3 min read. Updated: 29 Oct 2020, 09:39 AM IST Tauseef Shahidi , Nikita Kwatra

- Indian CEOs are increasingly likely to ‘resign’ rather than retire, a Mint analysis shows

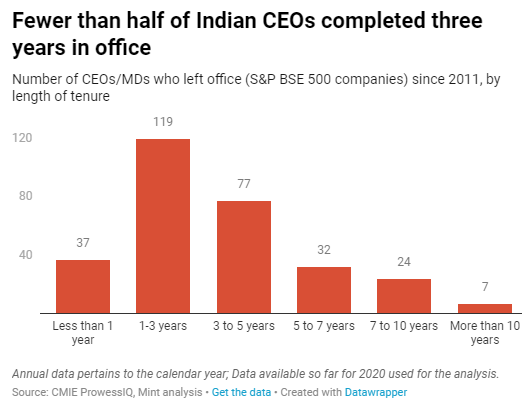

Top Indian corporate leaders last fewer years in office than politicians do. A chief executive officer or managing director of an average BSE 500 company stays in the role for 3.4 years, a Mint analysis of data from the past decade suggests. The global average for the world’s largest 2500 companies during 2004-18 was 5 years according to a PwC study, about 47% higher than the Indian average.

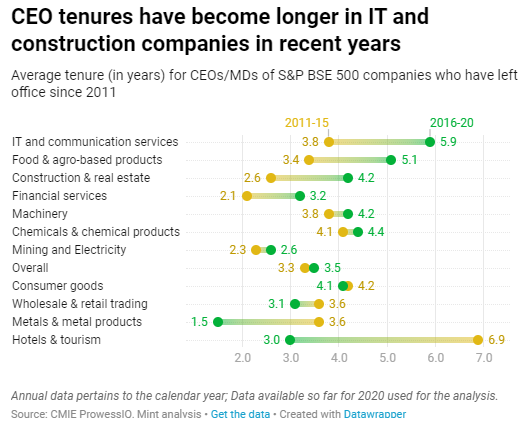

Over the past five years, the tenure of Indian CEOs have gone up slightly even though it still remains below 4 years. CEOs have longer tenures in mature markets but a tenure of around four years in an emerging market such as India isn’t unusual, said Anshul Lodha of the global recruitment firm, Michael Page.

The analysis is based on data of all companies that have been part of the S&P BSE 500 universe at least once in the past decade. The sample covers 296 CEOs and managing directors (MDs) of these firms who have left office in the 2011-20 period, and for which CMIE provides data. Chairpersons are excluded as their role could be non-executive.

Over the past few years, the average tenure of CEOs have gone up, including in some beleaguered sectors such as real estate and financial services. In construction and real estate, for instance, the average tenure length in the 2016-20 period was a little over 4 years. The average tenure in the industry was just 2.6 years in the 2011-15 period.

Real estate operations were earlier driven by specific projects, and they would shrink once a project got over, said Prashant Thakur, head of research at Anarock, a property consultant. “With policy changes such as GST and incoming foreign players, we are seeing consolidation in operations and improved corporate structures being put in place, leading to longer tenures,” he added.

But in industries such as hotels and tourism and metals, tenures have significantly shortened in recent years, the data shows. The trends are similar for median tenure length.

Only 7 chief executives in the sample lasted longer than 10 years. Data on whether the executive heads were promoters or not were available for only 14% of the companies in the sample. In this truncated sample, barely 8% CEOs and MDs were non-promoters..

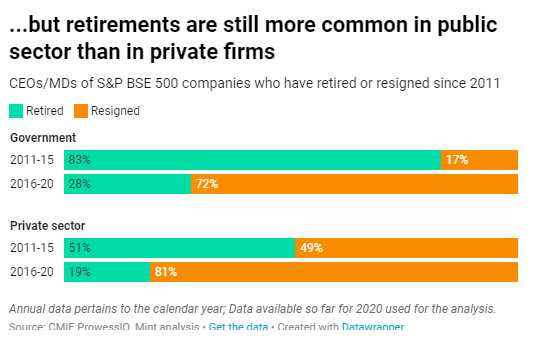

Increasingly, resignations rather than retirements are cutting short CEO tenures, particularly in the private sector. Some of these may be ‘forced resignations’ where the board asks them to put in their papers.

The past decade can be split into two eras. A majority of chief executives retired in the first half, but since 2016, nearly three-fourths have resigned from office. Retirements are more common in the public sector than in the private sector. Public sector chiefs have shorter tenures compared to private sector CEOs but that’s because they tend to get the corner office closer to their retirement age.

Resignations have become more common since 2016 in both private and public sectors. Retirements are still relatively more common in government-led companies (28%) than in private firms (19%).

There is only one woman among 10 longest-serving CEOs and MDs in the sample. Women anyway are under-represented in corner offices: our sample of 296 had only 14 women. Of these women, 43% were in financial services.

The average tenure among women CEOs was 3.4 years, the same as that of men. But this is driven by a few big names. Shikha Sharma of Axis Bank and Chanda Kochhar of ICICI Bank, who have exited their roles amid controversy in recent years, served for 9.6 and 6.5 years, respectively.

In developed markets, CEO tenures are linked to how well the company performs under them in gaining market share and delivering superior financial returns, research suggests.

In India, there isn’t any clear link between CEO tenures and stock returns.

“Often, CEO’s rewards are not linked to their company’s performance,” said Hemindra Hazari, an analyst. “This is because promoter CEOs or long-tenured CEOs tend to attain an iconic status, and exercise undue influence on the board.”

The age of iconic CEOs may however be ending, some analysts said. Companies are very aggressive in setting growth targets these days, said Lodha of Michael Page. It often causes CEOs to falter at some point, cutting short their tenures, he added.