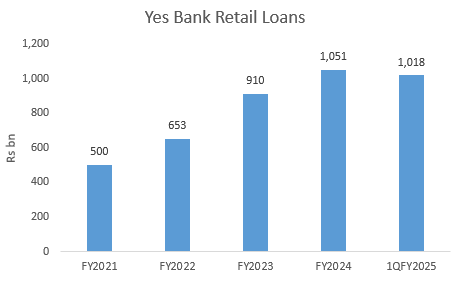

Yes Bank’s 1QFY2025 results which revealed the fall in outstanding retail loans as compared with March 31, 2024 and the sacking of at least 500 staff, with more forced exits expected in the near future (as reported by The Economic Times, dated June 25, 2024), is an admission that the bank’s ‘born again’ retail strategy is on life support. Signs that the bank’s retail engine was misfiring were evident in the segmental results since FY2022. But it appears the management, the board of directors and the analysts covering the bank were more focused on the bad debt recovery from the legacy corporate loans portfolio, and failed to notice the serious issues in retail.

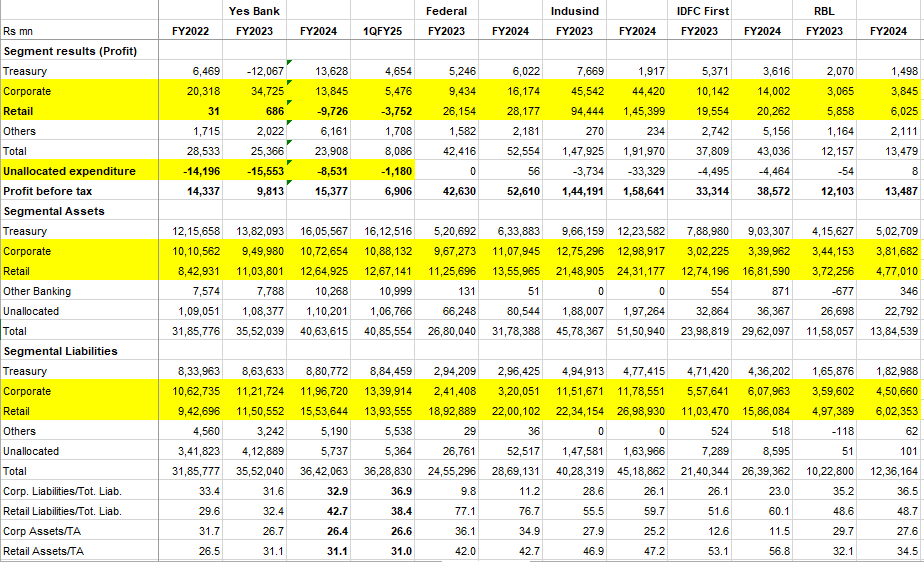

Segmental Results of Peer Banks

Ironically, since FY2022, the bank’s corporate division had been subsidising and masking the poor performance of the retail division. Stakeholders were complacent in the belief that, in the initial stages of re-building a retail franchise, operating costs were secondary, as long as retail loans were briskly growing. The high unallocated expenditure, which, in the opinion of this analyst, was linked to retail, resulted in inflated retail profits in FY2022 and FY2023, and understated losses in FY2024 and 1QFY2025. It is surprising that even a much smaller peer bank, like RBL Bank which had retail assets of only 38% of Yes Bank in FY2024, reported segmental retail profits of Rs 6 bn with nil unallocated expenditure.

Scant attention was paid to the unprofitable nature of Yes Bank’s growth in retail, which was due to the high cost of acquisition of such low margin assets. The problem in retail finally surfaced when the bank reported its 4QFY2024 results on April 27, 2024. It revealed full year losses of Rs 9.7 bn in its retail division (with unallocated expenditure at Rs 8.5 bn). Subsequently, on May 5, 2024, the Yes Bank CEO said that the bank plans to reduce its retail loan growth, thereby bringing down the curtains on the bank’s unprofitable retail assets strategy. In 1QFY2025, retail continued to bleed with losses of Rs 3.75 bn and unallocated expenses of Rs 1.2 bn.

A deeper analysis is necessary to understand how its retail strategy unravelled. After the moratorium in March 2020, the restructured board decided to focus on liquidity, by getting institutional depositors to park their funds in the bank. On the assets side, the bank emphasised low-yielding, presumably higher quality, loans to mitigate the effects of the earlier strategy of the erstwhile founder-CEO, which emphasised high-risk, high-yielding corporate loans. This was also a time when there was poor demand for corporate loans in the banking industry, as the private corporate sector was not investing in capacity. As deposits flowed into banks, retail loans became the parking space for the funds of the banking industry.

NIM, Cost and Yield on Loans in 4QFY2024

| % | NIM | Cost of Funds | Yld. On Loans | Yld. On Retail |

| Yes | 2.4 | 6.4 | 10.3 | NA |

| Federal | 3.2 | 6.0 | 9.5 | NA |

| Indusind | 4.3 | 5.6 | 12.7 | 15.5 |

| RBL | 5.5 | 6.5 | 14.1 | 17.3 |

NA – Not Available. Source: Banks

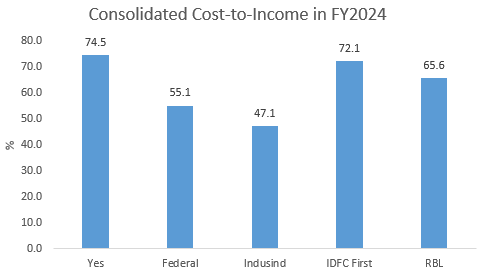

The problem for Yes Bank was its cost of funds, which was higher than in most peer banks, as it needed to offer higher rates to attract institutional deposits. The bank also had a low yield on its corporate loans, as much of its legacy portfolio was contaminated. The bank decided to grow corporate loans conservatively (low yield and high quality), and hence the margins were low. Apparently, a similar strategy of low-yielding retail loans was also approved, in order to be risk averse. Hence the average yield on its loans was lower than most of its peer banks. Unfortunately, the bank also had high operating costs, and it appears that such a strategy continued in retail, with less attention being paid to the retail segment’s high operating costs.

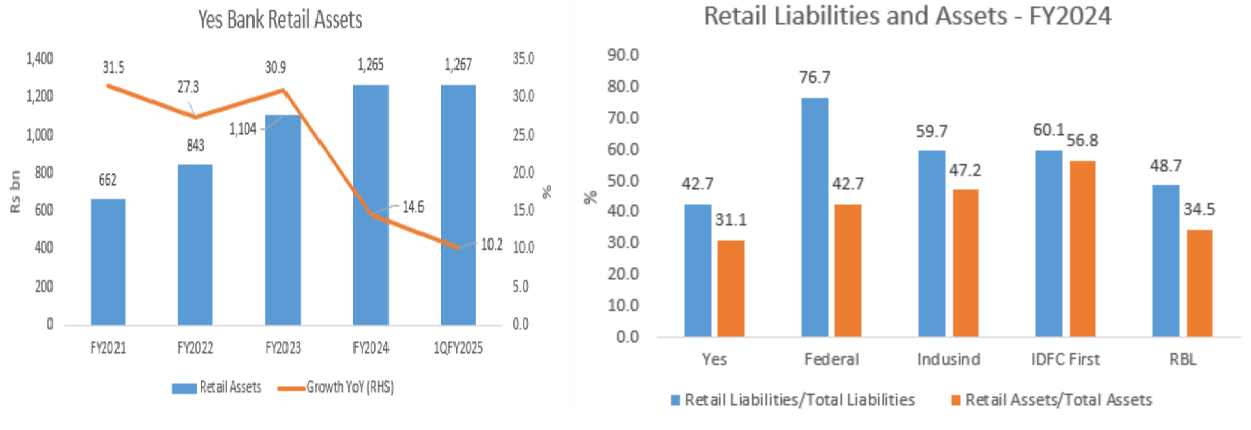

Yes Bank rapidly grew retail assets from FY2021 till FY2023, averaging nearly 30% per annum in this period, as it planned to shift its focus, from being a corporate bank to becoming a retail bank. The bank slowed its growth in FY2024 to 14.6% per annum and 10.2% per annum in 1QFY2025 as it decided to review its retail asset strategy. Retail assets to total assets increased from 26.5% in FY2022 to 31.1% in FY2024 and surpassed corporate assets. While Yes Bank grew retail assets, retail liabilities were more difficult to grow as compared with peer banks. After the moratorium, retail customers probably had some concerns about parking their financial savings with Yes Bank.

Yes Bank Retail

Source: Banks

The rapid growth (FY2021-FY2023) in retail assets has led to the bank ignoring priority sector lending commitments. It is basic banking that a bank’s growth strategy has to budget for meeting priority sector targets, which the banking regulator monitors. Failure to meet priority sector lending targets entails the bank having to invest the shortfall in low yielding priority sector lending certificates (PSLC) as a penalty. It is poor profitability planning when a bank has to keep investing in PSLC. In the FY2024 results call, Yes Bank stated that its Rural Infrastructure Development Fund (RIDF) placed for its PSL shortfall peaked at 11% of total assets, as compared with 9% in FY2023, and reassured shareholders that there will be no incremental investments in PSLC from FY2025. The question is why the management and the board of directors permitted such a situation to arise when it was rapidly increasing retail assets; normally in banks, the responsibility for PSL is with the retail bank. The failure to prioritise PSL has led to an increase in the bank’s operating expenses and a drag on its profitability.

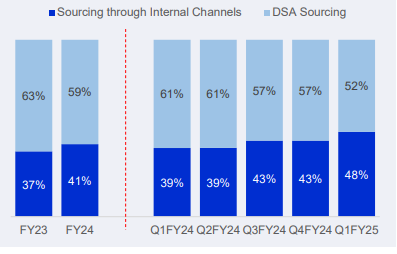

A key component of the bank’s retail asset foray was its dependence on Direct Sales Agents (DSAs). In FY2022, DSAs accounted for 65% of loans, which came down to 52% in 1QFY2025. The dependence on DSAs results in substantial commissions to these agents, and more importantly, it requires the bank to exercise due diligence on the quality of the retail loans sourced by this outsourcing channel.

Yes Bank Sourcing Retail Loans through Internal Channels Vs DSA Sourcing

Source: Yes Bank

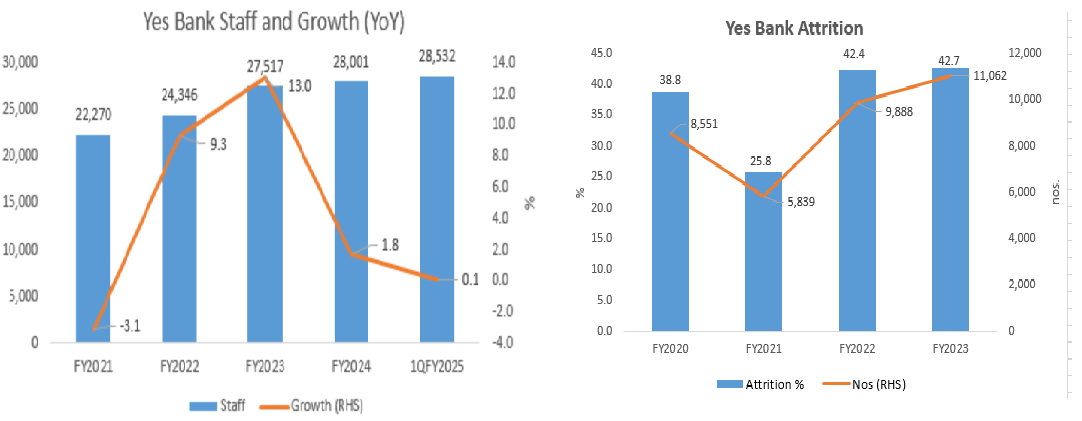

Even as Yes Bank raised the majority of its retail assets from DSAs, it continued to raise headcount in its retail operations. From FY2021 till 1QFY2025, the bank added 6,262 staff. Even though staff increased in 1QFY25 as compared with 4QFY24, there is a sharp slowdown in the addition of staff which indicates the bank is reviewing its staff requirements. In addition, the bank had high attrition rates which peaked at 42.7% in FY2023, especially for lower level staff (56% attrition in the age bucket of < 30 years in FY2023). The addition of staff plus the high attrition contributed to bloated staff costs, as attrition and rehiring increases training and hiring costs.

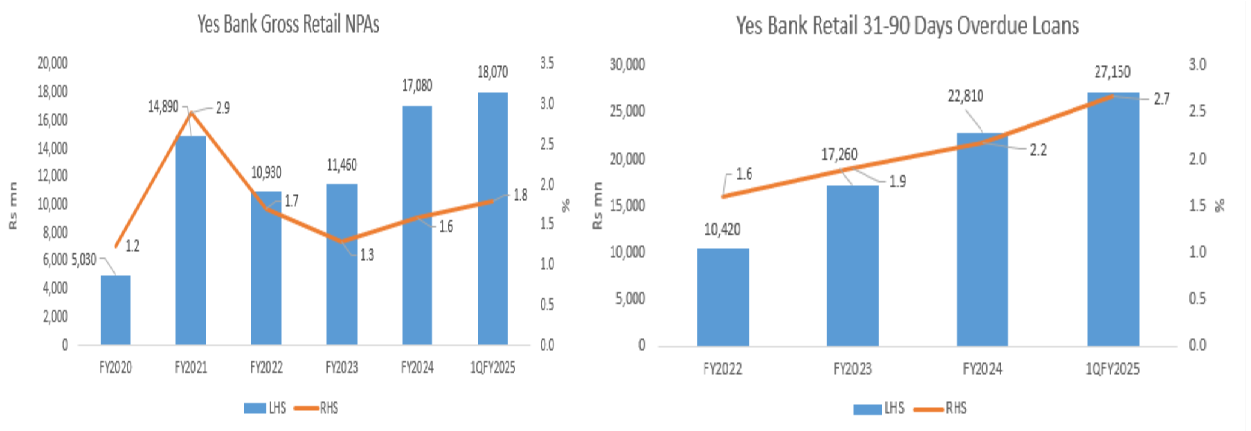

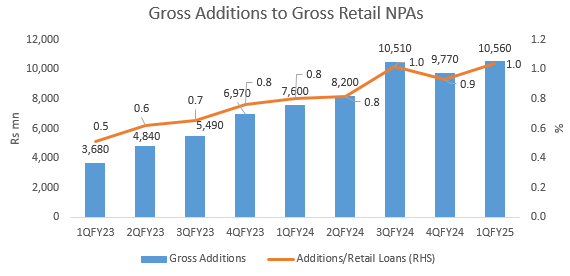

Since the average yield on the bank’s loans was 10.3% in 4QFY2024, as compared with Indusind Bank’s 12.7% and RBL Bank’s 14.1%, one can assume that Yes Bank’s average yield on its retail loans was also lower than that of its peers, as it supposedly focused on high quality, low yield retail loans. However, the growth in its retail gross non-performing assets and 31-90 days overdue retail assets in absolute amounts, indicates that its retail assets are not of the quality expected from its lower yield on them.

After the moratorium, and post a bailout by banks (led by the State Bank of India), Yes Bank determined that its path to restoring liquidity and profitability lay in a retail asset growth strategy. It is apparent that the retail foray was ill-conceived and poorly executed, with little control over costs. The dependence on DSAs and increasing staff led to overstaffing and higher costs, and also may have resulted in acquiring low yielding, poor quality retail loans. It is clear that the board of directors and the executive management allowed this strategy to continue with poor financial controls and a lack of accountability.

Outstanding Retail/Consumer Loans

| Rs bn | 4FY2024 | 1QFY2025 | QoQ (%) |

| Yes Bank | 1,051 | 1,018 | -3.2 |

| RBL Bank | 491 | 537 | 9.3 |

| HDFC Bank | 12,627 | 12,818 | 1.5 |

| Kotak Mahindra Bank | 1,773 | 1,834 | 3.5 |

Source: Banks

In its 1QFY2025 results call, Yes Bank stated that it has course corrected in retail and turned more cautious on unsecured retail loans and it is recalibrating the retail loan mix towards quality and more profitable growth. The bank is also looking at new business from large companies, small and medium enterprises and mid-companies.

Thus Yes Bank has finally acknowledged the failure of its strategy of rapidly growing low-yielding retail loans, which have also turned out to be of poor quality. That the bank has had to sack staff and reassess its strategy 4 years after its bailout reflects poorly on the board of directors and the senior executive management. Yes Bank’s low net interest margin and high operating cost provides a limited cushion to absorb any financial misadventures. Moreover, its dependence on corporate deposits renders the bank highly vulnerable to outflows as these deposits are interest rate sensitive and react instantly to negative developments. Public funds from SBI and other banks were utilised to bail-out the bank, and the board was restructured to represent the new shareholders. Given Yes Bank’s history, it is unfortunate that the revived bank continues to be dogged by mismanagement, and is unable to implement a profitable retail strategy.

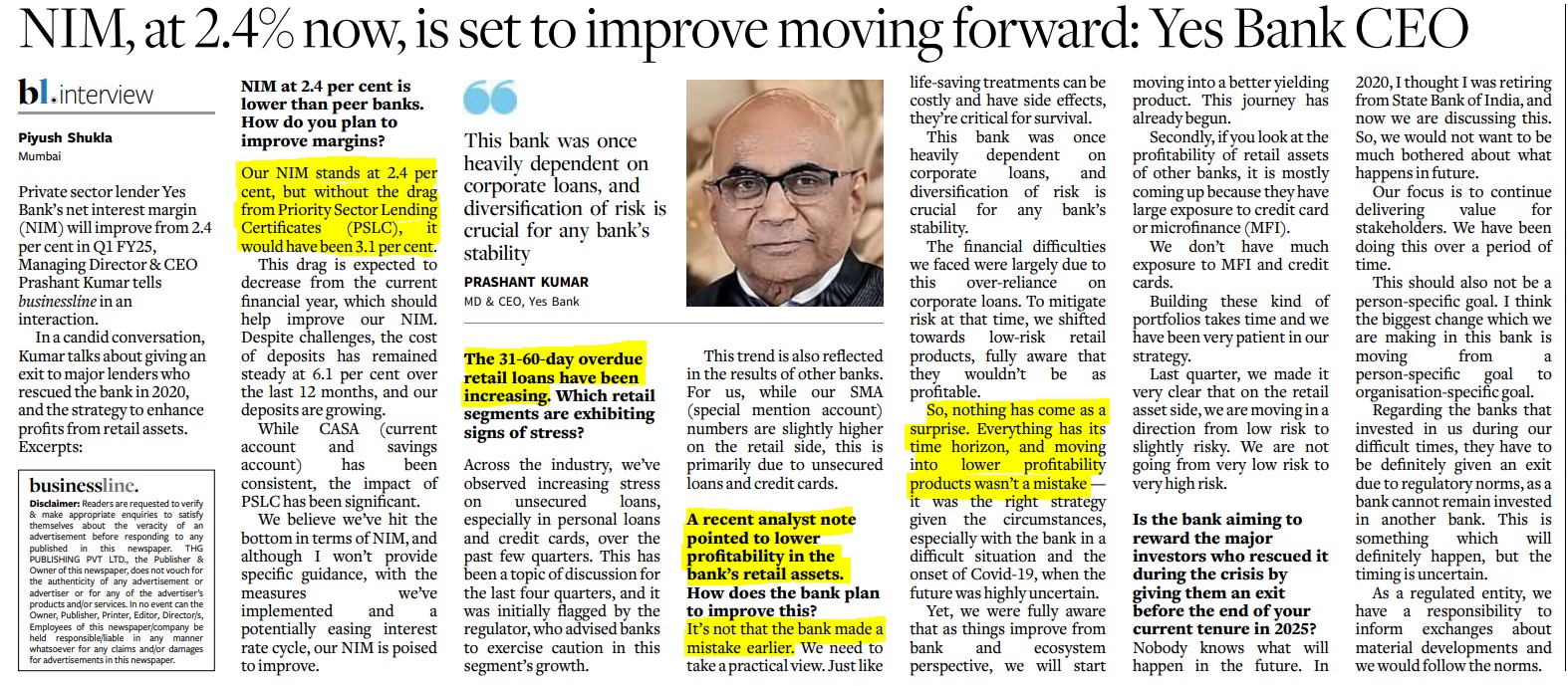

Interview of Yes Bank CEO to Business Line 4th September 2024

________________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own equity shares in all the banks mentioned in this note. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: