June 2012. Later, as deposits collapsed in FY2020 by around Rs 1.2 trillion, the bank had to rebuild its entire retail operations.

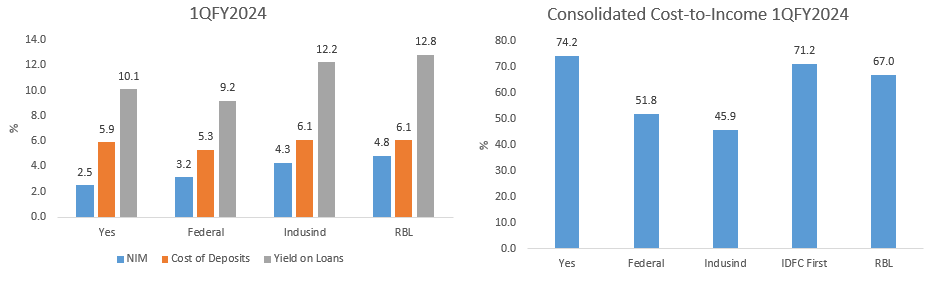

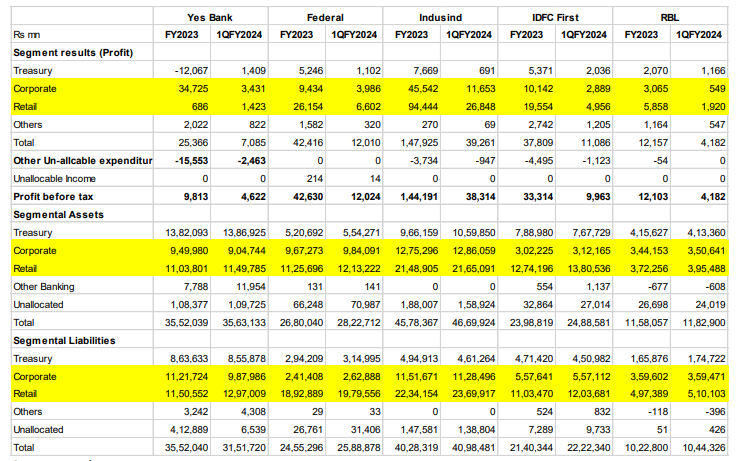

Analysing the current segmental results of the bank reveals that while its retail assets are now more than its corporate assets, in profits the former are still playing second fiddle to the latter. In both FY2023 and 1QFY2024, profits from the corporate division were nearly 2x retail profits, unlike the case of its peers, where retail profits are significantly higher than corporate profits. Moreover, unlike peer banks, Yes Bank has significant “other un-allocable expenditure”. Normally expenses in the corporate division are much less than in retail, and are also easily identifiable. It is possible that expenditure on branding/publicity and information technology may be difficult to categorise as for a particular division, but normally it is associated with retail. If we take this fact into account, it appears that Yes Bank’s retail profits reported in the existing format may be inflated. It is therefore surprising that, despite the bank’s supposed focus on retail since 2012, the business is still stuck at an infant stage.

Consolidated Segmental Results

Source: Banks

Yes Bank was felled by taking on high-risk corporate loans with inadequate risk controls. While deposits fled the bank in the immediate wake of the moratorium, once the rescue was mounted, financial stability was restored. It is possible that the introduction of senior retail bankers into the bank since 2012 was undertaken for optics, and major investments in retail only occurred after the moratorium, under a restructured board of directors and newly inducted shareholders. At present, the corporate division is driving Yes Bank’s overall profits, followed by the treasury division.

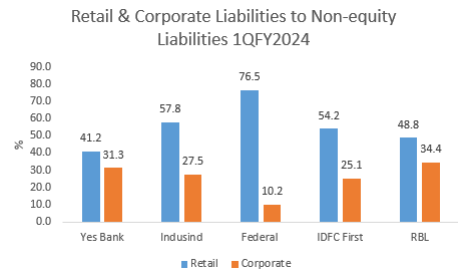

Another unusual feature in the segmental results is the low composition of retail liabilities to non-equity liabilities, as compared with peer banks, and the higher reliance on corporate deposits. These again demonstrate the prolonged infancy of Yes Bank’s retail strategy. The higher composition of corporate liabilities indicates companies are comfortable with parking deposits with Yes Bank at interest rates higher than SBI, in the belief that, since SBI is the single largest shareholder, holding 26.1%, the probability of default is remote. Companies are therefore taking advantage of this fact and parking their funds in Yes Bank.

Source: Banks

After the restructuring in January 2020, there were significant changes in Yes Bank. The board of directors was revamped with new shareholders, who led the rescue, and a new CEO was appointed. Significant equity was injected to make good the losses, and loan processes and systems have been reportedly tightened. In an interview on Linkedin, Sumit Gupta, the Chief Risk Officer, Yes Bank, stated,

“The fact that we went through such a deep surgery or a pain, you know the positive side was that the top management everybody whoever was doing right, whoever was on the wrong side, everybody understood and appreciated that we got to change.”

The “deep surgery” and “pain” that Gupta refers to are probably the embarrassment of being employed with a failed bank, the sacking of the erstwhile board of directors, the ‘voluntary’ salary cuts senior executives had to endure in the immediate aftermath of the reconstruction, and the gradual removal of certain executives. However, when a bank fails in such a spectacular fashion, necessitating a bailout, a new board and a CEO imported from outside the bank, one expects a complete revamp of the senior executives to instil confidence in stakeholders. This was all the more important as the Enforcement Directorate’s charge sheet alleges that senior executives at Yes Bank knowingly engaged in sham transactions, and the accused Yes Bank officials put the onus of the transactions on the now jailed Rana Kapoor, the erstwhile founder-Chief Executive Officer (CEO), Yes Bank. The charge sheet alleges that the senior/middle management in the bank’s credit and risk management acted as ‘yes men’, blindly engaging in fraudulent transactions on orders from above. The calibre of these individuals is important.

The bank has disclosed its 3 year-old 19-member senior executive team.

Source: Yes Bank

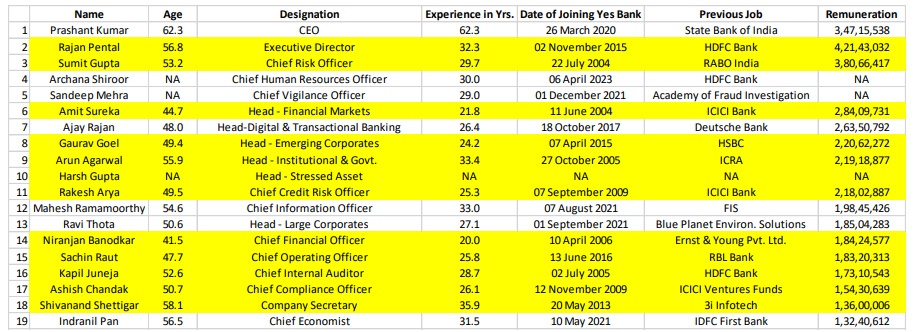

Surprisingly, in the senior executive team, 12 of the 19 executives, that is, the majority, were recruited during the tenure of Rana Kapoor, the founder-CEO. While the present CEO is a former SBI executive, most of the key posts are occupied by Yes Bank executives who have been with the bank for many years. During the founder-CEO’s long tenure, the bank was characterised by high-risk asset growth, with minimal compliance with prudent banking practices, as was observed by the Enforcement Directorate. It is strange that, despite the restructuring of the board of directors, the senior executive management team is dominated by the old timers of Yes Bank. Therefore, contrary to the assertion of the Chief Risk Officer, who joined the bank in 2005, the “surgery” is not “deep.”

NA Not Available. Highlighted in yellow are those who joined when Rana Kapoor was the CEO

Source: Yes Bank

Yes Bank is expected to remain dependent on its corporate division to drive its profits even as it invests in its retail strategy. A worrying concern is that the bank is unable to significantly attract retail liabilities which indicates more expenditure on marketing/branding to reassure the retail public. In its 1QFY2024 results call, Yes Bank stated that its marketing/advertisement expenses would rise by 25% in FY2024 for its rebranding exercise. While retail deposits may take time, the bank is compelled to continue to attract corporate deposits at higher interest rates, thereby keeping its cost of funds elevated. With Yes Bank unwilling to inflict deep pain by reducing staff, the bank will have to maintain a high cost of banking operations. As its corporate division is currently conservatively growing loans, the spreads on the corporate loans is likely to be slim, and the only option for increasing yields is to venture into high yield retail loans such as credit cards, vehicle finance and micro finance. There have been media reports that the bank is planning to acquire a micro finance company. Even if the bank acquires a micro finance company, it may take some time for it to have a meaningful impact on its yield on loans and its NIM.

Shareholders should not expect a significant increase in the bank’s net interest margin or profitability in the immediate future.

[1] Mondal quit Yes Bank in January 2019 to join Axis Bank. He is currently CEO, CSB Bank.

___________________________________________

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in all the banks except Federal Bank and RBL mentioned in this report. HDFC Bank subscribes to this analyst’s research and a member of this analyst’s family is employed with HDFC Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

www.hemindrahazari.com

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: