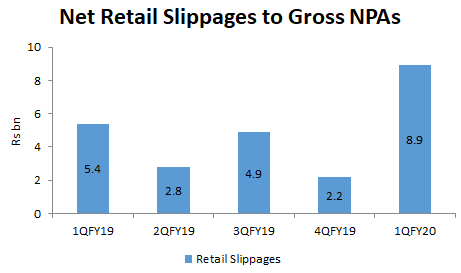

EXECUTIVE SUMMARY. The market has not been kind to Axis Bank after its 1QFY2020 results. The share price has fallen 7%, as compared with a fall in the NIFTY of only 2%. While analysts have raised concerns on the elevated credit costs and high slippages to gross non-performing assets, the major issue remains whether the surge in share price that welcomed the arrival of Amitabh Chaudhry, the new CEO, was premature, and whether the entry of erstwhile HDFC Bank executives in Axis Bank would take time to address the underlying legacy concerns on asset quality. The continuing sharp growth in retail loans, especially in unsecured personal loans and automobile loans, could also add to concerns as the economic slowdown deepens.

Recent Posts

Most Popular

Is Yes Bank Providing Custodial Services to RInfra for Its Valuable Property?

A high-profile bank collapses on account of high-risk, bulky non-performing corporate loans. With the intervention of the Reserve Bank of India (RBI), the errant...

Karnataka Bank board showed who’s the boss

As Hemindra Hazari, a Sebi-registered independent research analyst, has pointed out in his report, “Bank boards have clear-cut policies on the approval powers of all...

Economist – Prof R Ramakumar’s Speech at Tarakeswar Chakraborti Memorial Lecture – 1

https://www.youtube.com/watch?v=l72vK9c1RFg

Hemindra Hazari Speech at Tarakeswar Chakraborti Memorial Lecture – 2

https://www.youtube.com/watch?v=eXiLiqh6tuo

Memorial Lecture Held on June 14, 2025, at the Walchand Hirachand Hall, Indian Merchants Chamber, Churchgate, Mumbai

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and...

Official Trailer | The Great Indian Illusion | a Film By Varrun Sukhraj ।...

https://www.youtube.com/watch?v=nuJUMCz7yI8