While the media was occupied with the government’s sudden move to replace the board of Infrastructure Leasing and Financial Services (IL&FS), another drama was playing out at the swanky headquarters of the firm. The Serious Frauds Investigation Office (SFIO) was primed to spring into action, even as the government moved the NCLT (National Company Law Tribunal) at Mumbai. Sources say that an SFIO team was already hanging around the landmark IL&FS building waiting for the NCLT order. As soon as it received intimation that the NCLT had ruled in the government’s favour, SFIO officials swarmed into the building and took charge of the 9th floor which houses top management. They took control of the main server, to ensure that no documents/emails or information was destroyed or tampered with. Some insiders say that the server was shut down. While details could not be clearly ascertained, some employees believe that the SFIO team was accompanied by officials form the Reserve Bank of India. One source says that the two seniormost officials who have been with IL&FS for decades were being questioned by SFIO late in the evening. They were vice-chairman and managing director (MD) Hari Sankaran and Arun Saha, the joint MD and CEO (chief executive officer).

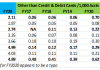

Sources say that lookout notices have been put out at airports to prevent the top brass, including Mr Sankaran, Ramesh C Bawa and K Ramchand from leaving the country. Ironically, right until Saturday, when IL&FS held its board meeting, the top management and the board behaved as though it was business as usual and had put out a statement to say that key shareholders would subscribe to a rights issue to bail the company out of its difficulties. Interestingly, while IL&FS has always presented itself as a quasi-government entity, two of its largest shareholders are ORIX Corporation of Japan, which has a 23.54% stake and Abu Dhabi Investment Authority with 12.56% stake. Strangely, these large foreign shareholders do not seem to have questioned the management about its poor performance and lavish perks. While some investors have been trying to claim that top management hid issues from them, this is clearly false. Banking analyst Hemindra Hazari has written about how the complete erosion of IL&FS’s networth has been disclosed in the consolidated balance sheet for several years. In an article in The Wire he writes: “A cursory analysis of the consolidated accounts however reveals a horrifying saga: IL&FS has been an insolvent company since at least FY’2014 (no disclosure of consolidated accounts prior to FY’2014).” However, senior management and the board not only put a lid on the mess, but also continued to sanction the lavish salaries, perks and high-spending ways of senior managers across the massive and diversified IL&FS group. Clearly, a lot of dirt is set to come out if the SFIO is allowed to investigate without interference. The modus operandi of IL&FS and how it gold-plated projects is already in the public domain. Former bureaucrats and executives who quit the group and attempted to expose the group have been hounded, humiliated and even arrested—the media was silenced by the confused narrative and false charges that the company put out. Others were too intimidated to speak. Over the past 10 days, many of these victims have begun to speak out, especially after the gold-plating of the GIFT City project was exposed by Moneylife. In the next few days Moneylife intends to reveal some of these inside stories.