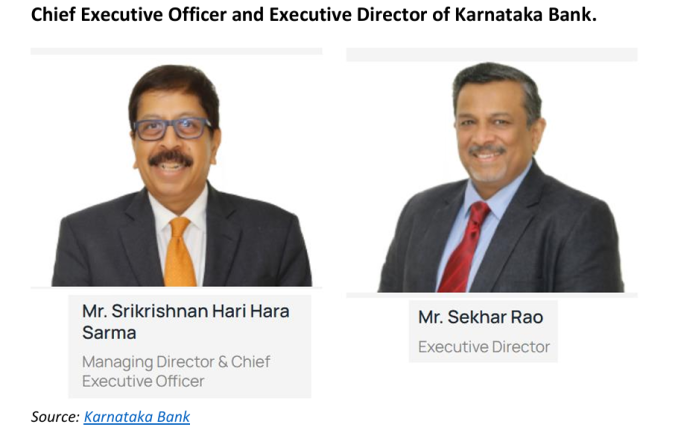

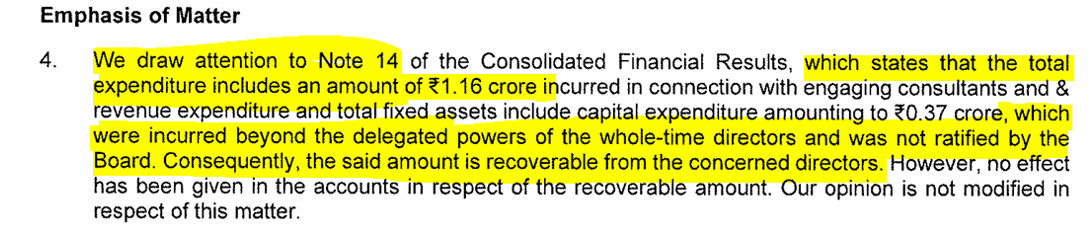

Tucked away in the notes to the 4QFY2025 accounts of Karnataka Bank, a century-old regional private sector bank which once enjoyed a conservative reputation, is a very alarming note. It should have raised huge corporate governance concerns among stakeholders and even more so the Reserve Bank of India (RBI), the banking regulator, yet it seems to have passed virtually unremarked. The statutory auditors of the bank, Ravi Rajan and Co. LLP and RGN Price and Co., stated that the bank had incurred Rs 15.3 mn expenditure beyond the delegated powers of the whole-time directors, which expenditure was not approved and ratified by the board. The break-up is Rs 11.6 mn in connection with engaging consultants, and Rs 3.7 mn revenue and capital expenditure. The whole-time members of the board are Srikrishnan Hari Hara Sarma, Managing Director and Chief Executive Officer (CEO) and Sekhar Rao, Executive Director (ED). It said that the said amounts would have to be recovered from these two gentlemen.

Auditors’ Comment in Karnataka Bank’s 4QFY2025 Results

While the amounts mentioned are not large, the fact of such expenditure exceeding the designated powers of the CEO and ED, and of the board not ratifying the said expenditure, has great significance for corporate governance, and is a stark symptom of the storm raging within the Karnataka Bank boardroom. Pertinently, as per the bank’s disclosure, the board meeting which considered finalising the accounts for 4QFY2025 and for FY2025 was unduly delayed, resulting in the postponement in timing of the analysts’ conference call which was held on the same date.

In response to an analyst’s query on the issue of this expenditure not ratified by the board, the CEO on the 4QFY2025 conference call said (p. 21),

“It’s a very simple matter. The amounts are very insignificant, but it’s just the governance part,the bank had to take this into account. If there is anything which is incurred beyond the delegated authority, obviously there are explanations and making sure that those are either ratified or we will have to kind of make sure that the bank has a very conclusive part related to that, so that has been done and which is why it is a simple matter which is an emphasis of matter , which is normal and the amounts are not at all large

[responding to a further query on whether the bank has adequate processes]…we do have a policy and process, etc., but there was some kind of, I would say, interpretational or ambiguity in the policy, which has been corrected already. And we will ensure the same so that it doesn’t happen again.”

In response to a query sent by this analyst, Karnataka Bank stated,

“The matter is under discussion at the Board level as the amounts are only estimations from the statutory auditors. The quantum and justifications for the same will be identified and substantiated only after the conclusion of the discussions with the Board. The Whole-Time Directors would be explaining to the Board the details with respect to the above. There have been no such prior instances.”

While the auditors have taken pains to specify the quantum, the bank claims the amounts to be mere “estimations.” The bank’s statement that “there have been no such prior instances” in all likelihood refers to no such instances in the bank’s history of the board not approving the expenditure and demanding that the whole-time directors reimburse the expenditure to the bank. Even though the CEO may say “the amounts are very, very insignificant”, the issue is far from being a “simple matter”.

Banking is a highly regulated industry and bank boards have clear-cut policies on the approval powers of all the staff, which have to be followed. As the CEO and ED report to the board of directors, they have to be in compliance with the powers delegated to them by the board. Any staff exceeding his/her powers and not getting it approved by the seniors is considered a major offence. Even in the rare case of the CEO/ED exceeding his/her powers, if the amounts were indeed insignificant, the board would caution the executives and ratify the decision. But in this case the board of Karnataka Bank has insisted on not ratifying the expenditure, and has apparently not objected to the auditors’ mentioning it in the accounts. Most managements bend backwards to implore auditors not to qualify the accounts or pass adverse comments in them, but in this case it appears the board did not mind that the auditors were highlighting this “insignificant amount”.

The whole-time directors’ conduct and the auditors’ comment indicates that the CEO and the ED may be repeat offenders. In all probability they have been cautioned earlier by the board, and they have continued to exceed their powers in defiance of the board of directors. If this is the case, their persistent misconduct would be a very serious offence by the two highest executive officers in Karnataka Bank.

In any professional organisation, especially a bank, which manages the savings of the public, authority and powers are delegated at every level. Executives, especially senior executives, cannot exercise powers not delegated to them. These powers are exercised not by divine right, but can be taken away or modified by the higher authority. When the CEO and ED defy the board of directors, which is the highest authority in the organisation, and the auditors mention it in the accounts, which are for public viewing, it undermines discipline in the organisation. This may prove disastrous in a bank, which operates in a highly sensitive part of the economy. This is the reason why banking is heavily regulated, and the RBI has introduced many norms pertaining to corporate governance. When the two highest executives of a bank brazenly defy the board, what signals does it send to the rest of the bank and the industry?

One of the costs which the board has insisted be clawed back from the CEO and ED was the unauthorised appointment of a Deputy General Manager (DGM) by the whole-time directors. On April 8, 2025 a DGM, product-head assets and co-lending, and a designated member of the senior management, resigned for personal reasons. He had joined the bank only 3 months earlier on January 9, 2025. Karnataka Bank’s response to a query sent by this analyst acknowledges that this appointment was not ratified by the board and hence the individual had to resign. However, the bank also acknowledges that the individual was reappointed at an “appropriate level fully adhering to the recruitment and compensation policies of the Bank.”

The concerned individual was reappointed in the same department as an Assistant General Manager (AGM), i.e. one level below DGM a few days after he resigned from the bank. Pertinently, the appointment as an AGM does not require board approval, as the post is not considered senior management in Karnataka Bank. The issue here is that when a higher authority has rejected the appointment of an individual, can a lower authority reappoint the same individual at a lower grade? Although appointment as an AGM does not require the approval of the board, in this case, since the board had specifically rejected the candidature, should it not have been informed that the bank is reemploying the same individual? The reappointment displays an attitude on the part of the CEO and the ED, indicating that they wanted to directly confront the board of directors, the higher authority.

This analyst has been a vocal critic of the non-performance of directors in many banks and companies in the financial sector. Boards have turned a blind eye to many misdeeds by the senior executives, and often made a display of waking up only after the organisation suffered losses. In demanding that the amount be recovered from the CEO and ED, the bank’s Nomination and Remuneration Committee (NRC) has played a pivotal role in recommending this course of action to the board of directors, which has approved the decision of its sub-committee. It is commendable that the board of directors at Karnataka Bank has taken a firm stand against the CEO and ED, and that, by not approving the expenditure, has permitted the senior executive leadership’s deviant behaviour to be recorded by the auditors and released in the public domain.

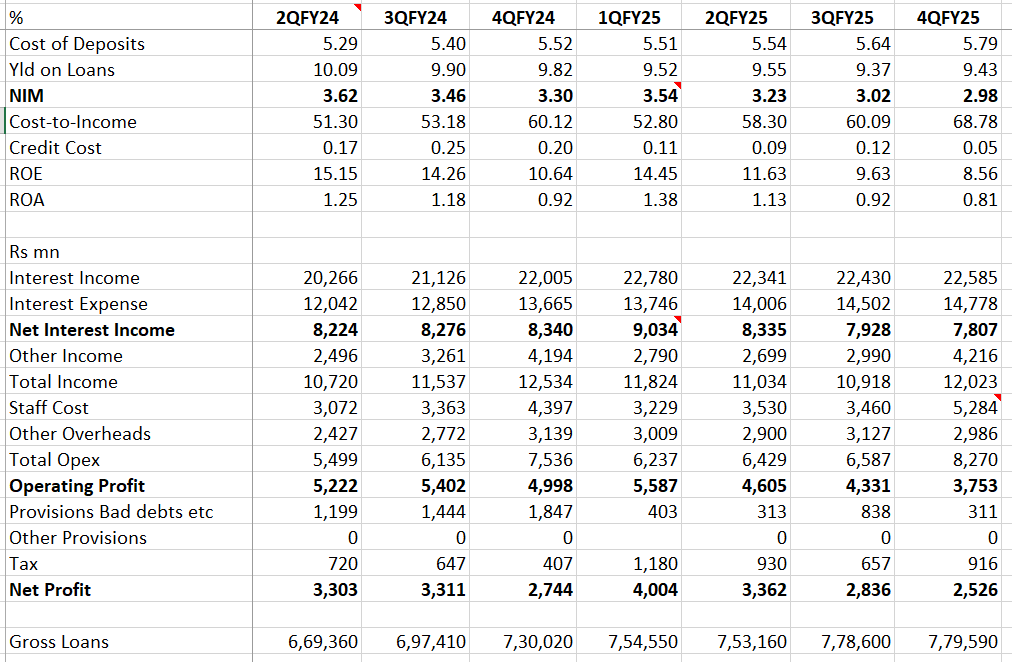

Srikrishnan Hari Hara Sarma took charge as the MD and CEO of Karnataka Bank on June 9, 2023 for a period of 3 years, while Sekhar Rao was appointed as the ED of the bank on February 1, 2023 for a period of 3 years. The bank’s performance under their leadership since 2QFY2024 (from quarter of July-September 2023) is a consistent downward trajectory in key operating metrics.

Karnataka’s Bank performance in the past 7 quarters reveals a decline in net interest income, operating profit, net profit, net interest margin (NIM), ROE and ROA. In 1QFY2025, the bank received a one-time significant amount of interest on income tax refund, which propped up the numbers for that quarter. What is unusual in the bank’s performance is that the figure of gross loans has continued to rise, while the NIM and net interest income have declined. It is evident that the bank’s growth in loans is having an adverse impact on its profits and profitability.

Karnataka Bank’s Quarterly Key Financial Performance

A possible explanation for this is that the growth in loans is an optical illusion, as they are growing only at the quarter end, while the average weekly loan (not disclosed) growth may be stagnant. Added to this dismal performance, the bank’s operating cost is steadily rising as it attempts to build a digital platform for retail loans, putting further pressure on profits. The only consolation is growth in ‘other income’ on account of third party selling and declining credit costs. The bank had an asset quality issue which had been adequately provided for in the period prior to the entry of the current executive leadership, and the bank is currently benefitting from the recoveries and upgrades of the erstwhile bad loans.

Defending its financial performance, Karnataka Bank stated the following to this analyst,

“The Bank is undergoing major transformative steps that require capital and investments. During the transformation process, there will be an interim impact on many financial metrics, some of which have steadily improved as of March 31, 2025. This has been communicated in the Q4 FY25 earnings call post publishing results.”

The problem is that there is no definite time line provided by the bank for when the financial metrics would turn around. Moreover, the tenures of the CEO and the ED are for 3 years from their date of appointment (2023), and even by the end of their second year the deterioration has continued. The likelihood of the bank’s performance improving in their final year appears bleak.

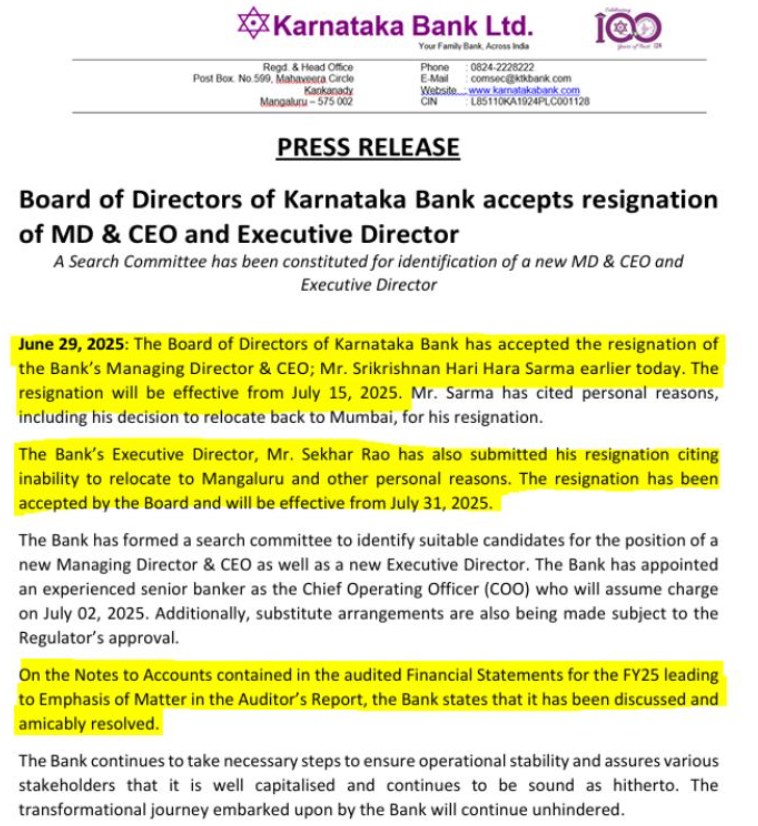

Karnataka Bank’s experiment in getting its top executive leadership from outside the bank has proved to be less than stellar. Profits and profitability have been steadily declining, but worse, corporate governance at the highest executive level has reached its nadir. The bank’s CEO and ED are exceeding their delegated authority in brazen defiance of the board of directors. It is unprecedented not only in Karnataka Bank’s own history, but in banking, that the executive leadership openly defies the board of directors, and that the latter refuses to approve and ratify certain expenditure undertaken by the executive and demands that the CEO and ED reimburse the bank for these unauthorised expenses. No institution can allow executives to continue when such information is in the public domain, as it will send a signal to the entire staff of the bank and the wider public that exceeding one’s powers and defying higher authority will be tolerated and condoned. Once the auditor highlights such malpractices, no institution, least of all a bank, can tolerate the continuance in office of such executives. The auditors’ comment has sealed the fate of Karnataka Bank’s whole-time directors. There is no place for the Karnataka Bank CEO and ED in any boardroom, as they have no respect for their higher authority, and have lost the confidence of the board of directors.

Note: On June 29, 2025, Karnataka Bank informed the stock exchanges of the simultaneous resignations of the CEO and the Executive Director.

This article was also published in The Wire and can be read here and was “The Most Read” article on The Wire post its publication.

_________________________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). BSE Enlistment No. 5036. Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

www.hemindrahazari.com