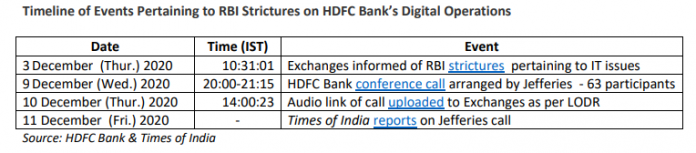

EXECUTIVE SUMMARY. It was unfortunate that HDFC Bank decided to provide selective disclosure at a conference call hosted by Jefferies. Only 63 institutional investors participated on the evening of December 9, 2020, where the bank publicly disclosed what went wrong at its recent digital outages. More importantly, in the opinion of this analyst, it provided market sensitive information in the form of the time span it would take to rectify some of the information technology issues raised by the Reserve Bank of India (RBI). The bank disclosed the conference audio link to the exchanges nearly 16 hours later (at the latter half of the trading day). Such sensitive information should have been disclosed via a specially arranged press conference followed by an analyst conference, instead of providing such information to an exclusive audience of 63 institutional investors. Pertinently, HDFC Bank’s share price on December 10 closed 1.5% lower than the previous day, as compared with a 0.4% fall in the Nifty-50. This analyst understands that in future the Bank will disburse such information through a wider dissemination rather than such selective disclosure.

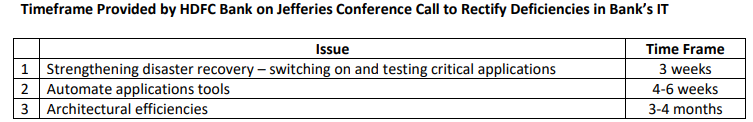

At the conference call, the Bank acknowledged that its critical disaster recovery system required manual intervention to be activated, and that it would take 3 weeks for the automation to be implemented. This is a very important disclosure as this was not communicated to customers in its ‘Forget Cash…Go Digital’ publicity campaign or in its ‘Digital 2.0’ strategy to stakeholders. It is disappointing that even though the RBI released guidelines for Business Continuity Planning (BCP) in April 2011, more than 9 years later, India’s most valuable bank, which markets its digital prowess, has been found to being so exposed and vulnerable at its backbone of banking operations.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own HDFC Bank equity shares. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.