Hemindra Hazari

Equity research analysts produce impressive reports, operate complex statistical models, and can talk confidently about the future on the business channels. But the past year has not been kind to the fundamental predictions of most analysts.

In particular, there is a strong inbuilt bias of analysts to remain bullish. That is not to say that all analysts say the same thing. Rather, an analyst’s unique selling proposition (USP) depends on being ‘contrarian’ in some respect, so you must differ in the details. But there is a strong herding tendency, generally bullish. But one rule applies even to bearish analysts: If they are pessimistic about the market, they must nevertheless recommend some stock or the other. If ‘cyclicals’ are risky, move into ‘defensives’, goes the theory. This would make sense if the stock market were a zero sum game, and a fall in the price of one stock would be matched by the rise in that of another. But in fact people can withdraw from stocks into other assets, most easily bank deposits. In fact, even the whole economy isn’t a zero-sum game, which is why we have booms and recessions.

The most taboo word among analysts is ‘bubble’ – the idea that the rise of the whole market is powered not by fundamentals, but by some financial mania. Therefore, when the fundamentals are grim, and do not offer much basis to make rosy predictions, the trick is to locate some ‘green shoots’ – some advance signals that can be cited to say the cycle is now turning upward.

With the International Monetary Fund (IMF) downgrading global economic growth to 3.3 per cent for 2015 (the worst year since 2009), China’s economy slowing rapidly and its stock market in a meltdown mode, and Greece remaining a festering sore, there is a good chance global capital flows, the critical driver of markets, may flow back to their traditional safe haven of U.S. government bonds. The Indian stock market, though, appears resilient to all these turbulences. The 30-stock Sensex has remained flat for the calendar year 2015, but is up a robust 24 per cent from 31 March 2014 and a remarkable 47 per cent since 31 March 2013.

India’s recent stock market rally really took off from early February 2014 (Sensex 20,334) in anticipation of a Narendra Modi-led government coming to power. It was thought there would be decisive decision-making, economic reforms and corruption-free governance reviving private sector capital expenditure in the economy. As stock markets discount future corporate profits (simplistically, if profits increase/fall by 10 per cent, the stock price should increase/fall by 10 per cent), pundits justified the stock rally by arguing there would be a surge in corporate profits from September 2014 onwards.

The new government, enjoying an absolute majority in the lower house, announced major economic reforms such as the liberalisation of insurance, opening of the defense sector for private sector investment, drastic slashing of welfare expenditure and subsidies and a land bill favouring corporate India at the cost of the rural peasantry. The ministry of Environment began behaving like the Industry and Commerce ministry in rapidly clearing environmental clearances. The Sensex continued its surge to close at an all-time high of 29,006 on 22 January 2015.

Stock market euphoria

While the Indian stock market was displaying euphoria, on the ground, economic conditions were not any better. Instead, corporate profits were alarmingly deteriorating. The Economic Survey 2014-2015 found the surge in share prices (since January 2011) mystifying, as it coexisted with, “rising stalling rates of big projects, weak balance sheets, declining new investments in the private sector, and toxic assets on banks’ balance sheets.”

The Survey’s analysis of equity values of companies with stalled projects found that the “market is not penalising severely for the debt pile-up in the wake of investments turning sour”, as the market may be factoring a bail-out for these companies. Research analysts had expected the 3QY2015 (Third quarter of Financial Year 2015) and 4QFY2015 corporate profits to bounce back, but exactly the reverse transpired. The last quarter was the worst quarter in 14 years, and according to data collated by Kotak Institutional Equities; Sensex profits declined 10.9 per cent, even worse than the 10.6 per cent decline reported in March 2009, at the peak of the global financial crisis. At the beginning of FY2015, analysts were expecting the Sensex companies to report a 15-17 per cent net profit growth, instead the Sensex companies ended FY2015 with a net profit decline of 12.2 per cent, and excluding the non-cash losses at Vedanta and Tata Steel, with a marginal profit growth of 0.3 per cent.

In retrospect we can now see that the rise in the stock market since February 2014 was unwarranted. The surge in the market since then could perhaps be justified by the expectation that, from FY2016, market earnings were going to increase significantly. But a more plausible explanation is that liquidity – funds flowing into Indian markets – was driving up valuations.

With such a severe earning shortfall compared to expectations in FY2015, one would logically have expected modest expectations for FY2016, as the economic situation has remained the same: a weak 1Q FY2016 performance, with Sensex companies’ earnings expected to decline by 3-4 per cent or remain flat. Instead, the same parody is being played out again, with the consensus among analysts being that Sensex profits will increase by 15-16 per cent with a strong recovery from September 2015.

Analysts are expecting a revival driven by further economic reforms by the government, a reduction in interest rates as inflation remains low, an expansion in profit margins as global commodity prices are falling, and an increase in government’s expenditure on infrastructure such as roads and railways, which will crowd-in private sector capital expenditure. To support their optimistic stance on the market, analysts focus on ‘green shoots’, the so-called leading indicators.

Among the examples they give are the increase in medium and heavy commercial vehicle (MHCV) and passenger car sales, the rise in capital goods imports and the capital goods production in the index of industrial production (IIP). These positive indicators, it is believed, will drive the long-awaited capital expenditure cycle and push India’s economic growth rate and corporate profits.

Poor aggregate demand

The Indian economy has been on a path of economic reforms for many years, and in certain periods reforms have accelerated or decelerated, but the basic agenda of reform has remained. Since FY2012, industrial activity has been suffering, with the annual IIP unable to increase from the 3.1 per cent recorded in FY2012 and with a low of a negative 0.1 per cent in FY2014. In analyzing the near stagnant industrial performance most stock market experts have focused on inflation and interest rates, reforms and decisive government decision-making. Negligible attention has been given to aggregate demand.

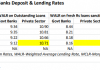

The decline in the wholesale price index (WPI), low IIP growth, the poor capacity utilization of critical industries like cement and steel, the depressed real estate market (particularly the huge unsold inventories in major cities), the poor asset quality of Indian banks, the low bank credit growth and the marginal sales growth in corporate India are classic signs of a paucity of demand. To stimulate the Indian economy either the government has to significantly increase its expenditure, which will result in a higher fiscal deficit, or global economic growth has to increase.

Nowadays, financial markets do not allow governments to increase fiscal deficit, in the mistaken belief that it results in crowding-out private sector investment and increases inflation. The markets penalise countries with higher fiscal deficits through capital outflows. Global economic growth remains anemic in the post-Lehman period, and the recent IMF downgrade of US and global economic growth further worsens the situation. In the absence of higher government expenditure and global economic growth, more economic reforms, lower interest rates and faster government approvals are unlikely to stimulate private sector capital expenditure (capex) to revive the Indian economy and corporate India.

As for the ‘green shoots’, are they leading indicators of a general corporate revival or merely standalone upticks in individual segments? It’s difficult to say. In FY2015 the MHCV sector recorded a growth of 16 per cent to 232,000 vehicles, but that is considerably below the 348,000 vehicles achieved in FY2012. That indicates the low base from which the numbers are recovering, and the revival could be on account of replacement demand and perhaps the rise in shipping logistics of e-commerce.

Another so-called ‘green shoot’ is the capital goods sector. The capital goods index in the IIP rose by 6.3 per cent in FY2015 as compared with the IIP growth of 2.8 per cent and in April-May 2015 it increased by 4.4 per cent as against the IIP of 3 per cent. The rise in capital goods is puzzling. While some sectors which have seen clearances, such as mining, may account for some revival, it is well known that most sectors have sizeable excess capacity. So one ought to see a rise in the general IIP before a rise in capital goods growth, if the latter is to be durable.

Finally, certain segments such as roads construction may report an uptick on account of some higher front-loaded government expenditure, but concluding that these are the much-awaited green shoots of economic revival is premature, given the overall restraint on government expenditure.

The analyst community interprets the slowdown in the Chinese economy, India’s largest trading partner, as a positive for India. Most analysts argue that capital flows may come to India and not to China, and that a further collapse in commodity prices would be positive for India. But the China slowdown is itself a reflection of lower global growth, which also affects India. Cheap Chinese goods may further flood the Indian market (e.g. steel), and India’s exports may also suffer further, impacting Indian companies’ sales.

With the situation in Greece still uncertain, notwithstanding reports of a deal, with a steep fall in the Chinese stock market, global economic growth a major concern, and the possibility of an interest rate hike in the US, capital flows to India cannot be taken for granted. Hence the expectation of lower interest rates driving corporate investment may not materialise to the extent expected by the market. The Reserve Bank of India may have to focus on stalling capital outflows, with the possibility of even rate hikes, despite real interest rates being high in India.

Analysts are also enthused by the government’s decision to increase infrastructure spending in FY2016. While this is positive news for companies engaged in these segments (especially roads), the government has simultaneously being cutting expenditure on welfare schemes.

The Union Budget 2015-2016 reveals plan capital expenditure to increase from 0.8 per cent of GDP in FY2015 (Revised Estimates) to 1 per cent of GDP in FY2016 (Budget Estimates) while plan revenue expenditure is expected to decline from 2.9 per cent to 2.3 per cent of GDP. As a result, total central government expenditure to GDP is expected to fall sharply from 13.3 per cent of GDP to 12.6 per cent of GDP in FY2016BE.

In this way it plans to achieve a fiscal deficit of 3.9 per cent of GDP as compared with 4.1 per cent in FY2015RE, and reassure global finance. In effect what the central government is adding to aggregate demand with one hand, it is taking away, and more, with the other hand. Hence the stimulus from central governmental expenditure in FY2016 will be less than what it was in FY2015. Even so the market is expecting corporate performance to be significantly better than in FY2015. It should be recalled that the 25-30 per cent collapse in Greece’s GDP and the huge Greek unemployment are a direct fall-out of the Geek government undertaking steep expenditure cuts.

Who knows? Perhaps the optimistic consensus among stock market analysts will turn out to be right. But if the performance of corporate earnings falls short of estimates in FY2016, the analyst community will renew its efforts at discovering green shoots for FY2017.

Hemindra Hazari is a research analyst.