Updated: 27 Jun 2021, 10:13 PM IST Gopika Gopakumar, Shayan

Ghosh

Sandeep Bakhshi took over an embattled bank in late 2018. In just 10

quarters, things have changed

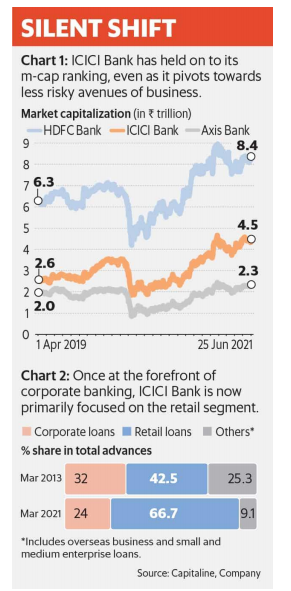

Since Bakhshi joined, the share of the bank’s corporate loans in the

total loan book has been almost flat at 24%. Moreover, the bank now

has 73.2% of its loans to customers rated ‘A-’ and above

MUMBAI: Employees clocking in early on a muggy November 2018

morning to get into the comfort of ICICI Bank’s air-conditioned

headquarters in the central Bandra Kurla Complex spotted someone

unusual among them in the elevator queues.

It was Sandeep Bakhshi, the new managing director and chief executive

officer who had slipped into those shoes just a few weeks earlier. Like any

other legacy institution in India, ICICI Bank Towers has separate

elevators for regular employees and directors. Bakhshi, too, had access to

an exclusive elevator that could whisk him away to his 10th floor office.

But he was waiting in the queue meant for all bank employees.

The new CEO was signalling a powerful culture change at India’s second

largest private bank by assets. “I was pleasantly surprised at his humility,

or at least the intent to be seen as a regular employee,” said an employee

who stood in the elevator queue that morning. “I have not seen any former

boss do that.”Bakhshi continues to use the common elevator to date.

It has been 10 quarters since Bakhshi was brought in to steady the ship

after the bank had been buffeted by allegations that the previous managing

director and CEO, Chanda Kochhar, had favoured the Videocon Group.

She had resigned on 4 October 2018 and on the same day Bakhshi, then

chief operating officer at the bank, was appointed as the top boss.

Within a short span, he has attempted a slew of changes, some of which

will yield results only in the long run at the 27-year-old lender. The bank

has renewed its focus on better quality assets, shedding its earlier singleminded attention to growth. Branch-level managers now have greater leeway to decide targets that best suit their context. There is also a renewed push into retail banking spearheaded by digital operations. The

common thread connecting the disparate changes: A focus on the bank’s

culture and an effort to get rid of ‘short-termism’.

Bakhshi was not available to be interviewed for this story, but it doesn’t

seem to worry him much that arch rival HDFC Bank, India’s no. 2 lender,

keeps the position in the leader board that it had wrested from ICICI Bank

in 2017 (India’s top bank by assets is the government-owned State Bank

of India).

“The new CEO believes that we should only sell products to customers

which we think we could sell to our family,” said the employee quoted

above.

Bakhshi, who has clocked 35 years at the ICICI group of companies, has

fought corporate fires before. In 2010, he was brought in to lead ICICI

Prudential Life to manage an internal crisis. He had inherited an

aggressive sales-at-any-cost culture set in place by the firm’s first chief

executive Shikha Sharma, who was immensely successful during her

time. Mis-selling was rampant in the insurance industry, especially in the

equity-linked product segment. Bakhshi turned around ICICI Pru, as it is

known in the industry, by shrinking its set of products and eventually took

the company public. What he delivered made him the shoo-in candidate

to restore the credibility of ICICI Bank and he was inducted as the chief

operating officer in August 2018, two months before Kochhar quit. Then,

he became the CEO.

A new narrative

Embattled troops need hope the most and like any leader stepping into a

bad situation, Bakhshi crafted a new narrative: “One bank, One RoE, one

KPI” (RoE being short for return on equity and KPI for key performance

indicator). He removed several performance indicators that were

associated with multiple products at the branch level.

Experts credit this one tagline for improved efficiency at the bank, as it

removed the burden of monthly sales targets on several products. Insiders

say that there used to be as many as 14 different KPIs at the branch level,

making work distracting and difficult for employees. Some of these

targets were related to fixed deposits, current and savings accounts, and

mutual funds, among others.

The bank woke up to the need for KPIs at the branch level, depending on

the location and local demographic profile. For instance, a branch in a

locality of retirees would not need credit cards or small business loan

targets. Instead, the staff must woo depositors and maintain a strong

inflow of term deposits.

On the lending side, ICICI Bank’s new strategy shows the risk profile of

its corporate assets. Since Bakhshi joined, the share of the bank’s

corporate loans in the total loan book has been almost flat at 24%. And

asset quality? The bank now has 73.2% of its loans to customers rated ‘A-

’ and above, up from 62.5% as on 31 March 2018, thereby clocking more

than 1.5 times growth in that cohort of customers with lower risk profiles.

The bank’s gross bad loans as a percentage of total loans was 4.96% at

the end of fiscal 2021, down from 7.75% on 31 December 2018, the

quarter when Bakhshi took charge.

In the lending business, riskier bets allow lenders to charge more than

high-rated corporates, who tend to bargain hard for cheaper loans. In other

words, there will inevitably be pressure on margins at ICICI Bank. To

circumvent this, Bakhshi had the bank take a 360-degree approach to

cover all business verticals as a whole and not operate in silos.

What this meant was more teamwork and an attempt to recoup lost

margins in the corporate loans business through volumes in other

segments.

“It was like taking the entire bank to a customer. Even when ICICI Bank

executives now go to a corporate (house), besides giving a term loan, it is

also about getting his transaction banking account, financing his dealers,

vendors and their employees,” said a person aware of the changes.

Retail banking executives pass on opportunities to the corporate team, for

instance. “This is because everybody is looking at achieving the target as

a whole bank,” said the person quoted above.

A third person, who also spoke on condition of anonymity, said that after

the introduction of the new norms, the leadership team of about 400

people get the same bonus, irrespective of the performance of their

verticals. “The idea is to win as a team or lose as a team.”

By removing multiple KPIs, the management also gave flexibility to the

bank branch manager to decide what business worked best for the branch.

Instead of targets that were set top-down from the corporate office, the

manager can decide targets within the guardrails of risk. “The manager

(now) has to decide how to meet the profit target by selling the right

products,” says a former employee of the bank.

The intent was clear—improve operating profit and grow the business

through a risk-calibrated approach.

Stay with the product

The other significant change that Bakhshi brought was to put in place a

sales culture that dislikes customer churn. He had learnt from his ICICI

Pru days that unless the customer stays with a product, the firm cannot see

sustainable profits. At the bank, his motto read: Be fair to the customer,

fair to the bank.

The bank, thus, stopped selling products that were not seen to be

beneficial to customers. As head of the ICICI Prudential Life, Bakhshi

had witnessed rampant mis-selling of products. At ICICI Bank, he

stopped the sale of participating insurance products from ICICI Pru.

Participating products allow the insured customer to receive dividends

from the profits of the insurance company.

This hit the revenue of the ICICI insurer as 60-70% of its business was

dependent on distribution through the bank. The bank also suffered in

terms of loss of fee income. But this was absorbed by the bank’s focus on

selling multiple products to a single customer. The bank’s return on assets

improved from 0.39% at the end of fiscal 2019 to 1.42% by end of fiscal

2021.

ICICI Bank, once at the forefront of corporate banking, has also pivoted

majorly towards the retail segment. The share of retail loans to total

advances has moved from 59% in the December quarter of fiscal 2019

(when Bakhshi joined) to 66.7% in the January-March quarter this year.

In the same period, the bank’s current and savings account deposits, also

called Casa deposits, have grown 44% to ₹4.31 trillion.

While the bank made its digital strides early, it has, of late, started

harnessing the power of data. According to the second person quoted

earlier, over the last three-four years, big, public data meshed with the

bank’s own data has worked well for ICICI Bank. “There are several

customers who keep their digital footprints with the bank and the bank

can therefore align its offerings accordingly. These footprints have

exponentially grown and any bank or financial institution which is able to

use that data and execute on it will be a winner,” said the person

mentioned above.

The bank took another bold decision in December last year when it opened

its mobile banking platform iMobile Pay to customers of other banks.

“Come, try out our offering” was the offer. Over two million sign-ups

from other banks were recorded and many among them opened savings

accounts and applied for credit cards, home loans, and personal loans, the

bank said this June.

All credit to Bakhshi?

How much of the new spring in the steps of ICICI Bank is Bakhshi’s

doing? For all of the credit for turning around the bank, the CEO has

avoided the limelight—a stark difference from his predecessor Kochhar’s

high profile presence in the media and industry bodies. Bakhshi, a

mechanical engineering graduate from Chandigarh, stays the reticent

banker he is.

“Bakhshi seems to be different from former heads of the bank and is more

focused on the job at hand,” said Hemindra Hazari, an independent

commentator.

Others say it’s too early to judge Bakhshi on the basis of his performance

over the last three years. For example, they point out that the economy

was slowing even before the outbreak of the covid-19 pandemic and this

necessitated a pull back on corporate loans.

Inherited momentum helped Bakhshi, too. “He happened to be at the right

place at the right time. The bank had undergone a lot of improvement

under Kochhar’s tenure itself. He, therefore, managed to get a much

cleaner book with a strong retail franchise,” said an analyst, adding that

consistency in the operating numbers for another two years is key.

The recovery in the quarters ahead in the aftermath of the economic ruin

caused by covid-19 will decide much of ICICI Bank’s trajectory under

Bakhshi. For instance, an analyst at a rating agency said, “Our concerns

remain on the quality of retail assets over a period of time as the growth

has been substantial.”

A hit on the salaries of consumer loan borrowers could directly impact the

bank’s retail portfolio. For now, the markets seem sanguine about ICICI

Bank and Bakhshi. Shares of ICICI Bank have more than doubled to reach

levels of ₹640-650 in the week gone by, as compared to where they stood

when Bakhshi took over as the CEO. This compares to a 57% increase in

the BSE Sensex, the Bombay Stock Exchange’s benchmark index, and

40% increase in BSE Bankex.

It reflects confidence in the ICICI Bank stock—a confidence pinned on

the bank’s turnaround of operations and perhaps a turnaround scripted by

Bakhshi.