EXECUTIVE SUMMARY. On November 5, 2021, the auspicious day of the Hindu New Year, the Economic Times burst a firecracker of a news story on IndusInd Bank. The story cited whistle blowers (a group of anonymous senior employees), who alleged that the bank’s microfinance subsidiary, Bharat Financial Inclusion (BFIL), carried out large scale evergreening of loans in 80,000 accounts in May 2021. The story also disclosed for the first time that M R Rao, the non-executive vice-chairman, BFIL, and formerly its CEO, had resigned on September 15, 2021. His resignation letter specifically stated:

“…I am aware that RBI [Reserve Bank of India] has raised issues with respect to BFIL particularly the 80,000 loans given in May 2021, without customer consent. This is a point on which I expressed deep concern in the board and in fact demanded a third-party audit too. To me it appears to be not a process lapse but a deliberate act to shore up repayment rates. I had warned the board too about the serious consequences…”

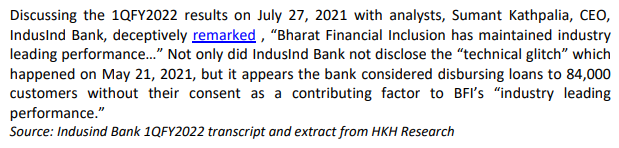

In response, IndusInd Bank issued a statement to the stock exchanges denying evergreening, but admitting to disbursing nearly 84,000 loans without customer consent. However, IndusInd attributed it to a technical glitch, which was detected and rectified. It said only 26,073 clients were active, with outstanding loans of only Rs 340 mn. Unfortunately for IndusInd Bank, the stock market rejected the management’s explanation, and shareholders lost Rs 94 bn (US$ 1.3 bn) in market capitalisation.

Assuming IndusInd Bank’s explanation to be credible, it highlights the high operational risk in the bank, as it implemented a technology upgrade in its end-to-end digital customer loan disbursal system with inadequate testing. Shockingly, it appears that in the ‘upgrade’, the key customer approval stage was bypassed in disbursing loans. Worse, in the bank’s detailed explanation, there is not a single reference to accountability. Nobody is held responsible for the huge reputational loss to the bank and the US$ 1.3 bn loss to shareholders’ market capitalisation. Such misconduct in any bank is unacceptable. This analyst had earlier highlighted the IndusInd Bank’s board of directors’ high level of tolerance for incompetence in the bank’s corporate credit and risk management divisions. The culture of lack of accountability for senior executives appears to be widespread in the bank.

With such a loss of credibility, only an RBI inspection and/or a forensic audit authorised by the banking regulator can unearth what exactly happened in IndusInd Bank, as the market has discarded the bank’s explanation.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in Indusind Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.