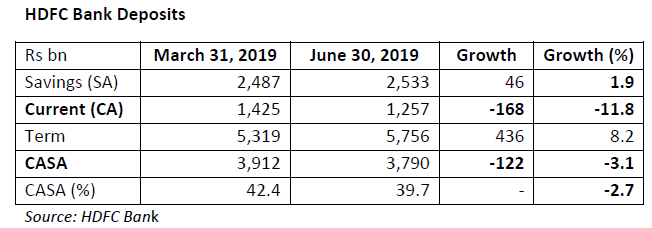

EXECUTIVE SUMMARY. HDFC Bank’s low-cost liabilities strategy of focusing on huge numbers of new client acquisitions in the semi-urban and rural centres may be getting large numbers of new customers, but is not resulting in significant growth in current and savings account deposits (CASA). The pressure on CASA appears to be an industry-wide problem, on account of falling interest rates and the squeeze on corporate liquidity due to the economic slowdown. HDFC Bank believes that growth in customer acquisition can alleviate its situation in the present economic environment. While its strategy may assist the bank in defying the tide, the fact remains that the new CASA liabilities will not be as lucrative as in the past.

Recent Posts

Most Popular

Is Yes Bank Providing Custodial Services to RInfra for Its Valuable Property?

A high-profile bank collapses on account of high-risk, bulky non-performing corporate loans. With the intervention of the Reserve Bank of India (RBI), the errant...

Karnataka Bank board showed who’s the boss

As Hemindra Hazari, a Sebi-registered independent research analyst, has pointed out in his report, “Bank boards have clear-cut policies on the approval powers of all...

Economist – Prof R Ramakumar’s Speech at Tarakeswar Chakraborti Memorial Lecture – 1

https://www.youtube.com/watch?v=l72vK9c1RFg

Hemindra Hazari Speech at Tarakeswar Chakraborti Memorial Lecture – 2

https://www.youtube.com/watch?v=eXiLiqh6tuo

Memorial Lecture Held on June 14, 2025, at the Walchand Hirachand Hall, Indian Merchants Chamber, Churchgate, Mumbai

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and...

Official Trailer | The Great Indian Illusion | a Film By Varrun Sukhraj ।...

https://www.youtube.com/watch?v=nuJUMCz7yI8