EXECUTIVE SUMMARY. Institutional investors were recently in the news for opposing a 10% pay hike for a CEO-promoter in FY2021, a year of bad results for his firm. One big story went unremarked: that the latest pay hike was on a high base, since the CEO had received a 51% pay hike in the previous year of poor performance (FY2020). Interestingly, two of the three ‘independent directors’ who staff the crucial Nominations and Remuneration Committee (NRC) are former employees of the firm.

Composition of Siddhartha Lal’s Compensation

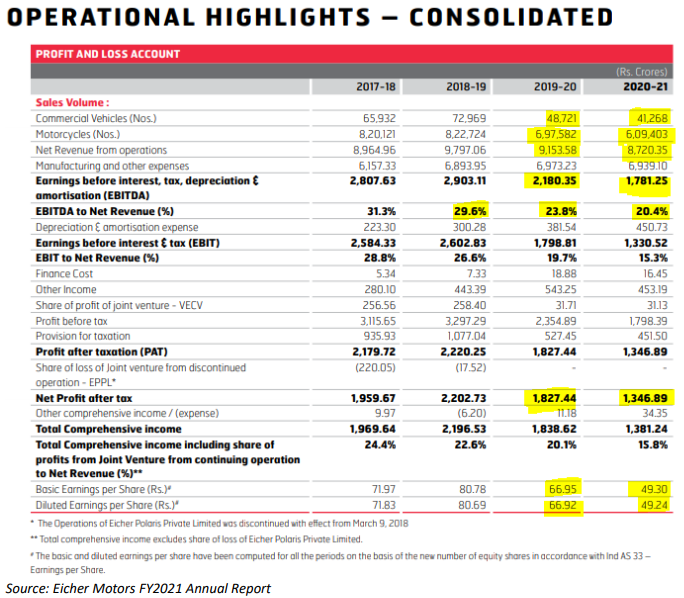

Special Resolutions, proxy advisory firms and institutional shareholders are proving to be the bane of corporate India and of Chief Executive Officers (CEO) with generous remuneration packages seeking reappointment. The case of Siddhartha Lal, the CEO-promoter of Eicher Motors, received wide publicity when institutional shareholders at the August 7, 2021 annual general meeting delivered a humiliating rebuke by rejecting his candidature. They expressed discomfort with the 10% remuneration hike Lal received in FY2021 on the back of poor financial performance by the company, and with the clause which stated that Lal’s future remuneration would be capped at 3% of the company’s profits. On August 23, 2021, a chastened Eicher Motors decided to once again reappoint Lal as managing director, but with a reduced remuneration cap of 1.5% of the company’s profits. They also issued a clarification justifying his remuneration hike in FY2021.

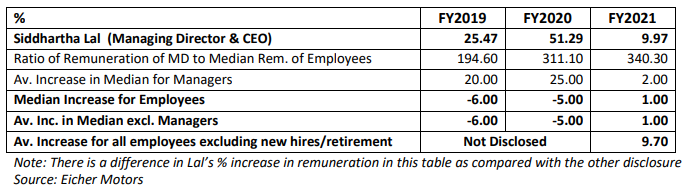

The revised notice, citing Manvi Sinha, Chairperson of the NRC, gives rise to questions. It underlines the fact that NRCs appear ever willing to rubber stamp and defend the liberal remuneration packages provided to CEOs. The remuneration for promoter-CEOs like Lal ought to be dependent on the performance of the company, unlike remuneration for the general cadre of employees; thus the average 10% hike the firm claims it gave its employees (after adjusting for new hires/retirees) cannot be a justification for providing a 10% hike to Lal. Furthermore, Lal as a promoter with a substantial equity interest in the company, is also rewarded through dividends, and hence his remuneration is only one component of the monetary benefits he derives for his efforts.

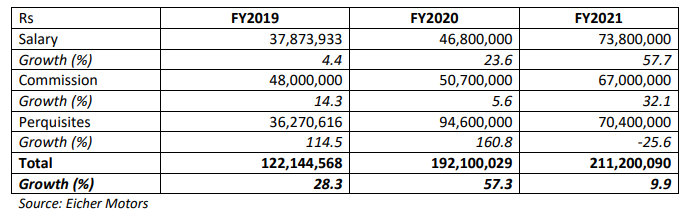

Increase in Remuneration of Siddhartha Lal and Eicher Motor Employees

The clarifications by S. Sandilya (chairman, Eicher Motors) and by Manvi Sinha, both members of the NRC, fail to explain why, in FY2020, when the sales, profits and profitability of the company declined, Lal was given a 51% (57% as per a different disclosure) hike in remuneration, in contrast to the 5% decrease in median salary of all employees. Therefore the 10% hike in Lal’s remuneration in FY2021 was on a base of a 51% hike in FY2020. For two successive years of declining performance by the company, an indulgent NRC was willing to handsomely reward Lal, completely delinking the CEO’s remuneration from the company’s performance. When institutional shareholders witness such blatant indulgence, it is a scathing comment on the independence and competence of the NRC and the board of directors.

NRC of Eicher Motors in FY2020 and FY2021

The NRC of Eicher Motors consists of 3 independent directors. Manvi Sinha has a background in media and has reportedly known Lal from childhood; S. Sandilya was for many years a senior executive in Eicher Motors; and Inder Mohan Singh, partner of the law firm Shardul Amarchand Mangaldas, was earlier the Head – Legal and Secretarial at Eicher Motors. While independent directors may have known the promoters or worked with them earlier, their decisions on the board must defend the interests of the company and not just the promoter. Sadly, the manner in which the board has rewarded Lal for two consecutive years, when the company performed poorly, speaks volumes about its competence and independence.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I have no equity exposure to Eicher Motors. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.