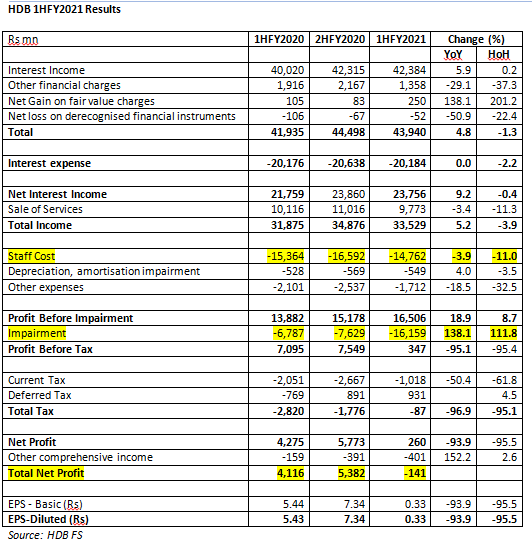

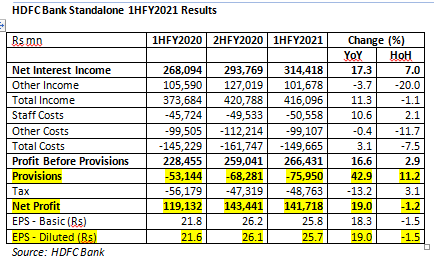

EXECUTIVE SUMMARY. HDFC Bank’s 1HFY2021 results is a study in contrasts to its non-bank finance company (NBFC) subsidiary, HDB Financial Services (HDB). While the standalone bank reported a 19% yoy growth in net profits, HDB’s profits collapsed by an alarming 94% yoy (HDB reports only half-yearly performance). The dichotomy in performance lucidly highlights the concentration of stress in both entities, with HDB customers apparently being far worse off than HDFC Bank standalone. It appears the Covid-19 lockdown has taken a heavier toll on the higher-risk portfolio of HDB, especially on its Loan against Property (LAP) and commercial vehicle loans. It is now clear why HDB in a non-transparent and inhumane manner decided to remove staff in April 2020, as the management were aware of the problem at an early stage. Pertinently, while HDB’s staff costs in 1HFY2021 declined 4% yoy, the bank’s standalone staff costs rose 10.6% yoy. On the results conference call while outgoing CEO, Aditya Puri reassured investors that the bank had not removed staff, and had even given increments and bonuses, it appears the HDB staff were treated differently in this period.

It is also unfortunate that in its results call held on October 17, none of the senior business heads at HDFC Bank, who spoke at length reassuring investors that all was well on their respective fronts, chose to mention the disastrous performance at HDB, which appears to have borne the full brunt of the Covid-19 lockdown (one analyst, though, did query the bank on HDB’s poor performance). Indeed the management commentary on the call was in direct contradiction to HDB’s financial performance. HDB’s valuation (prior to 1HFY2021 results) has estimated to have declined by around 25% from 3 months ago, to nearly US$ 9 bn. After the results, the valuation should be further impacted. HDB’s results is an early indicator of the performance of the NBFC sector during the lockdown and investors must exercise caution. Even though HDB’s loans are only around 5% of HDFC Bank’s consolidated loans, it is a relevant subsidiary in terms of valuation, and one hopes that in future under the leadership of Sashi Jagdisan, transparency and corporate governance improve in the bank.

DISCLOSURE

I, Hemindra Hazari, am a commentator on Indian banks, economy and the capital markets. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. I own HDFC Bank equity shares. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.