EXECUTIVE SUMMARY. The ET Prime 3-part series based on the Securities and Exchange Board of India’s (SEBI) show cause notices to Standard Chartered Bank, Indusind Bank and Aditya Birla Finance highlighted the manner in which these institutions allegedly ‘evergreened’ their exposure and shifted their loans from the unlisted Thapar group entities to the listed CG Power and Industrial Solutions (CG Power) in 2017-2018. These transactions, if proven, would demonstrate the misuse of their banking and non-bank finance company license. In all three cases a similar structure was adopted: transactions were layered by providing loans to a shell company, thus eventually shifting liabilities from founder/promoter unlisted companies to CG Power and Industrial Solutions (CG Power), a publicly listed company. Obviously, this adversely affects the minority shareholders of CG Power.

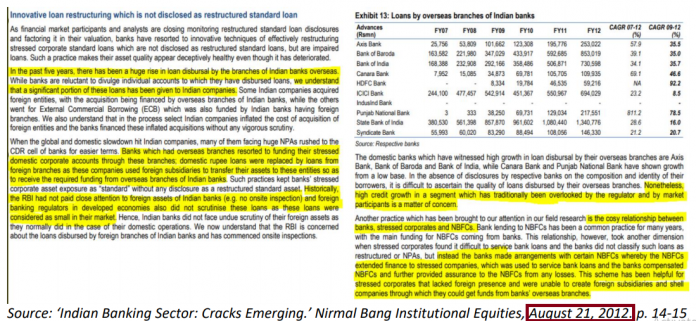

The modus operandi of providing foreign exchange loans to a foreign subsidiary of an Indian company to repay rupee loans of the parent, thereby ‘evergreening’ the loan, was not new. This analyst had first highlighted it in a research note in August 2012, when he was Head of Research and banking analyst with a sell-side firm. The dubious practice in these cases by the mentioned entities, apart from alleged ‘evergreening’, was the use of this route to shift liabilities from an unlisted company to a listed company. The ET Prime scoop has perhaps for the first time made public documentary proof of specific cases of the money trail and of routing funds through various companies to achieve the objective.

The purpose of lending in foreign exchange to a foreign subsidiary of a domestic company, and layering the transactions through various companies, was to confuse auditors and regulators, and to hide the objective of the end-use of the loans. The brazenness of these transactions (transferring the funds to other companies within the same day or in a few days) and the possible violation of the Reserve Bank of India (RBI) norms for the end-use of external commercial borrowings indicate that these banks believed the regulators would not catch them, and it is therefore possible that it was a common practice.

That these transactions were systemic, with a top-down approach, and not the work of ‘rogue’ employees, is visible in the fact that these dubious loans were cleared by the risk department and key divisional heads at Indusind Bank and Aditya Birla Finance, far from being punished for structuring the loans, were rewarded through promotions (here and here) and allowed to retain their jobs. It can therefore be presumed that these transactions had also been approved by their boards of directors, and they have to be held accountable.

The important fact is that the three entities targeted by SEBI are not some fly-by-night operators. Rather, they are well established banks and an NBFC belonging to the house of Aditya Birla. If this analyst in 2012 was confident to publish and inform investors about such practices, as the facts were well known within banking circles, why was the banking/NBFC regulator not taking action against senior officials? It is on account of the lack of action by the RBI that senior officials in these entities were brazenly structuring such loans in 2017-2018. Sadly, to date, the Reserve Bank of India (RBI) has not exerted its considerable muscle to bring the key officials and the boards of directors in these institutions to account. So far the RBI has been content with levying monetary penalties on errant institutions; whereas in fact the regulator in the cases unearthed by SEBI should not only sack the key senior executives but render them unemployable in the financial sector, and also remove independent directors for their complicity. As long as the regulator mollycoddles errant senior executives and independent directors, such malpractices will continue to flourish as, understandably, the culprits have no fear of the regulator.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I have no exposure to companies mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.