On the one hand, Kotak Mahindra Bank (KMB) is proudly broadcasting to shareholders its thoughts on the virtues of corporate governance, and how the bank is more than merely conforming to the letter of the law. At the same time, a notice to KMB shareholders seeking approval to re-appoint Mr. Gaurang Shah as an executive director conveniently omits relevant information for shareholders to take an informed decision.

KMB’s FY2022 annual report states (p.197),

“Corporate Governance is more than just adherence to the regulatory and statutory requirements. It is equally about focusing on the voluntary practices that underlie the highest levels of transparency. The Bank is committed to achieving and adhering to the highest standards of Corporate Governance and ethical practices and constantly benchmarks itself with best practices, in this regard.”

This statement reassures KMB’s shareholders that the bank’s standards are higher than the legal requirement.

In the AGM Notice dated July 23, 2022, the bank is seeking shareholders’ approval, via an ordinary resolution at its Annual General Meeting (AGM) on August 22, 2022, for the re-appointment of Mr. Gaurang Shah as executive director till October 31, 2022. Although Shah is eligible to continue as a director, he has decided to step down as director from October 31, 2022 for personal reasons. However, he will continue as a director on the boards of Kotak Mahindra Asset Management Company (KMAMC), Kotak Mahindra Life Insurance, Kotak Mahindra General Insurance, Kotak Investment Advisors and Kotak Mahindra (International).

It is unusual that an executive director aged 60 years would like to step down as a bank director in order to devote more time for personal issues, while choosing to retain his directorship in 5 other Kotak companies.

Extract from Kotak Mahindra Bank’s Notice to Shareholders for the AGM

Source: Kotak Mahindra Bank

Although Shah has cited personal commitments, a Securities and Exchange Board of India (SEBI) order dated August 27, 2021, which highlighted the role of Kotak Mahindra Asset Management Company’s (KMAMC) 3-member Investment Committee, of which Gaurang Shah was a member, may have contributed to his decision to disassociate himself from KMB’s board beyond October 31, 2022. The SEBI order highlighted serious issues in mismanagement pertaining to KMAMC’s investment in debt securities of dubious shell companies of the Zee founder group of companies. The SEBI order had exposed the incompetence of senior executives of Kotak AMC such as the Debt Investment Committee, who did not bother to find out the identity of the recipient companies when they approved investing in debt securities of the Zee founder companies on March 7, 2016 and May 18, 2016. Gaurang Shah was one of the 3 members of the Debt Investment Committee of the KMAMC at that time of approving the investments. KMAMC appealed to the Securities Appellate Tribunal (SAT) and SEBI’s direction for the AMC to refund part of the advisory and investment management fees was stayed by an order dated October 21, 2021.

SEBI’s Listing Obligations and Disclosure Requirements (LODR) Regulations, 2015 clearly states (pgs 6-8),

“Chapter II PRINCIPLES GOVERNING DISCLOSURES AND OBLIGATIONS OF LISTED ENTITY Principles governing disclosures and obligations. 4. (1) (d) The listed entity shall provide adequate and timely information to recognised stock exchange(s) and investors. (e) The listed entity shall ensure that disseminations made under provisions of these regulations and circulars made thereunder, are adequate, accurate, explicit, timely and presented in a simple language (2) (d) Role of stakeholders in corporate governance The listed entity shall recognise the rights of its stakeholders and encourage co-operation between listed entity and the stakeholders, in the following manner: (iii) Stakeholders shall have access to relevant, sufficient and reliable information on a timely and regular basis to enable them to participate in corporate governance process [bold mine].”

It is unfortunate that when SEBI released its order penalising Gaurang Shah, KMB did not inform the stock exchanges that its executive director had been penalised for grave offences. It is also extremely disturbing that in the explanatory note to shareholders, KMB has withheld this vital information, and thus deliberately kept the shareholders in the dark at a time when the bank is approaching shareholders to approve Shah’s re-appointment as an executive director.

This analyst sent a questionnaire to KMB enquiring why the bank had not informed the exchanges when SEBI had penalised Mr. Gaurang Shah in its order dated June 30, 2022 and why this information was withheld in the explanatory statement of the AGM Notice sent to shareholders seeking their approval to re-appoint Shah as an executive director. The query also cited SEBI’s LODR Regulations, 2015 regarding providing timely availability of relevant information to shareholders. KMB sent the following reply,

“This has reference to your email of 29th July, 2022 on the captioned subject.

Please note that we have examined the matter in detail and have received legal advice that all disclosures made in the AGM Notice with respect to the re-appointment of Mr. Gaurang Shah as a Director (liable to retire by rotation), are in order and are as per applicable law. Please also note that the proposed resolution for re-appointment of Mr. Gaurang Shah is an ordinary resolution and ordinary business. Further, the Bank was not required to make the disclosure with respect to the SEBI order, as it is not a mandatorily disclosable material development under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“LODR”) and is not a “material development” as per the Bank’s materiality policy. All due procedures for re-appointment of Mr. Shah have been followed by the NRC [Nominations and Remuneration Committee] and the Board of the Bank, while considering the said re-appointment and we have been advised that the same are in accordance with applicable law.

It may be further noted that the SEBI’s order against Kotak Mahindra Trustee Company Limited (“KMTCL”) and the persons mentioned therein as Noticees was in public domain and on SEBI’s website. The Noticees are in the process of filing an Appeal against the said order before the SAT [Securities Appellate Tribunal] shortly and will be seeking a stay on the said SEBI order. Please note that in the same matter and on similar facts and grounds, SEBI had passed an order against Kotak Mahindra Asset Management Company (“KMAMC”), which on appeal, has been stayed by the SAT. So this SEBI order has not attained any finality.

We would, therefore, urge you to desist from publishing any article on this subject, which is not based on complete facts / appreciation of the legal position and which is biased or prejudicial to us.”

KMB’s response should be of concern to all stakeholders, stock exchanges and SEBI, as the bank avers that a regulatory penalty on an executive director of a bank is not a “mandatorily disclosable material development;” equally worryingly, it is not a “material development” as per KMB’s materiality policy. The prevailing wisdom of KMB’s board of directors through its designated officer, the Group Chief Financial Officer has reduced a monetary penalty imposed by SEBI on an executive director of a bank for a serious offence in the asset management company to the status of a mere traffic fine which need not be disclosed to shareholders.

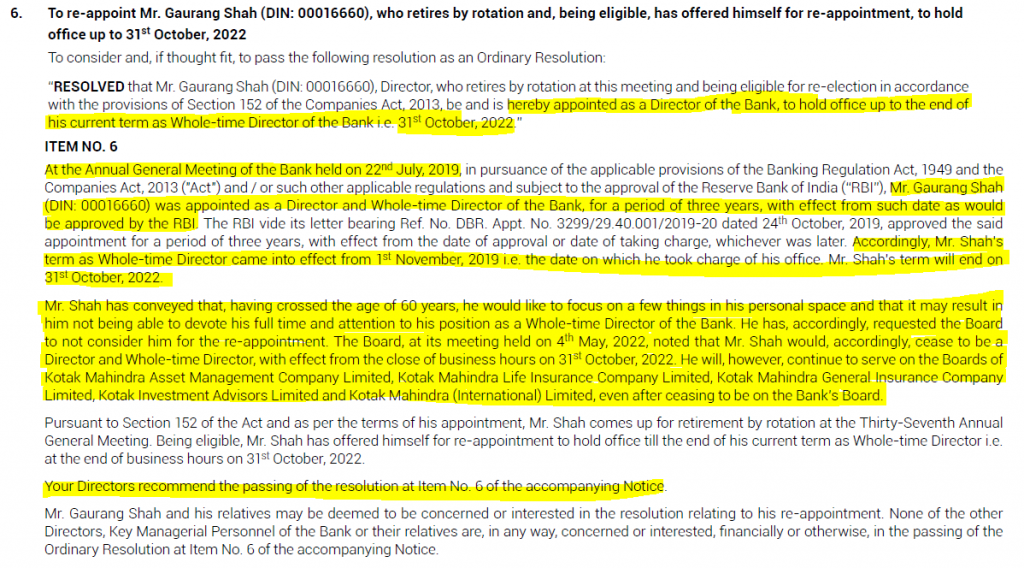

The bank’s response also flies in the face of RBI’s “Fit and Proper’ Criteria for Directors on the Boards of Banks, which explicitly states that for the annual ‘fit and proper’ criteria for bank directors, any proceedings against the director for violation of regulations and any adverse notice by a regulator like SEBI must be disclosed when the NRC and the board conducts its review. The ‘fit and proper’ criteria indicate that not only for the RBI is a regulatory penalty a relevant disclosure, but also such a development may render the director unfit to serve on a bank’s board. It is therefore shocking that in KMB’s materiality policy, a penalty by a regulator on a serving executive director is not considered a “material development.”

Extract from RBI’s ‘Fit and Proper’ Criteria for Directors on the Boards of Banks

KMB’s argument that SEBI’s order was in the public domain and on SEBI’s website and therefore it was not required for KMB to disclose it to the stock exchanges within 24 hours of its release, or to include it in the explanatory statement in the Notice, appears weak. The purpose of an explanatory statement in the Notice to shareholders is to provide all the relevant information in one place so that the shareholders can take an informed decision. The stock exchanges and SEBI needs to examine the deliberate omission by KMB extremely carefully, as other companies may follow this example to the detriment of shareholders.

It is also pertinent to note that the noticees in SEBI’s order, as on the date of the Notice to shareholders and to date, have not filed an Appeal against the order before the SAT. Therefore it is presumptuous for KMB to assume that the recent order is similar to the earlier order and that this order will also be stayed. The correct procedure for KMB was to disclose the SEBI order and inform shareholders that the Noticees plan to challenge the said order before the SAT. On that basis the shareholders could take an informed decision on the re-appointment of Gaurang Shah. By omitting this critical and highly relevant information on the penalty by SEBI on Gaurang Shah, KMB has exhibited poor standards of corporate governance.

The lack of any disciplinary action by KMB against the concerned senior executives of KMAMC and the trustees who have been penalised by SEBI for mismanagement, and the omission of the information on the penalty on Shah in the Notice to KMB shareholders, raise concerns regarding the competence and independence of the bank’s independent directors. All the KMB stakeholders – shareholders, the stock exchanges, SEBI and RBI – need to examine the conduct of the KMB board of directors.

The entire episode highlights that a firm merely chanting the mantra of corporate governance in its annual report is not indicative of how it practises it. In KMB there appears to be a wide and deep gorge between claims and practice.

Note: An earlier version of this article stated, “Although Shah has cited personal commitments, a Securities and Exchange Board of India (SEBI) order dated June 30, 2022, which penalised him Rs. 2 mn for his role in KMAMC, may have contributed to his decision to disassociate himself from KMB’s board beyond October 31, 2022.” This has been subsequently rectified to “Although Shah has cited personal commitments, a Securities and Exchange Board of India (SEBI) order dated August 27, 2021, which highlighted the role of Kotak Mahindra Asset Management Company’s (KMAMC) 3-member Investment Committee, of which Gaurang Shah was a member, may have contributed to his decision to disassociate himself from KMB’s board beyond October 31, 2022.”

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in KMB. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.