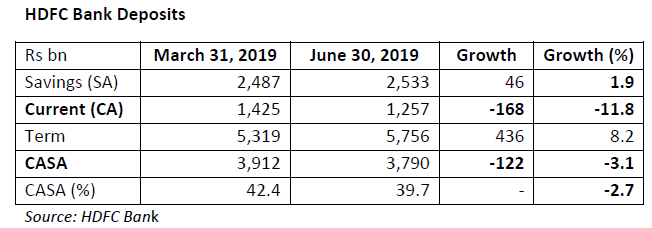

EXECUTIVE SUMMARY. HDFC Bank’s low-cost liabilities strategy of focusing on huge numbers of new client acquisitions in the semi-urban and rural centres may be getting large numbers of new customers, but is not resulting in significant growth in current and savings account deposits (CASA). The pressure on CASA appears to be an industry-wide problem, on account of falling interest rates and the squeeze on corporate liquidity due to the economic slowdown. HDFC Bank believes that growth in customer acquisition can alleviate its situation in the present economic environment. While its strategy may assist the bank in defying the tide, the fact remains that the new CASA liabilities will not be as lucrative as in the past.

Recent Posts

Most Popular

Not a Private Matter: Did Axis Bank Share Price Sensitive Information to a Select...

An ordinary meeting of Axis Bank on December 15, 2025 with institutional investors had an extraordinary outcome, one which may need to be probed...

Does the IndusInd Board Run the Bank? Or Is There a Centre of Power...

Ashok Hinduja, chairman, IndusInd International Holding, told the press recently:

"Could you have as a promoter taken steps to avert the crisis at IndusInd Bank?

Money...

Cobrapost Expose on Cholamandalam & Murugappa Group | Cobrapost Press Conference Live Lootwallahas 2

https://www.youtube.com/live/JjL1S77TQXA

Venue: Press Club of India, New Delhi.

My commentary starts from 30:00 mins.

A Tale of Two Banks

Take two old private banks, of similar backgrounds. One embarks on an ambitious, disruptive strategy of nationwide expansion; the other remains stuck to its...

India’s big bank moment has arrived. Why it matters

“Somehow, they feel size is everything. It is true that if the net worth gets bigger, they would be able to give larger corporate...