A Kotak family entity, Infina Finance Private Ltd. (Infina), purchased electoral bonds totalling Rs 1.3 billion – which is more than twice the amount disclosed by the State Bank of India (SBI) to the Election Commission of India (ECI) during FY2019 to FY2022.

In FY2020, the company purchased Rs 760 million electoral bonds, but in the SBI’s disclosure only Rs 350 million was disclosed. During FY2019 and FY2020, the Kotak entity purchased Rs 1.06 billion of bonds and these years were critical for Uday Kotak as in August 2018, the Reserve Bank of India (RBI) rejected the Kotak Mahindra Bank’s (KMB) proposal of issuing preference shares to reduce Uday Kotak’s holding in the bank. KMB responded by taking the banking regulator to court in December 2018 and although the RBI had a strong case, it capitulated in an out-of-court settlement on terms favouring Uday Kotak in January 2020.

At that time, the public was unaware of the reasons for RBI’s humiliating capitulation. But the disclosure of the electoral bonds data and the fact that at least Rs 350 million was given to the ruling Bharatiya Janata Party (BJP) in FY2020 raises a huge concern of a quid pro quo arrangement and regulatory capture.

Infina’s Purchase of Electoral Bonds and Infina’s Net Profits

| Rs mn | FY2019 | FY2020 | FY2021 | FY2022 | FY2023 | Total |

| Electoral bonds purchased as per Infina’s disclosures | 300 | 760 | 0 | 250 | 0 | 1,310 |

| Electoral bonds purchased as per SBI’s disclosures | – | 350 | 0 | 250 | 0 | 600 |

| Net Profit of Infina | -306 | -513 | 2,263 | 2,703 | 1,055 | 5,202 |

Source: Election Commission of India and Infina

Uday Kotak, Asia’s richest banker, an authority on corporate governance, who chaired the prestigious Securities and Exchange Board of India (SEBI) Committee on Corporate Governance (October 2017), has been caught with his hand firmly in the electoral bonds jar. A Press Trust of India report recently highlighted the fact that Infina, a company belonging to the Kotak family group, had bought Rs 600 mn of electoral bonds and generously donated the entire amount to the ruling BJP. An investigative report by Ayush Tiwari and Project Electoral Bond, using the same data, tallied the dates on which the Kotak family group company bought the bonds with the periods when the Reserve Bank of India (RBI) provided highly unusual concessions to Kotak. These concessions pertained to Uday Kotak’s holdings in Kotak Mahindra Bank (KMB) and to the extension of his term as CEO, KMB. Both these reports put Infina’s donation of electoral bonds, as disclosed by the Election Commission of India (ECI), at Rs 600 mn. (see Annexure 1 and 2)

Infina is a non-deposit-taking systemically important non-bank finance company (NBFC). It is 49.99% owned by Kotak Mahindra Capital Company (KMCC), a 100% subsidiary of KMB; another 49.98% is held by Komaf Financial Services Pvt. Ltd, a Kotak family company; and 0.03% is owned by Kotak Trustee Company Private Ltd. The ownership structure of Infina is rife with conflict of interest as slightly more than 50% of Infina is owned by the Kotak family while the remaining is owned by a 100% subsidiary of the bank where Uday Kotak is the promoter.

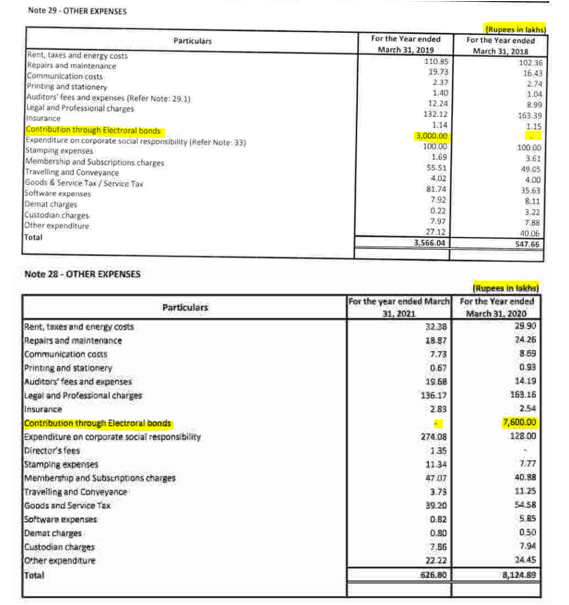

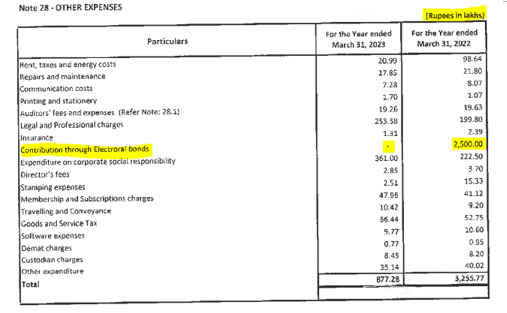

A study of Infina’s accounts reveals that from FY2019 till FY2023, the company bought a total of Rs 1.3 bn of electoral bonds (see Annexure 3), which is more than twice the amount disclosed by the State Bank of India (SBI) to the ECI.

The huge difference in the amounts as disclosed to the ECI and the amount revealed in the NBFC’s own accounts underlines the need for analysts studying the electoral bonds data to also use company data. They must reconcile the ECI disclosures with the companies’ own financial accounts to determine the actual amount of electoral bonds purchased by the companies.

As the SBI’s electoral bonds disclosures to the ECI pertain only to the period from FY2020, Infina’s Rs 300 mn purchase in FY2019 would not have been captured. However, in FY2020, Infina reported purchasing Rs 760 mn of electoral bonds, while SBI’s disclosures reveal that Infina had directly purchased only Rs 350 mn. This indicates that Infina either purchased the remaining Rs 410 mn bonds in the April 1 till April 11, 2019 period prior to the Supreme Court disclosure date (commenced from April 12, 2019) or had purchased electoral bonds from the secondary market within the 15 day window and depositing it with a political party. The secondary purchase of bonds by Infina could only have been for providing the company a second layer of anonymity, as the electoral bond scheme did not ration the bonds: there was no restriction on the total amount that could be purchased from SBI. It is therefore obvious that if Infina had purchased these bonds post April 12, 2019, it did not want the purchase of the Rs 410 mn to be disclosed to the SBI.

It is also pertinent to highlight that in two (FY2019 and FY2020) of the three years (FY2019, FY2020 and FY2022) that Infina purchased electoral bonds, the purchase either directly resulted in the company reporting a loss (as in FY2020) or contributed to higher losses (as in FY2019). Although Infina is adequately capitalised (capital adequacy ratio of 318.2% in FY2020), the NBFC appeared not to mind either reporting a loss or increasing the existing loss as a result of the purchase of electoral bonds in those two years.

Infina is indirectly linked with KMB, as KMCC, a 100% subsidiary of the bank, owns 49.99% in the NBFC. But there is also a direct link with KMB, as a senior KMB official was directly involved with both KMCC and Infina. In all the three years that Infina purchased the electoral bonds, Jaimin Bhatt, president and group Chief Financial Officer (CFO), KMB, was on the board of directors of both KMCC and Infina. Bhatt’s presence on the boards of KMCC and Infina was to protect the interests of KMB. Since Infina is a NBFC, purchasing electoral bonds would not be a normal business for the company to be engaged in, and hence it would require board approval for the purchase of electoral bonds.

As purchasing electoral bonds is a sensitive political issue and is not part of the regular business of any of the three corporate entities, the question is whether Bhatt, as a serving senior KMB official, informed the board of directors of KMB that Infina was purchasing bonds, and more importantly, educated the board on why it was purchasing the bonds, and what its objective was in giving at least Rs 600 mn to the BJP. If the KMB board of directors was not informed of the purchase, it is a very serious governance lapse; and if the board was informed, the issue of the donation being a quid pro quo should have arisen. Interestingly, in the directors’ reports of Infina in those years, there is no disclosure that the NBFC was purchasing electoral bonds. The information can only be found in the schedule of ‘other expenses’ in Infina’s accounts (see Annexure 3).

In October 2017, Uday Kotak (then Managing Director and CEO, KMB) was chairman of the SEBI-appointed Committee on Corporate Governance. Commenting on the importance of disclosure and transparency, the report said (p. 63),

Disclosure and transparency underpin good governance and the efficient functioning of the markets. A corporate governance framework should ensure that timely and accurate disclosure is made on all material matters regarding the corporation, including the financial situation, business performance, strategic shifts, ownership, and governance of the company.

Regulations in India, have driven a large part of the disclosure and transparency construct, especially for listed entities. While companies, in general, comply with the regulatory minimum, the Committee encourages boards and managements to view disclosure and transparency as a means to build trust with stakeholders and to proactively disclose material information that may impact decision-making variables.

The KMB directors’ reports remained silent on the fact that a Kotak entity, in whose board KMB was represented by its CFO (also the group CFO), had purchased electoral bonds of Rs 1.3 bn from FY2019 till FY2022. Such is the state of corporate governance in a bank valued at nearly US$ 42 bn.

The Supreme Court of India’s judgement rendering the electoral bond scheme illegal said (p. 147 and p. 76),

…contributions made by companies are purely business transactions made with the intent of securing benefits in return…There is also a legitimate possibility that financial contributions to a political party would lead to a quid pro quo arrangement because of the close nexus between money and politics…The money that is contributed could not only influence electoral outcomes but also policies particularly because contributions are not merely limited to the campaign or pre-campaign period.

The sequence of donations of electoral bonds by a Kotak-linked NBFC to the ruling party, and the repeated, unique concessions extended to Kotak by the regulator, do raise the question of a quid pro quo arrangement.

Since the PTI and the Project Electoral Bond stories, the army of banking journalists and sell-side analysts that cover KMB have pressed the mute button on themselves. A major news story that a prominent private sector banker’s company donated Rs 600 mn in electoral bonds to the ruling BJP, and the suspicion of a quid pro quo arrangement to get concessions from the banking regulator, should have launched many analytical and opinion pieces. Instead what the public and the capital market has got from those whose job it is to report on and analyse KMB is a studied silence.

While the reputation of Asia’s richest banker has been tarnished by the electoral bond issue, the impact on RBI’s reputation as a banking regulator is far worse. Recall the harsh language exchanged between KMB and the banking regulator in the court papers during the dispute regarding Uday Kotak’s refusal to lower his equity stake, the disgraceful out-of-court settlement on Kotak’s terms, and the last extension given to Uday Kotak as CEO. The public can now match these developments with the periodic donations, totalling at least Rs 600 mn, given by a Kotak entity to the ruling political party at the Centre. It can now draw its own conclusions about the banking regulator’s inability to take action, and the apparent humiliating dictation it took from the political authorities. It is sad to see the once-exalted RBI transformed into a poodle for its 90th anniversary.

Note: A questionnaire was sent to KMB but the bank declined to respond

Note: The article was edited on Sunday, April 7, 2024, to take into account the fact that the State Bank of India has not disclosed electoral bond data for April 1-11, 2019, i.e. the first 11 days of FY 2020, and that although Infina appears to have begun buying bonds in FY2020 on October 10, 2019 – the date recorded in the SBI data – it is possible that the company bought Rs 41 crore of bonds during that 12 day window.

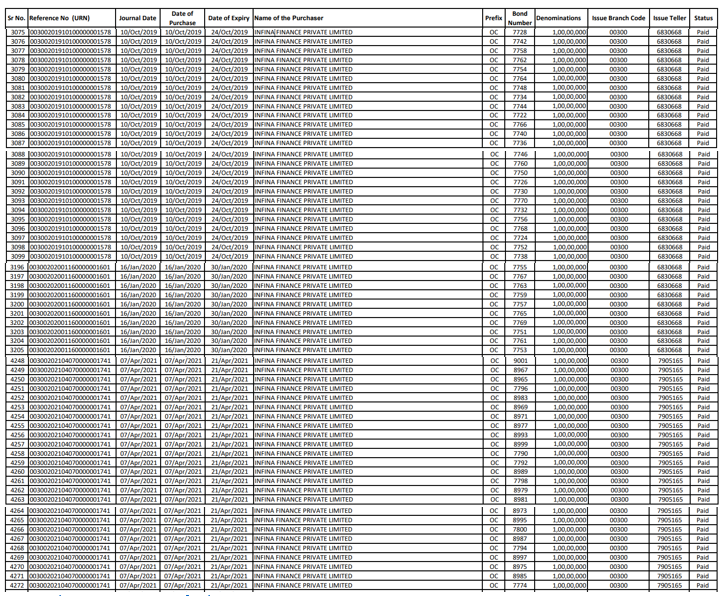

Annexure 1: Electoral Bonds Issued to Infina Finance Private Ltd.

Source: Election Commission of India

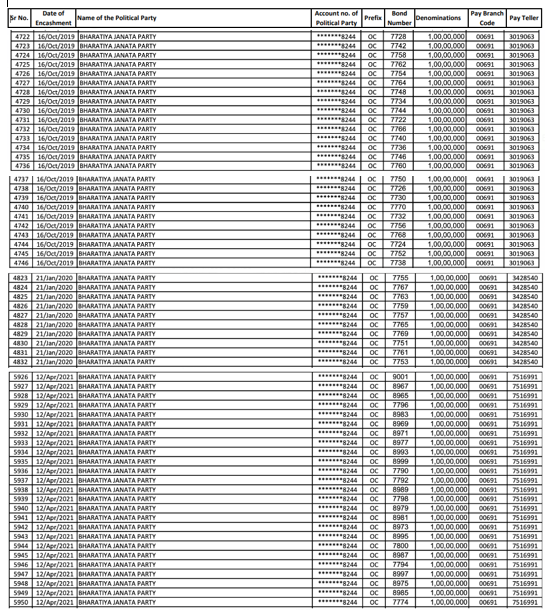

Annexure 2: Electoral Bonds Issued to Infina Finance Pvt. Ltd. Deposited in BJP’s Bank Account

Source: Election Commission of India

Annexure 3: Infina’s Purchase of Electoral Bonds FY2019 – FY2023

Source: Infina

This article was also published in The Wire.in (here) and by Zee Business (here).

__________________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own shares in KMB. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: