EXECUTIVE SUMMARY. HDFC Bank, India’s largest bank by market capitalisation appears to be the first off the block in demanding resignations from permanent staff at its non-bank finance company (NBFC) subsidiary, HDB Financial Services (HDB FS). While times are indeed difficult, stakeholders in the bank should note the manner in which the bank has conducted this covert operation.

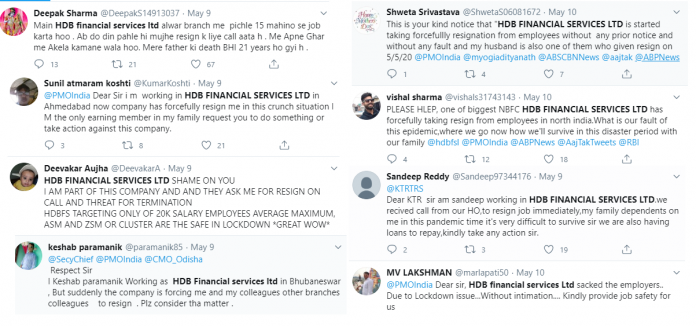

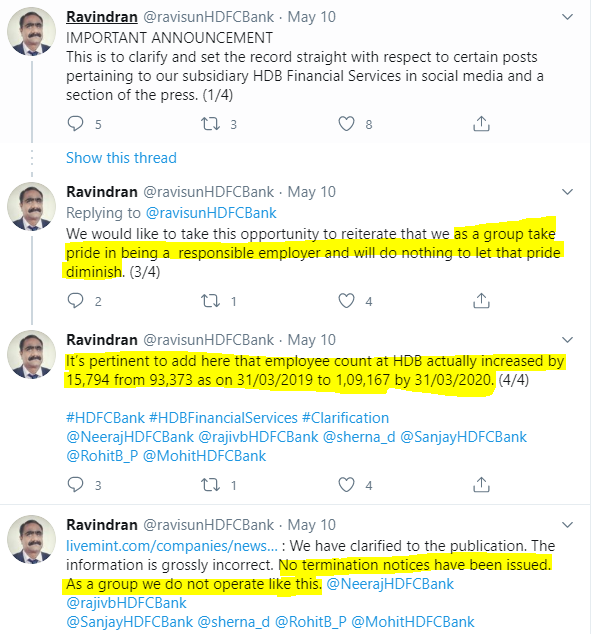

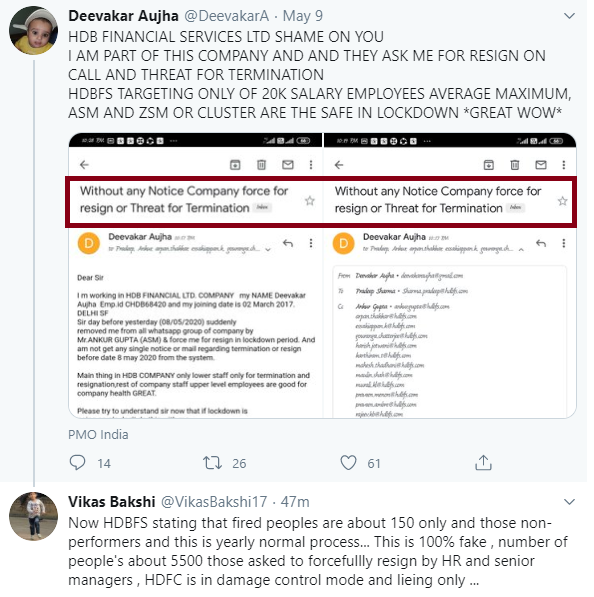

Officially, on Twitter, HDFC Bank states, “no termination notices have been issued”, while numerous HDB FS staff are countering the bank by stating that human resources personnel are calling them and demanding their resignation. The play with words by India’s largest private sector bank does not show its credibility and transparency in a favourable light.

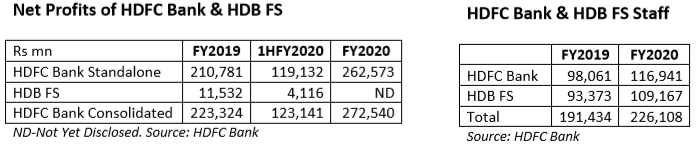

If the bank believes that in the changed environment of Covid-19 they are over-staffed, they should be upfront about it, introduce a retrenchment scheme for the identified staff and inform the public. Instead it appears the public and investors are being misled by the official spokesperson of the bank. The bank is focusing on the increase in head count in the period ending March 31, 2020, when the allegation is that the bank has taken the decision to remove staff after that date. The bank is not even prepared to acknowledge that they are downsizing.

HDFC Bank’ statement also goes on to state, “as a group we do not operate like this.” Indeed, for this highly profitable group, which donated Rs 1.5 bn to the PM Cares Fund and is the banker for the same, to push out low-level staff and not own up to it is a dark stain on the HDFC brand. Moreover, it creates doubts in the public’s mind about the state of affairs at the bank, and the credibility of its official statements.

Banking is all about trust, as the age-old adage says, “a banker’s word is his bond”. In these volatile times, HDFC Bank is in an unusual position (for it) of its share price being under pressure. In such a situation, if the bank’s official statements are seen as being misleading, stakeholders may turn extra cautious, and a public relations and labour issue may morph into a much larger issue.

As it is the stock market is apprehensive regarding other cracks in governance at HDFC Bank: the CEO succession fiasco, independent director, Sandeep Parekh’s unauthorised public statements on the bank as well as the bank’s unsecured lending. This analyst has been concerned, and has documented the major lapses by the Bank’s board of directors. Sadly the manner in which the bank is implementing downsizing only heightens these concerns.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I own shares in HDFC Bank and HDFC Standard Life Insurance referenced in this Insight. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.