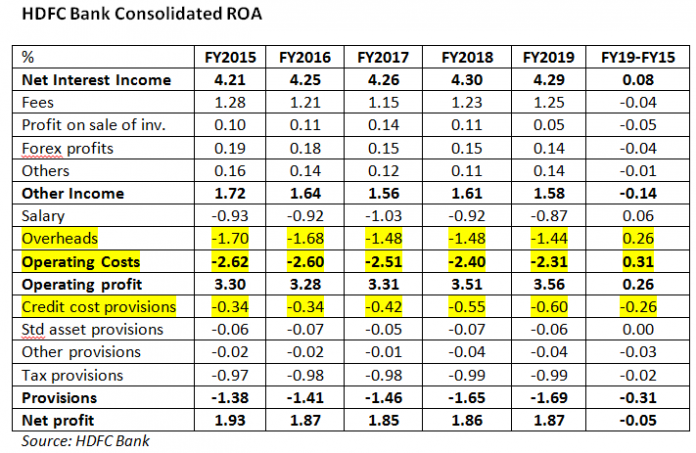

EXECUTIVE SUMMARY. On the eve of HDFC Bank’s 2QFY2020 results (October 19, 2019), an analysis of its profitability for the last 5 years reveals that, while its ROA marginally declined as credit costs increased, it was the leveraging of operating costs which compensated to maintain the bank’s excellent profitability. It appears that the bank has been able to successfully generate higher business through re-engineering its processes, and its digital strategy has contributed to this achievement. The bank has been able to sweat its labour force and existing infrastructure to achieve higher business. The critical issue remains whether the bank can continue with this strategy of leveraging its operating cost in the future. In the current faltering economy, the bank is unlikely to increase its net interest margin and its fees to compensate for the expected higher credit costs and if it is unable to continue with its earlier strategy, shareholders should expect a decline in its profitability.

Recent Posts

Most Popular

IndusInd Bank Board Protects Senior Executives Responsible for Fraud

One of the most shocking episodes in the history of Indian banking was revealed by The Wire.in in a recent exclusive: namely, that the...

Tata’s Outside CEO Battles Multiple Crisis After Bad Year

“For the future growth of the Tata group, Chandra has to find new businesses which can replace TCS’s cash generation which at this time...

Not a Private Matter: Did Axis Bank Share Price Sensitive Information to a Select...

An ordinary meeting of Axis Bank on December 15, 2025 with institutional investors had an extraordinary outcome, one which may need to be probed...

Does the IndusInd Board Run the Bank? Or Is There a Centre of Power...

Ashok Hinduja, chairman, IndusInd International Holding, told the press recently:

"Could you have as a promoter taken steps to avert the crisis at IndusInd Bank?

Money...

Cobrapost Expose on Cholamandalam & Murugappa Group | Cobrapost Press Conference Live Lootwallahas 2

https://www.youtube.com/live/JjL1S77TQXA

Venue: Press Club of India, New Delhi.

My commentary starts from 30:00 mins.