EXECUTIVE SUMMARY. In a little-publicised step, the Securities and Exchange Board of India (SEBI) has directed the first 1,000 companies by market capitalisation on the Indian bourses to disclose voluminous information in their business responsibility and sustainability reporting. For FY2022 this is voluntary, but from FY2023 it is to be mandatory. This largely non-financial data may provide significant insights into large cap companies’ impact on the welfare of stakeholders (communities, employees, customers and channel partners) and the environment.

Since 2012 the SEBI had mandated the disclosure of a Business Responsibility Report containing Environment, Social and Governance (ESG) parameters; however, the data was not standardised. The recent SEBI directive will standardise the data, facilitating its aggregation and its comparison across companies and industries. Even though they may not appear to be directly relevant to shareholders, these disclosures will shed light on how other stakeholders’ concerns are being addressed; and that can be relevant to the shareholders as well over the medium term.

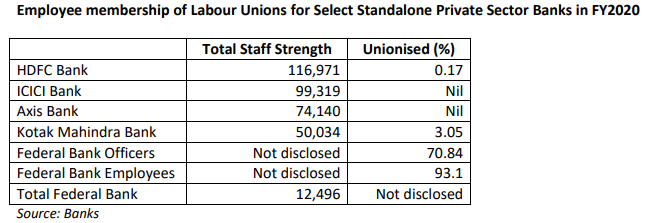

For the new private sector banking (established post 1991) and financial intermediaries, this data will reveal the near absence of trade unionism amongst their employees, and the high turnover of staff, especially at the lower levels. This turnover at the branches engaged in retail banking appears to be on account of ambitious sales targets set by the management. Such issues have typically been ignored by institutional investors, and indeed they often applaud such a policy, as it restrict wages and delivers higher profits.

The disclosures stipulated by SEBI will also cover how the communities, customers, channel partners and employees view the company. Will this mean that companies will not be able to focus solely on shareholder interest, but will also have to pay attention to stakeholders’ concerns? In some cases, anti-corporate campaigners (representing workers, project-affected communities, or consumers) may find in such reports revelations that are embarrassing to the firm.

The media and sell-side research have not reacted to these new requirements, as the disclosures are mainly non-financial. However, analysing and aggregating the data will provide valuable insights into companies and industries. In future, the cost of compliance for companies will increase. They will have to create separate departments, or outsource the function, in order to manage the voluminous data. It yet has to be seen how far the corporate sector cooperates, and the quality of the data provided. Nevertheless the step is likely to be helpful for understanding some aspects of the dynamics of corporate businesses in India.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in some of the banks mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.