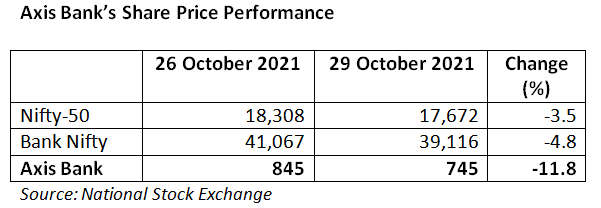

EXECUTIVE SUMMARY. Even though Axis Bank reported an impressive growth in net profit, higher than that of its peers, the stock market penalised the bank, as the growth of its business, top line and profit before provisions was lower than that of its peers. The stock market traditionally favours both top and bottom line growth, and in Axis Bank’s case the market believed that the poor business growth is a symptom of a deeper problem in the bank’s business model.

Some analysts have highlighted Axis Bank’s poor business indicators in the 2QFY2022 as compared with those of its peers, and their reading-between-the-lines is that it may be an undisclosed or even undiagnosed problem. It is also possible that Axis Bank 2QFY2022 was an off quarter, where the management took its eye off the ball, and that performance may rebound and match that of its peers in 2HFY2022. However, another, more ominous, explanation could be that staff morale may be the cause of the poor performance.

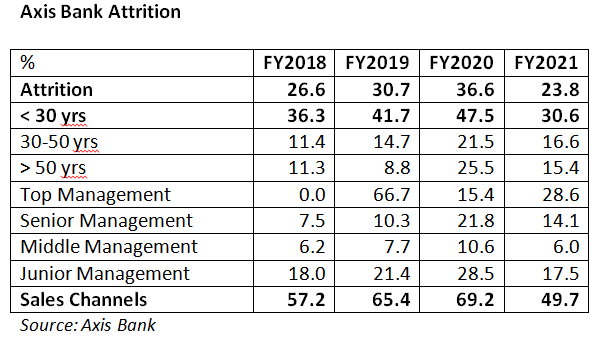

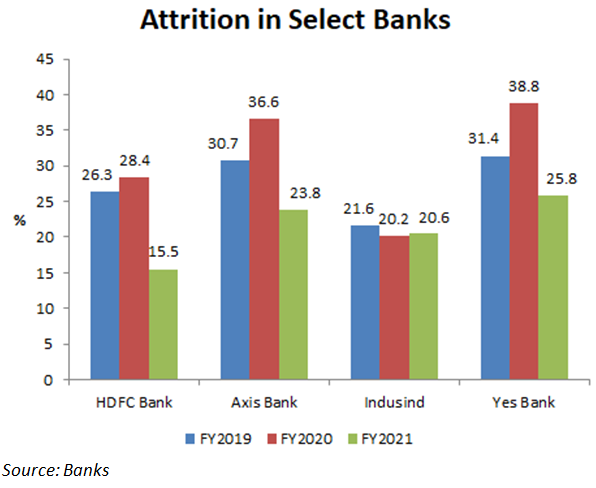

This analyst was the first to highlight Axis Bank’s high and worsening attrition from FY2018 to FY2020, when it peaked at 36.6% for the overall bank and an alarming 69.2% for the sales category (this category has the second highest number of staff which sources new business). In FY2021, Axis Bank reported a trend reversal, a significant improvement in attrition to 23.8% (sales attrition at 49.7%); the improvement was also seen in other private sector banks. It is possible that the work-from-home regime in FY2021 resulted in less stressful daily physical meetings, and relaxation in achieving sales targets, on account of the lock-down. With 2QFY2022 gradually returning to normal, the pressures on the staff may have resumed to a point where attrition may have increased and morale plummeted, impacting the top line performance of Axis Bank.

Attrition can be a lead indicator for future performance, and analysts have been concerned with the steady senior level exits since Amitabh Chaudhry took charge as Chief Executive Officer on January 1, 2019. The latest resignation was of Rajesh Dahiya, executive director and in-charge of human resources since June 2010. But what was unreported was the plight of the bulk of the Axis Bank staff, which was ignored by analysts. This despite the fact that the bank had comprehensive disclosures on the issue which painted a sorry picture of human resource management since FY2018. Staff discontent may take some time to filter down to impacting overall performance, and we need more quarters to monitor performance to validate this hypothesis.

The Axis Bank board of directors need to urgently enquire into the reasons for the poor business and revenue performance in 2QFY2022 and the stock market penalising the share price may provide the appropriate push to the board to investigate the matter and come out with remedial measures.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in all the banks mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

Its painful to see this happening in Axis which was once known for its employee friendliness and inspiring workplace. Hope the management quickly act on the issue and take corrective steps to reverse the trend.

Sad to see this. Board should investigate the hirings and their background. For every 1 employee of Axis Bank leaving, hiring 3 non-bankers from other banks.

Management discarded old employees contribution and told them it is better to find a new place. Not recognising existing staff and hiring new on higher packages for same grade in last few years has resulted in demotivation.

Very true. Most people leaving had served for almost 8 to 25 years. Unexpected at UTI Bank brand that became 3rd largest due to contribution from them. New hirings are immature, no relevant experience and take no responsibility, always finding someone to delegate. Only place they want to lead is taking credit, that too for ideas taken from Axis Bank staff.

While many banks came out of bell curve, Axis Bank made it tougher and not keen to give decent hike to old employees.

Under new management Bank has rolled out few good initiatives such as lower medical insurance premium for retired employees compared to peers, Hybrid working model on permanent basis, benevolent scheme, special benefits / support to Covid infected employees /support to families etc

I’m an ex employee of Axis Bank. There is no work life balance. Bank needs to focus on this issue immediately else there will be more attrition.

Bank board has never taken tough decisions in the past, nor in a position to take now. It’s easy to misguide them by twisting figures or issues. As long as fear psychosis keep gripping employees, the attrition rate is not going to come down drastically.

The culprit responsible for vitiating the work environment is on the verge of exit. It reminds me of a quote “you reap what you sow”, which has become true. It’s a decent way of showing the door. Erstwhile management axed its feet by asking seasoned bankers to leave, to save its own skin for non-performance, masquerading it under ERO. Since then Bank has always been in news for the wrong reasons like violation of policy guidelines, divergences, and non-compliance issues. Board has never played an active role in questioning top management for the lapses. Perhaps core competency at the board level was also an issue for quite some time in the erstwhile regime. It would be interesting to watch how long Non-bankers keep running the show?

The obvious culprit who brought attrition culture is on the verge of moving out. It’s rightly said that erstwhile top management axed its own legs by asking seasoned bankers to leave, to save their own skin, masquerading exits under Early Retirement Option (ERO). Thereafter, the bank has always been in the news for violation of regulator’s extant guidelines and non-compliance issues. Bank board has never taken tough decisions in the past, nor in a position to take now. It’s easy to misguide them by twisting figures or issues. As long as fear psychosis keep gripping employees, the attrition rate is not going to come down drastically.